Lord Ashcroft KCMG PC is an international businessman, philanthropist, author, and pollster. For more information on his work, visit lordashcroft.com.

The Conservatives have lost their lead on defence and national security and more voters would trust Sir Keir Starmer than Rishi Sunak in the event of an armed conflict, according to my latest poll. We also look at Rwanda and the ECHR, scams and inappropriate texts, and whether people care how many Conservative MPs are left after the next election.

War leaders

We regularly ask what people think are the most important issues facing the country, and which party they think would do a better job on each one. We can then chart which party holds which pieces of political territory, and by how much.

Astute readers will notice that there are no issues left in the Conservative side of the chart. The last to go was national security and defence, on which the Tories still had a small lead when I last asked the question in this form just under a year ago. That is not to say Labour can now call themselves the party of defence – just 28 per cent say they would do a better job, two points ahead of the Conservatives, with 46 per cent saying “don’t know” – but it is clearly no longer the reliably Tory issue it once was.

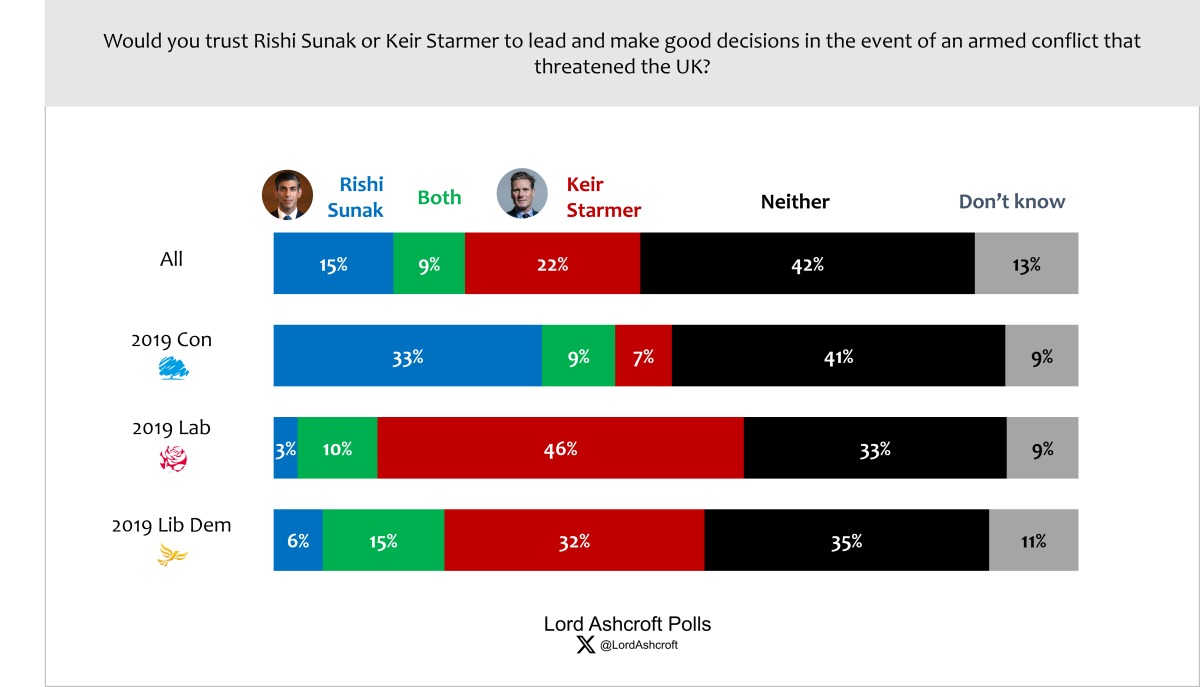

This point is underlined when we ask who people would trust to lead and make good decisions in the event of an armed conflict that threatened the UK.

Just over one in five (22 per cent) said they would trust Starmer more than Sunak in that situation, compared to 15 per cent who said the reverse; a further nine per cent said they would trust both. But more than four in ten, including 41 per cent of 2019 Conservative voters, said they would trust neither.

