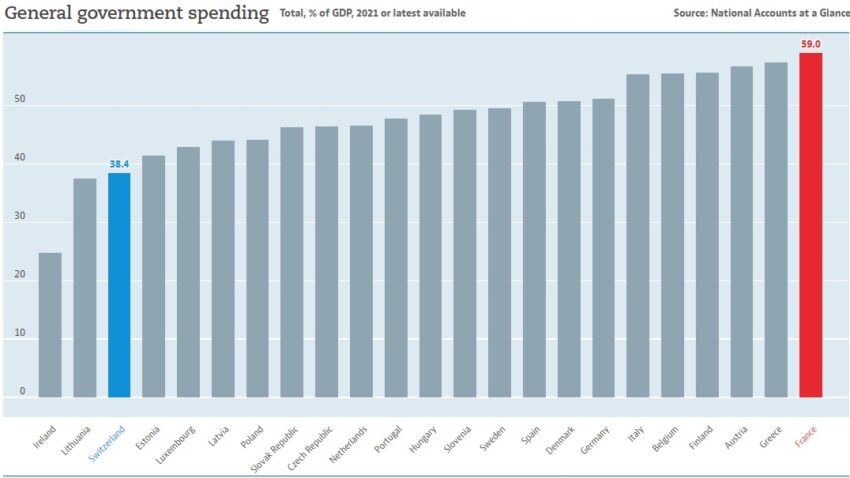

France is a role model, but not in a good way. It is a stark example of the dangers of excessive government spending.

To elaborate, it has the largest fiscal burden of any first-world nation, which necessitates an oppressive tax regime.

And a bloated public sector also means lots of debt.

Indeed, it may be the case that red ink is no longer just a symptom of the problem, but may be a problem in its own right.

That’s one of the takeaways from a column in the U.K.-based Telegraph by Ambrose Evans-Pritchard.

Emmanuel Macron’s failure to halt the runaway expansion of the French state…is the larger story of incorrigible Gallic wishful thinking. “Our sad record is that we are the most spendthrift country in the world. People simply don’t realise it, and those who ought to be talking about this are negligent,” said Jean-Claude Trichet, ex-president of the European Central Bank. …three storm-clouds are gathering: a) the country has crossed a critical line and is now in the early stages of an arithmetical debt trap; b) global real interest rates have jumped to a permanently higher level and creditors are freshly alert to debt dynamics; and c) the recent upheaval in Japan’s once-catatonic bond market has sent shivers up everybody’s spine. …“The situation is extremely serious,” said Mr Trichet. “We are in a terrible situation when you compare us with other countries. We have the least ambitious deficit plans in Europe by a long way.” He is watching with forensic fascination and alarm as France is forced to pay significantly higher borrowing costs than Spain and Portugal… “Emmanuel Macron has allowed such runaway growth in public spending that it is now nearly impossible to control. There are so many people dependent on the state that you can’t get a majority to agree to cuts,” said Prof Dor. …The International Monetary Fund says French public spending will be 57.3pc of GDP this year and is still on a rising trend. This is roughly 10 points higher than in Sweden or Denmark. …Debt will rise mechanically to 116pc this year from 113pc last year. It will reach 120pc by 2028 even if all goes well.

Here’s a chart from the article showing how France is diverging from Germany and the Netherlands…and not in a good way.

I don’t think that France is doomed to be in the “arithmetical debt trap” referenced in the article, though it’s international investors who will make that decision.

Any sort of hiccup in the global economy could have very worrisome consequences if the so-called bond market vigilantes decide that the French government no longer is trustworthy.

And that day will come if France doesn’t change course.

The good news is that there is a solution. France needs to follow the Golden Rule by making sure government spending in the future grows slower than the private sector.

Based on the numbers I shared last September, that wouldn’t involve dramatic changes. Slowing the budget so it grows by 2 percent per year (rather than 3 percent or 3-1/2 percent) is all that is needed.

A spending cap with some program reform would put France on the right path. Not that I’m optimistic that will happen (heck, we need something similar in the United States and I’m not hopeful that we’ll do the right thing, either).

Too bad we can’t both be like Switzerland.

———

Image credit: Yann Caradec | CC BY 2.0.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.