President Donald Trump raised many eyebrows with his recent deal with Intel to accept on behalf of the U.S. a 10 percent equity stake in Intel, the publicly traded chip maker worth $108 billion.

According to an Aug. 22 statement by Intel, the investment was worth about $8.9 billion and was funded using monies from the $280 billion CHIPS Act already passed by Congress: “Under terms of the agreement, the United States government will make an $8.9 billion investment in Intel common stock, reflecting the confidence the Administration has in Intel to advance key national priorities and the critically important role the company plays in expanding the domestic semiconductor industry. The government’s equity stake will be funded by the remaining $5.7 billion in grants previously awarded, but not yet paid, to Intel under the U.S. CHIPS and Science Act and $3.2 billion awarded to the company as part of the Secure Enclave program.”

In other words, it was monies that Congress had already spent and obligated to the chipmaker. Now, Trump was asking what the U.S. got in return, with the answer being stock that has the potential to grow in value.

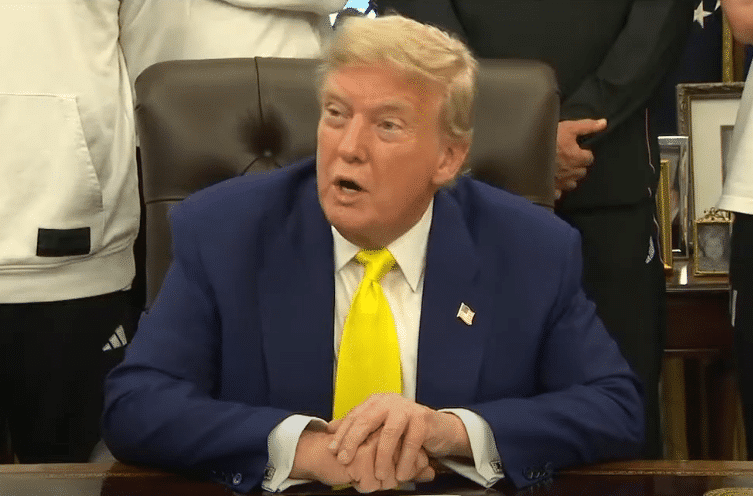

In a statement on Truth Social on Aug. 25, Trump wrote, “I PAID ZERO FOR INTEL, IT IS WORTH APPROXIMATELY 11 BILLION DOLLARS. All goes to the USA. Why are ‘stupid’ people unhappy with that? I will make deals like that for our Country all day long. I will also help those companies that make such lucrative deals with the United States… I love seeing their stock price go up, making the USA RICHER, AND RICHER. More jobs for America!!! Who would not want to make deals like that?”

While definitely different than previous government-sponsored enterprises — entities like Federal Home Loan Mortgage Corporation (Freddie Mac), Federal National Mortgage Association (Fannie Mae), the Federal Deposit Insurance Corporation (FDIC), the U.S. Postal Service and so forth were created by acts of Congress — taking a public stake in private companies might still raise similar concerns about government ownership and the direction of companies. Shareholders usually get voting rights and therefore influence in board decisions.

In the great scheme of things, it’s a small amount of money, $8.9 billion out of $60 trillion of U.S. publicly traded companies. If every publicly traded corporation were to offer 10 percent equity stakes, it would be worth approximately $6 trillion — with the potential to grow. Critics cry socialism.

The Intel sale of stock to the U.S. comes on the heels of the President’s proposed sovereign wealth fund from a Feb. 3 executive order. The President’s order stated “it is in the interest of the American people that the Federal Government establish a sovereign wealth fund to promote fiscal sustainability, lessen the burden of taxes on American families and small businesses, establish economic security for future generations, and promote United States economic and strategic leadership internationally.”

By now both Treasury Secretary Scott Bessant and Commerce Secretary Howard Lutnick have had an opportunity to produce the plan called for in the sovereign wealth fund executive order: “The Secretary of the Treasury and the Secretary of Commerce, in close coordination with the Assistant to the President for Economic Policy, shall develop a plan for the establishment of a sovereign wealth fund… The Secretary of the Treasury and the Secretary of Commerce shall jointly submit this plan to the President within 90 days of the date of this order. Such plan shall include recommendations for funding mechanisms, investment strategies, fund structure, and a governance model. The plan shall also include an evaluation of the legal considerations for establishing and managing such a fund, including any need for legislation.” The plan was due in May.

Equity stakes in companies like Fannie Mae, Freddie Mac or Intel are not the only types of assets the government owns. The federal government is sitting on some $7.3 trillion of intergovernmental holdings of non-marketable U.S. treasuries in various trust funds including but not limited to the Social Security and Medicare trust funds. What if those were swapped for equity, too?

There is also the $1 trillion Thrift Savings Plan that houses the federal employee retirement system that already has substantial stakes of equity worth hundreds of billions of dollars.

So, what Trump is suggesting and the sovereign wealth fund’s stated purpose of “promot[ing] fiscal sustainability [and] lessening the burden of taxes on American families and small businesses” is not an unprecedented idea. Assets owned by the federal government that generate revenue can and are used to pay down debt. For example, interest paid to the Federal Reserve is transferred to the Treasury.

The same could be done with equity stakes by the federal government. Care should be taken to remove the government from any decision-making at companies it has stakes in so they do not become politicized, and there is no reason why the U.S. couldn’t acquire substantial stakes in U.S. equities to bolster the government trust funds without jeopardizing private enterprise. What it would do is earn a far better rate of return than what is offered by the non-marketable treasuries.

Something needs to be done. The fact is, both the Social Security and Medicare trust funds will be exhausted by 2033 according to the trustees, at which point there might only be enough revenue to pay 80 percent of benefits. Meaning there actually is not a whole lot of time for Congress and the President to figure out how to bolster the U.S. financial picture.

Which is worse, the government having a stake in some publicly traded companies — which it already has — or a sovereign debt crisis? Choose your poison.

Robert Romano is the Executive Director of Americans for Limited Government Foundation.

The post The U.S.-Intel Partnership Is Not Unprecedented And Could Help Bolster U.S. Fiscal Outlook appeared first on Daily Torch.

Click this link for the original source of this article.

Author: Daily Torch

This content is courtesy of, and owned and copyrighted by, https://dailytorch.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.