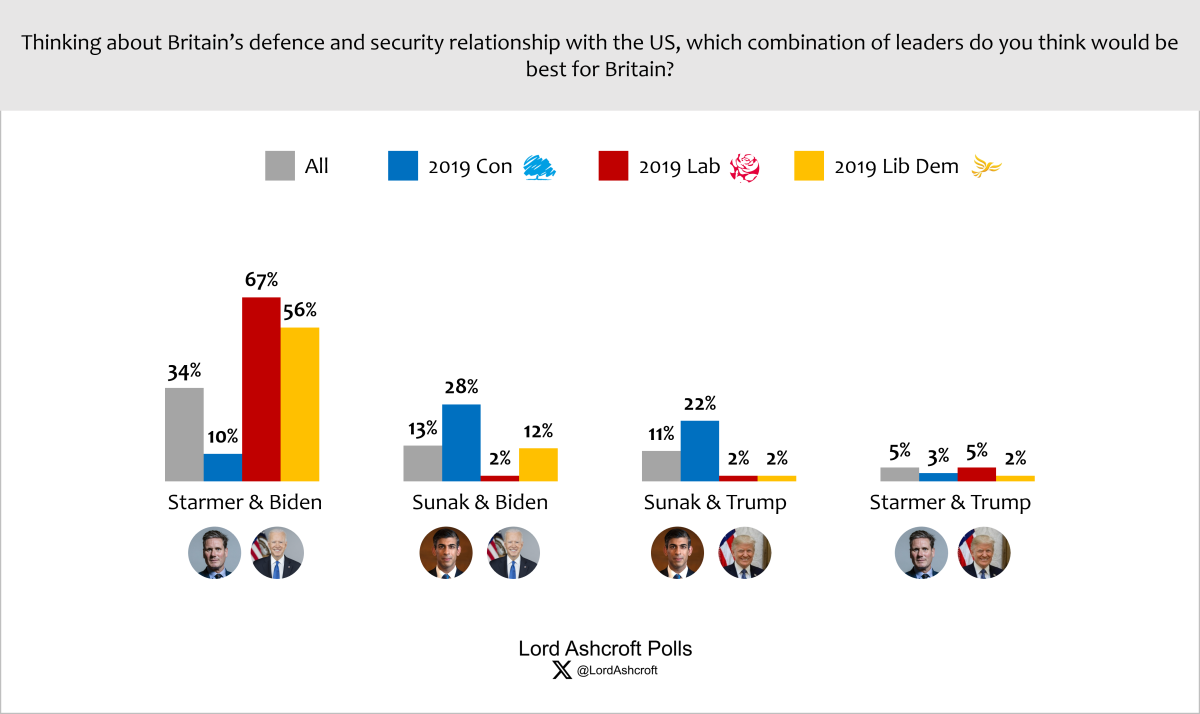

With elections likely this year on both sides of the Atlantic, we asked which combination of prime minister and president people thought would be best for Britain when it came to our defence and security relationship with the US. Starmer and Joe Biden were the most popular option, followed by Sunak and Biden – largely because, while Tories were divided between an alliance with Biden or Trump, Labour voters overwhelming preferred a partnership with the Democrat.

Rwanda and the ECHR

With the government’s Rwanda plan back before parliament, we asked whether people would rather see the scheme implemented immediately or abandoned altogether – and what role, if any, the ECHR should play in shaping such legislation.

People were closely divided as to whether the Rwanda plan should go ahead (38 per cent, including 66 per cent of 2019 Tories and three quarters of those leaning towards Reform UK), or scrapped (42 per cent, including two thirds of 2019 Labour voters).

