This post Trump 2.0 At 5.3 Months, Plus Gold, Copper and More! appeared first on Daily Reckoning.

Happy 1st of July. The year is now half over, and we’ve had five and one-third months of President Trump 2.0. His opponents wanted him in jail; instead, he’s in the White House.

Donald Trump mugshot, Fulton County Sheriff’s Office. Courtesy New York Times.

Are you tired of winning yet?

Odds and Ends, and Important Economic Numbers

Will we see a Big, Beautiful Bill this week, or not? Beats me, but I suspect that something will pass. It might be one of those abominable legislative monsters in which “you have to pass the bill to see what’s in it,” to borrow a famous line from Nancy Pelosi. But when it comes to tax cuts for the Wall Street Journal crowd, and continued big spending for the Washington Post crowd, Congress tends to come through.

In other news, over the past six months the price of oil has dropped down into the low-mid $60s per barrel, which is astonishing when you consider that we just had a short and sharp, but major war in the Middle East.

If someone had told me in January that Israel would duke it out with Iran in a massive, long-range aerial and missile war, I’d have called it a no-brainer that oil prices would rise. Then again, oil producers everywhere are pumping full-bore to raise cash, because everybody needs cash. And thus, there’s an evident glut of supply.

OPEC nations are cheating on their quotas. Russia is selling oil via its large shadow fleet of tankers. And U.S. production is strong, although now at an overall output plateau which raises the so-called “Peak Shale” issue, which is far closer and more serious than most people think.

Meanwhile, the national average price for gasoline is at a four-year low, under about $3.20 per gallon. Of course, the price you pay depends on your state tax; and on that point I’m looking at you, Pennsylvania, California, Illinois…

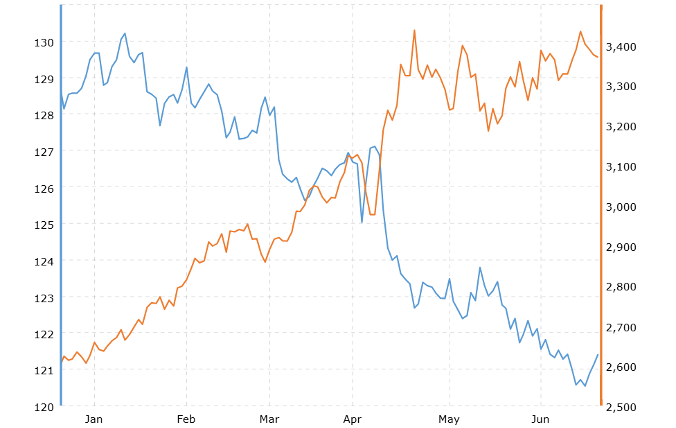

In terms of Big Picture economics over the first half of 2025, the dollar index declined more than 10% while the price of gold is up by well over 30%. Here’s a nice chart from Macrotrends that helps to visualize the relative moves.

First half of 2025: dollar down, gold up. Courtesy Macrotrends.com.

Predictably, the usual suspects (Financial Times, New York Times, The Economist, etc.) blame Trump and his trade and tariff policies for the dollar swoon, and related flight to safety with gold. Indeed, the FT cites a foreign exchange trader on the newspaper’s handy-dandy quick-quote Rolodex, that “The dollar has become the whipping boy of Trump 2.0’s erratic policies.”

Ah yes, blame Trump’s stop-start tariff talk. But the longer-term reality is that, for at least three years and long before Trump 2.0 hit Pennsylvania Avenue, many of the world’s central banks were buying beaucoups gold. This reflects a long-term de-dollarization trend, spurred on by the U.S. weaponization of its currency, and out-of-control federal spending.

That is, foreign nations are defending themselves against America’s monetary “bunker busters,” so to speak; namely, sanctions. Stated another way, central banks buy gold to de-risk from the profligate use of sanctions by the U.S., which had the temerity to seize over $300 billion of Russian sovereign state assets in response to the Ukraine military operation.

As an aside… If you can steal nuclear-armed Russia’s assets, who else is safe? Which prompts me to recall the words of Germany’s old Iron Chancellor, Otto von Bismarck: “The Russians always come back for their money.”

If de-dollarization was not enough, it’s crystal-clear that prudent, flinty, foreign central bankers (are there any other kind?) look with concern, if not raw horror, at the growing U.S. national debt and mushrooming interest obligations. In essence, America is financially insolvent. And the only thing that keeps the checks from bouncing is Federal Reserve money creation, charged off as so-called “national debt.”

The takeaway is this: foreign central bankers foresee inflation, inflation and more inflation. And they buy gold, gold and more gold.

Okay, so don’t take my word for inflation; ask the estimable “Dr. Copper,” with its PhD in economic forecasting and a long history of being right. That is, the price of copper is up over 15% year-over-year, reflecting growing demand and tighter supply.

Got copper? Ingot and elemental metal from Keweenaw Peninsula, Michigan. BWK collection.

How much is copper demand rising, you may be wondering? Well… There’s normal economic growth, particularly in the developing world where more and more people want more and more things that use copper, like electric lights, air conditioners, refrigerators, etc. Plus, we’re seeing more and more electric vehicles (EVs). Indeed, there’s a global EV glut out of China that Americans don’t notice because it’s happening everywhere else on the planet except here.

Then we have First World, copper-moving issues like rebuilding the under-invested, overtaxed grid across North America. And on that one point, a large, growing, and compounding demand wedge for copper is the rapid buildout of AI data centers all over the place, which use large amounts of copper for wiring, as well as radiators to cool things down. (And I’ll refrain from the energy and water usage angle, for now.)

All this, while global copper supply is tight and getting tighter. And how tight is copper supply, you may be wondering? Well… Just last week a consortium of Chinese copper smelters agreed to process copper concentrate from Chilean miner Antofagasta (ANFGF) for free, as in $0.00.