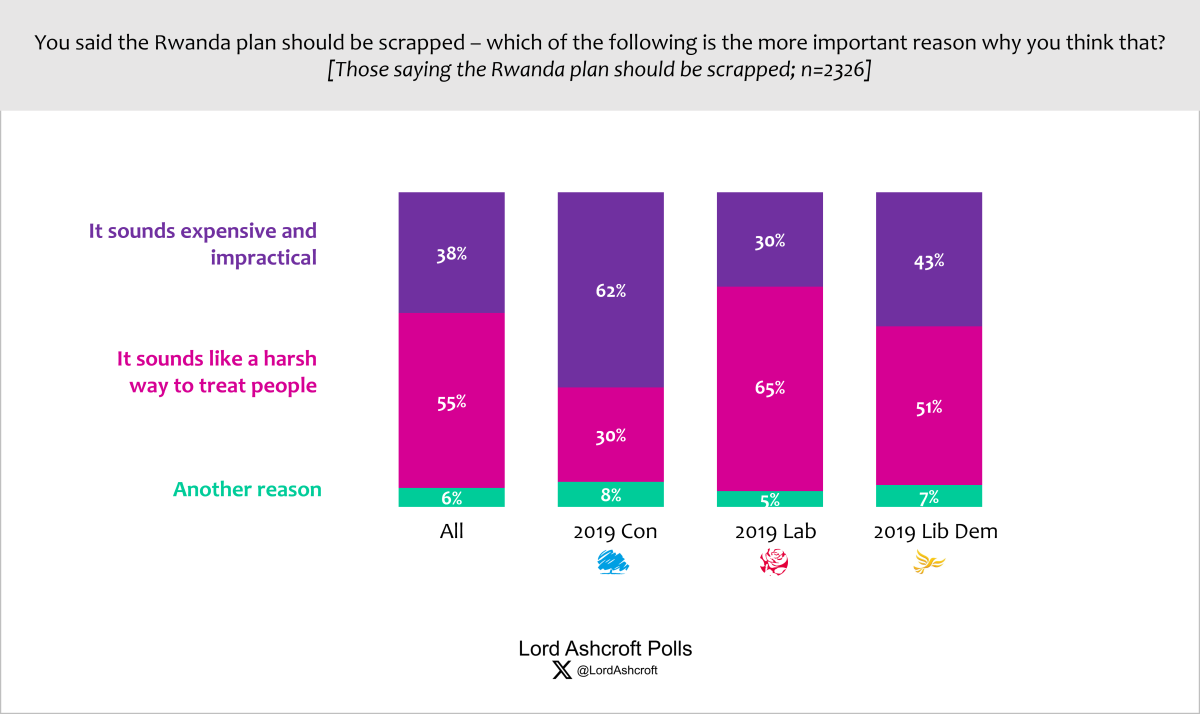

Most (55 per cent) of those who thought the plan should be abandoned said this was because it sounded like a harsh way to treat people, while 38 per cent said it was because the plan sounded expensive and impractical.

While most 2019 Labour voters who thought the plan should be scrapped said it was too harsh (65 per cent), most 2019 Tories who opposed the plan did so because they thought it expensive and impractical.

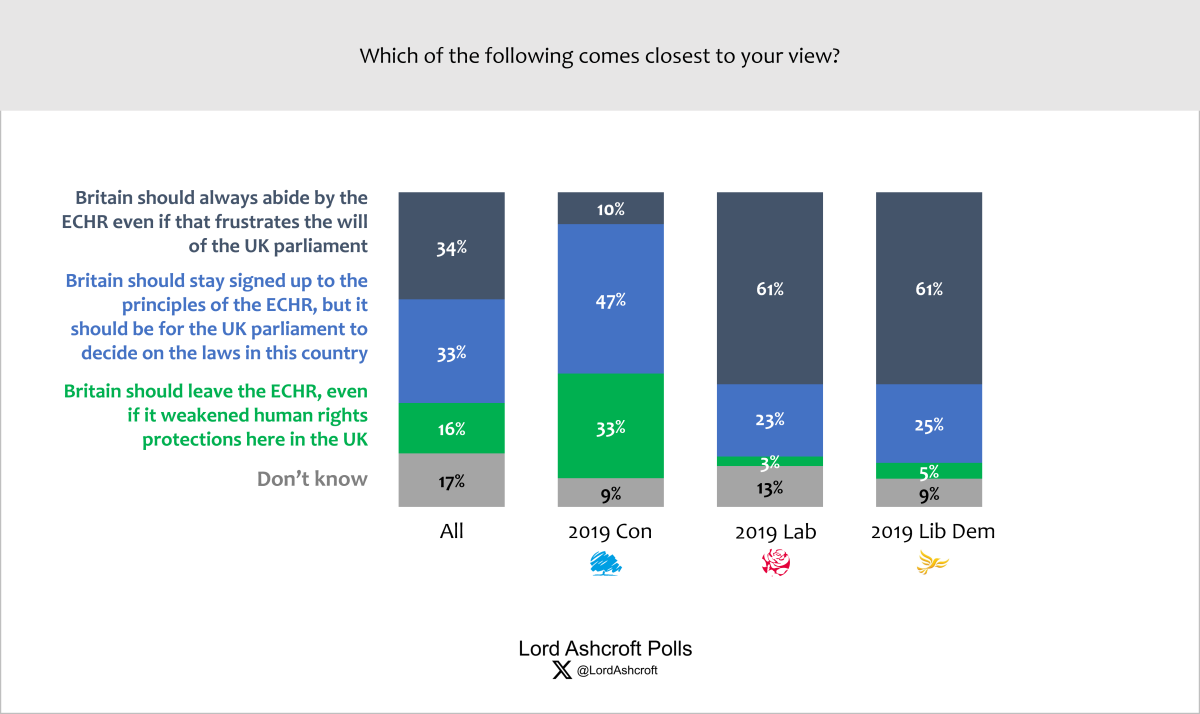

Reflecting on the Supreme Court ruling that the Rwanda scheme breached the European Convention on Human Rights, around one third of voters (including 61 per cent of 2019 Labour voters and 68 per cent of those who think the Rwanda scheme should be scrapped) said Britain should always abide by the ECHR, even if that frustrates the will of Parliament.

A similar proportion overall thought we should stay signed up to the principles of the ECHR, but that it should be up to parliament to decide on the laws in this country (the most popular option among 2019 Conservative voters); 16 per cent overall – but one third of 2019 Tories and 66 per cent of those planning to vote for Reform UK – thought we should leave the ECHR, even if that weakened human rights protections in the UK.

What else has been happening?

When we asked what recent political news stories people had noticed, the top answer was the investigation into Angela Rayner’s tax affairs, which was mentioned by more than one in five respondents. This was followed by William Wragg and the Westminster sexting scandal (13 per cent), with the Post Office scandal and the Gaza conflict each named by five per cent.

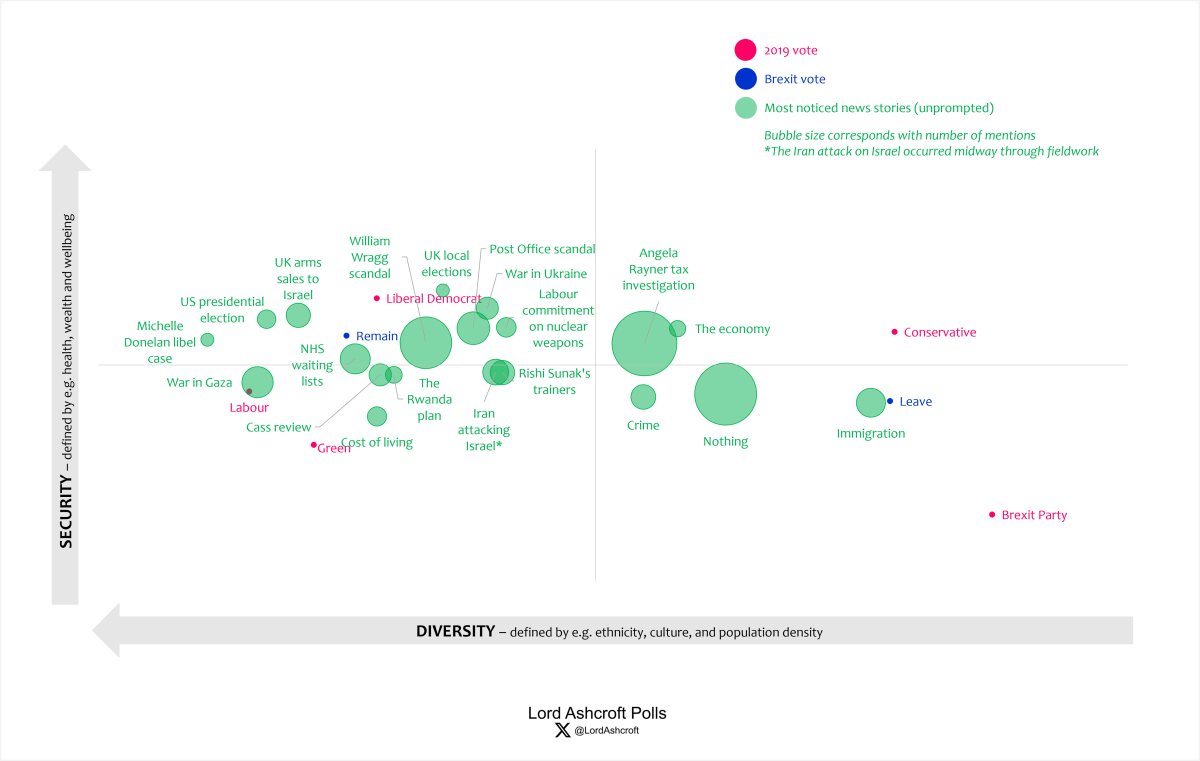

We can also plot on our political map where, in political terms, each story is most likely to have registered. Here we see that the Angela Rayner story, as well as being the most noticed, is also closest to the centre, meaning it has been noticed by people across the board rather than voters of a particular kind – whereas the William Wragg story was more likely to have been clocked by those in Labour, as were items about NHS waiting lists and Rwanda.