Let me make sure you understand this deal: Antofagasta (which is in Chile) will provide copper concentrate to refiners (in China, meaning it gets shipped across the Pacific Ocean) who will process it… for zero charge! Basically, Chinese refiners desperately need metal at the other end of the processing plant to sell to their customers. So, they are giving away their refining services to Antofagasta for zero, zippo, nada.

And if this lowball, giveaway processing arrangement seems odd, it’s because it is very odd. In fact, it sets a new low – i.e., zero – for what are called treatment and refining charges (TC/RCs) in the global copper business. This new, zero-pay charge for TC/RC highlights the absolute, real and growing scarcity of copper concentrate, the raw material that smelters use to produce refined copper.

And here’s something else that’s nothing less than astonishing about this Antofagasta deal: Some industry analysts have described the outcome as “better than expected,” which indicates the severity of the current market imbalance in red metal. The next stop is refiners bidding to pay suppliers of copper concentrate for the privilege of refining their mouth-of-the-mine material into usable metal.

Okay, so now let’s continue to discuss investment angles, but do it in the context of your Paradigm Press subscriptions; as in, let’s do some housekeeping…

Subscriptions and Housekeeping Items

Independence Day (i.e., 4th of July) looms, so have a good holiday. But…! Before you head off to the mountains, beach, golf course, baseball park, etc., be sure to watch for upcoming subscription items from Paradigm Press.

President Trump asks about his Paradigm Press subscriptions before heading out. White House photo.

For example, if you subscribe to Jim Rickards and his Strategic Intelligence letter, there’s an issue on the launch pad and set to roar into your inbox within the next day. Watch for an alert.

In this upcoming July issue of SI, Jim discusses developments in Europe and the global macro picture. Dan Amoss and Zach Scheidt offer strong and actionable investment ideas. And I have an investment-themed article as well, entitled “The Precious Metals of Mars.”

No, I’m not discussing mining for mineral ores on the fourth rock from the sun. I’ll leave that to Elon Musk and SpaceX. Instead, my focus is the array of exotic metals necessary to fight modern wars, and hence the Mars-allegory, relating back to the Roman god of war. I’ll even tell you some things you may not know about the BLU-57 “bunker buster” bomb.

If you subscribe to Zach Scheidt’s Lifetime Income Report, there’s also a July issue soon to hit the wires. As usual, Zach has a solid investment play for you with low downside and strong upside, along with dividend yield.

Plus, in this upcoming July issue of LIR, I’ll discuss hard assets like energy, gold and copper. But first, I’ll discuss shipboard firefighting (yes, you read that right). And I’ll pose some questions about whether or not the current, so-called “cease fire” can hold between Israel and Iran. Hint: maybe not.

Looking past the upcoming Independence Day holiday, next week is the Rick Rule investment conference in Boca Raton, from July 7 – 11. I’ve mentioned this before, and here’s the link for details; check it out after you finish with this note.

If you can’t make it in person to Florida, you can still sign up and watch proceedings online. But I know that some readers will attend Rick’s conference, so please feel free to walk up and say hello. And Adam Sharp of the Daily Reckoning will also be there; and he’s very friendly but shy, so say hello to him as well. Tirelessly, he toils to deliver these emails to you.

Meanwhile, Jim Rickards is on the agenda in Boca Raton, both as a panelist and keynote speaker. His talk is entitled “MAGA-nomics – A New Science for the New Age.” And definitely, we’ll hear Jim’s predictions about where things are headed under Trump 2.0.

All in all, next week in Boca will offer a strong macro picture, and plenty of superb, specific investment ideas in the gold, silver, copper and other hard asset spaces.

Looking ahead past this summer, save the dates October 8 – 11 for a trip to Nashville, where Paradigm Press is planning an event with the whole entourage of editors and related writers. We’re still in planning stages, so I can’t get into details. But it’ll be a couple of days of both big picture forecasts and specific investment ideas. Watch your inbox as the summer proceeds.

The Ongoing Ceremonies of 250 Years

Finally, this upcoming Independence Day holiday marks 249 years since the Declaration of Independence; and next year is the Big One at 250.

But why wait? We’ve already begun the 250th anniversaries of more than a few other, important milestones in American history. For example, in Massachusetts we celebrated Lexington & Concord 250 this past April, and the 250th anniversary of the founding of the U.S. Army was just this past June 14th.

“Before there was a nation, there was the U.S. Army,” goes the saying. And this recent Army birthday ceremony included a very nice parade in Washington, D.C. which you would have noticed if you watched it (as did I – see Morning Reckoning from June 17th). Or it was an awful parade if you just read about it in the bitter, resentful, hateful mainstream media.

Now, we can also look ahead to October 13th and the 250th anniversary of the founding of the U.S. Navy, while November 10th marks the 250th year of the U.S. Marine Corps, both established in Philadelphia. So, I suppose it’s fair to say that “Before there was a nation, there was the U.S. Navy and Marine Corps.”

There’s plenty of history here, to be sure; plenty to study and learn. But the true challenge ahead is to keep this country going strong, and not just fade into irrelevancy like many other nations from the past. Preserve wealth, create wealth, grow wealth. Make it all better, as best you can.

One point to consider is that the U.S. didn’t reach the current age of 249 years by not making mistakes along the way. The country only made it here by recognizing its problems and fixing those mistakes. So, get out there and fix something.

Again, have a good Independence Day holiday, and sincere thanks to you for subscribing and reading.

The post Trump 2.0 At 5.3 Months, Plus Gold, Copper and More! appeared first on Daily Reckoning.

Click this link for the original source of this article.

Author: Byron King

This content is courtesy of, and owned and copyrighted by, https://dailyreckoning.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.