Scams and texts

In the light of the Westminster sexting scandal we asked people whether they themselves had ever fallen for a scam. Six in ten said they had been targeted, though most of these said they had realised what was happening in time; 12 per cent admitted that they had fallen for it.

When it came to sending text messages of inappropriate pictures, just under one in five thought MPs were worse offenders than the public as a whole. Nearly two thirds (63 per cent) thought MPs probably do this sort of thing no more or less than people in general.

The political map

Our political map shows how different issues, attributes, personalities and opinions interact with one another. Each point shows where we are most likely to find people with that characteristic or opinion; the closer the plot points are to each other the more closely related they are.

Here we see that national security, borrowing and tax rates are most likely to be concerns for voters in the more prosperous Conservative-leaning top-right quadrant, while crime, pensions and immigration are most likely to have been chosen in the less prosperous Leave-voting, Reform-leaning bottom right, where the Tories picked up much of their additional support in 2019.

The fact that the centre of gravity of the current Conservative vote has shifted firmly into the top right shows that much of this bottom-right support has been lost since the last election. This is also the territory in which we are most likely to find those who would trust neither Sunak nor Starmer to lead and make the right decisions in the event of a conflict that threatened the UK, and who would prefer the UK to leave the ECHR.

The fundamentals

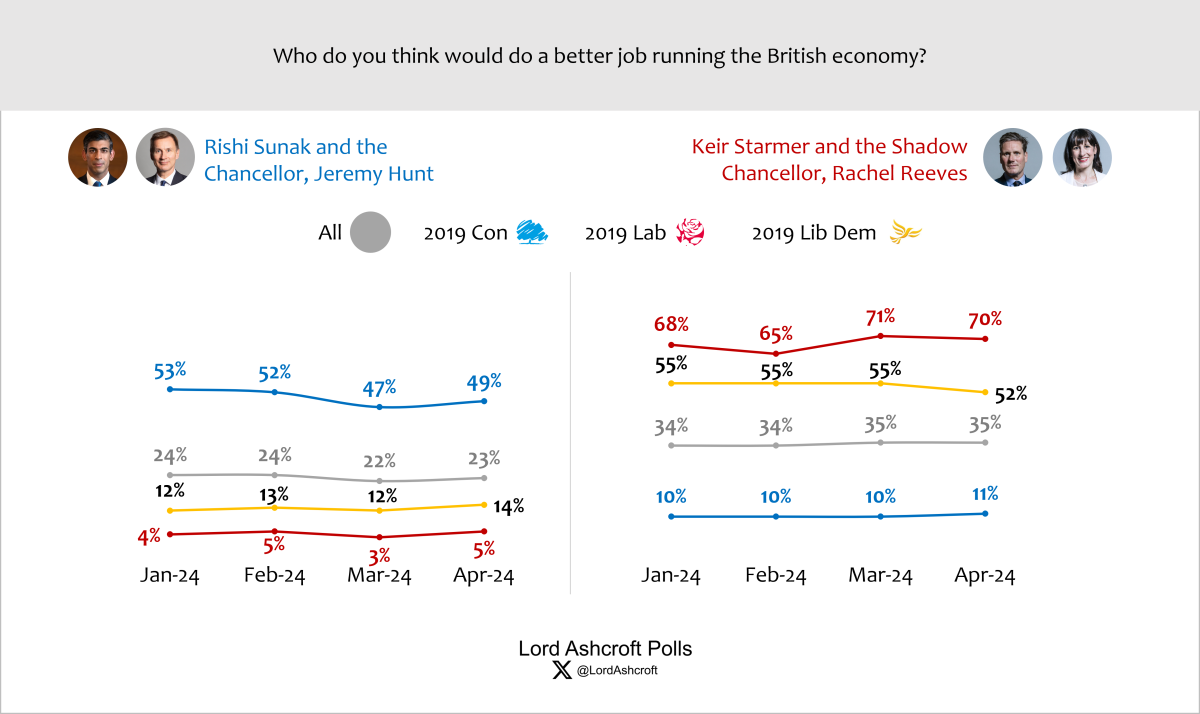

We found Labour leads on best PM and trust on the economy steady compared to recent months. Starmer was ahead of Sunak by 34 per cent to 19 per cent with 48 per cent saying “don’t know” and only 40 per cent of 2019 Conservatives naming Sunak.

Starmer and Rachel Reeves led Sunak and Jeremy Hunt by 12 points, with 42 per cent (including 40 per cent of 2019 Tories) undecided.

Only eight per cent, including one in ten 2019 Tories, said they were satisfied with the current Conservative government; a further 37 per cent (including 71 per cent of 2019 Tories) said they were dissatisfied but would rather have this government than a Labour government. Just over half (56 per cent), including nearly one in five of those who voted Conservative in 2019, said they would rather have a Labour government.

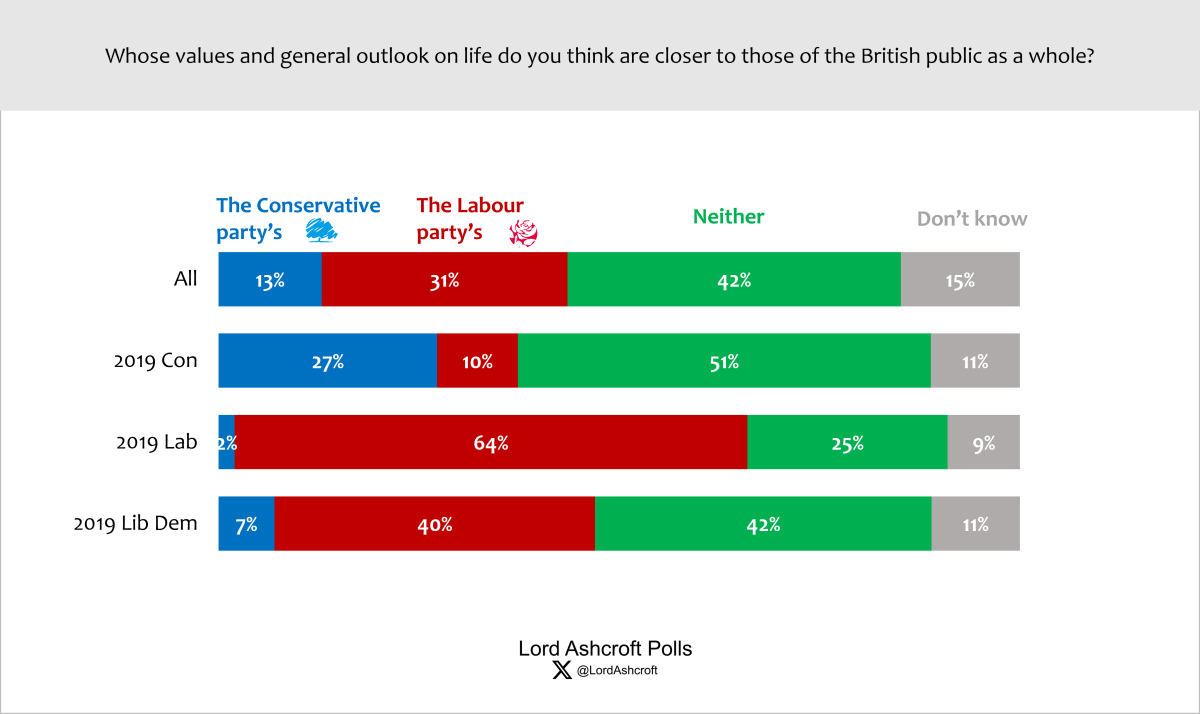

In January 2020, a month after the last election, I found 36 per cent saying the Conservative party’s values and general outlook on life were closest to those of the British public as a whole, while 20 per cent thought Labour’s were.

Now those positions are effectively reversed, with 31 per cent saying Labour’s values and outlook were closest to the country’s, with just 13 per cent saying the same of the Tories’. More than four in ten (42 per cent) said “neither”.

The next election

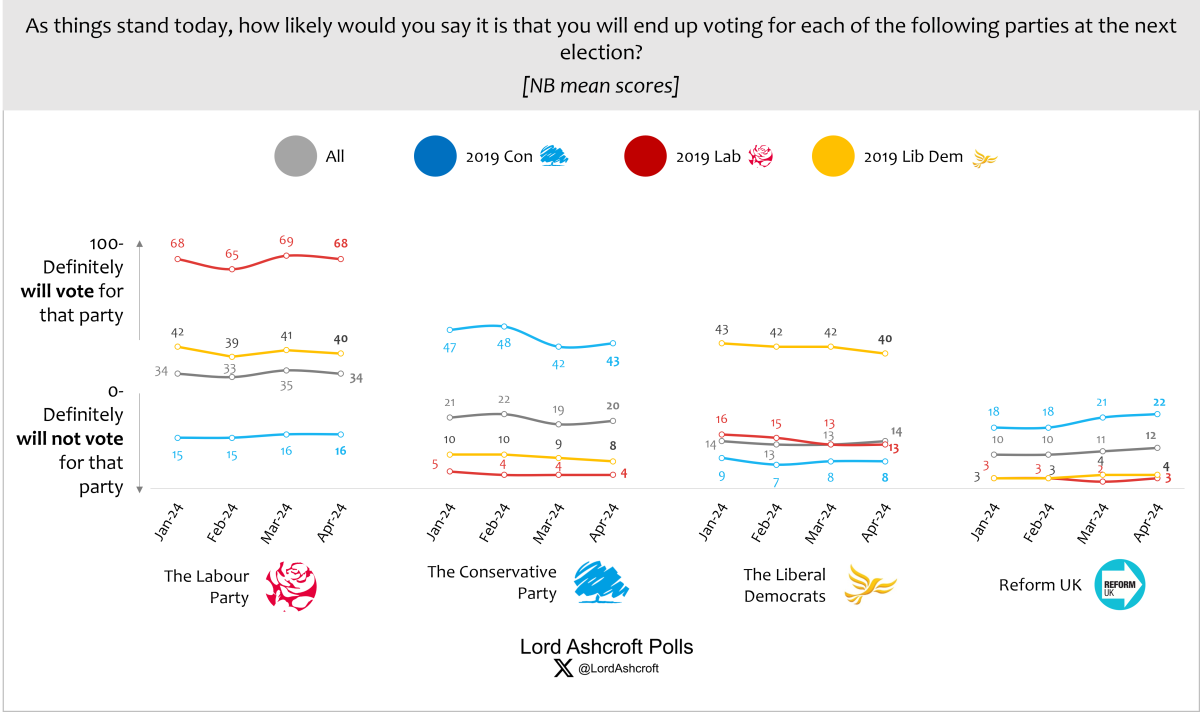

We ask people how likely they think they are to vote for each party on a 100-point scale, where zero means “no chance” and 100 means “definitely”. Among 2019 Conservative voters, the average likelihood of voting Tory at the next election was 43/100.

Including those whose highest score for one party was at least 50/100, this implies vote shares of Labour 44 per cent, Conservative 23 per cent, Reform UK 11 per cent, Green eight per cent, and the Liberal Democrats six per cent.

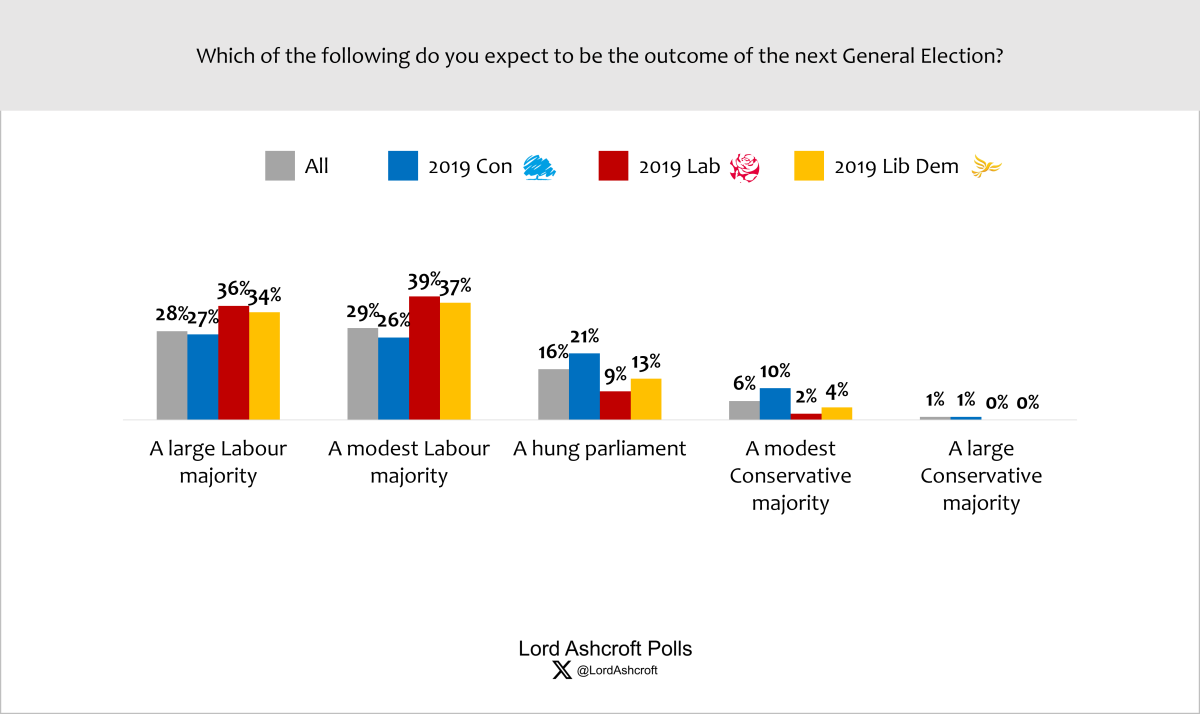

Nearly six in ten people said they expected Labour to win the next election, whether with a large majority (28 per cent) or a modest one (29 per cent). More than half of 2019 Conservatives also expected a Labour victory, as did 40 per cent of those currently intending to vote Tory.

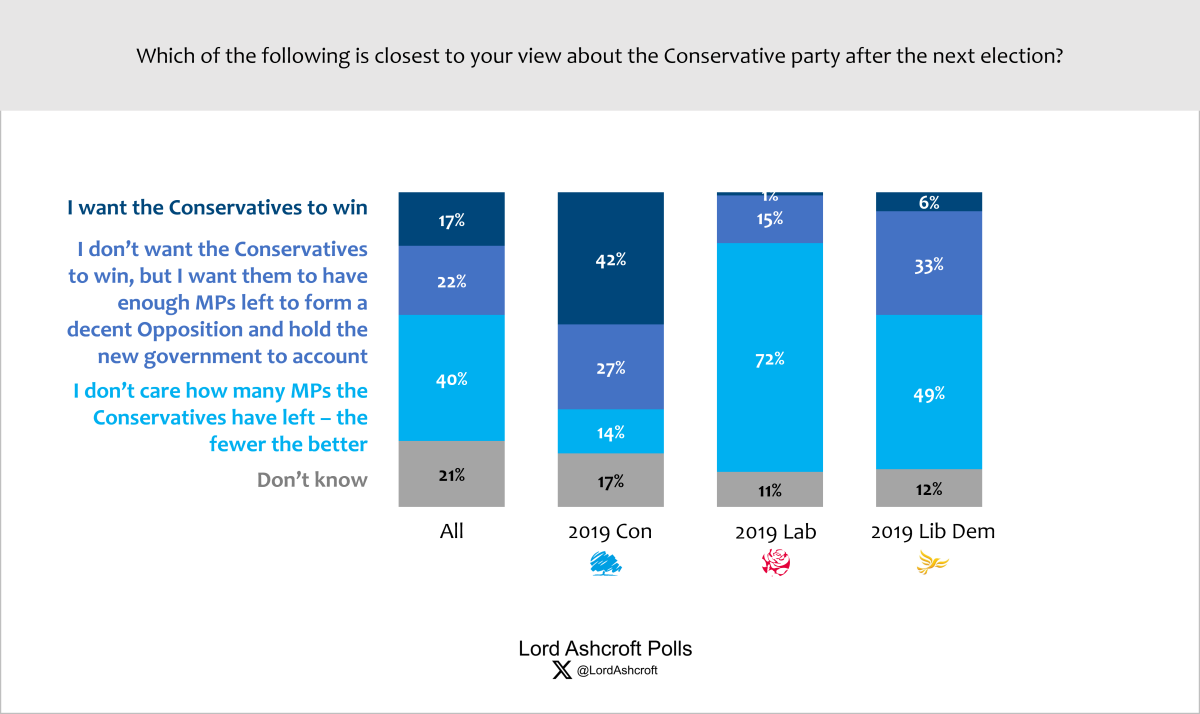

Overall, 17 per cent of voters, including just 42 per cent of 2019 Tories, said they would like the Conservatives to win the next election. Just over one in five, including 27 per cent of 2019 Conservatives and ten per cent of those currently intending to vote for the Tory, said they didn’t want the party to win but to have enough MPs left to form a decent Opposition and hold the new government to account.

However, four in ten – including seven in ten Labour voters and 14 per cent of those who voted Conservative in 2019 – chose with the statement: “I don’t care how many MPs the Conservatives have left – the fewer the better”.

Full data available at LordAshcroftPolls.com

The post Lord Ashcroft: My latest poll finds only four in ten 2019 Tory voters now want the party to win the election appeared first on Conservative Home.

Click this link for the original source of this article.

Author: Lord Ashcroft

This content is courtesy of, and owned and copyrighted by, http://www.conservativehome.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.