Three days ago, I wrote about Australia’s system of personal retirement accounts and explained why it is much better than America’s bankrupt Social Security system.

This does not mean, however, that Australia does a good job with overall fiscal policy.

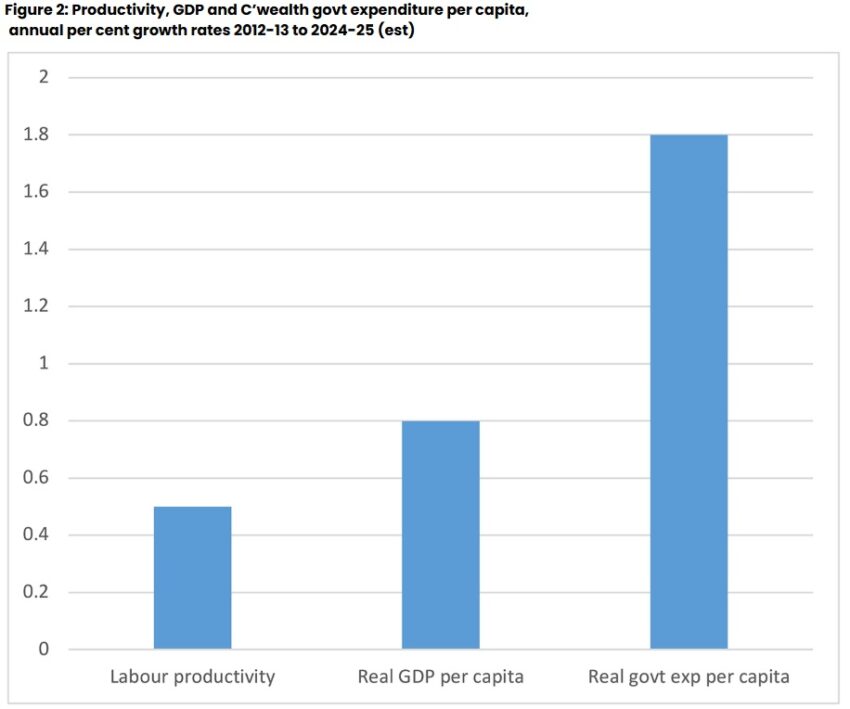

For instance, look at this chart from the Centre for Independent Studies, a think tank based in Sydney.

The politicians in Canberra clearly are violating my Golden Rule. And they are an real-world example of my 20th Theorem of Government.

The chart comes from an article on Australia’s fiscal status by Robert Carling.

Here are some highlights from the executive summary.

…the growth of government spending remains a serious economic concern because of what it means for persistent budget deficits, rising public debt and taxation, weak productivity growth and the societal consequences of a deepening dependency on government. …Total government expenditure now stands near 39 per cent of GDP, up from 34 to 35% before the global financial crisis of 2008. At the Commonwealth government level – which is the focus of this report – the increase over that period has been from 24 to 25% to above 27% currently. …Commonwealth real per-capita expenditure has registered an average annual increase of 1.8%, compared with productivity growth of 0.5% and real GDP growth of 0.8%. This gap cannot be allowed to persist, and its closure…will require action by government to moderate spending growth. …There is much talk of the need for tax reform, but the need for expenditure reform is just as pressing.

I like that Carling’s article also explains why government spending undermines prosperity.

In part, it is because higher taxes and more debt are bad, but also because government spending misallocates economic res0urces.

The reality is that the bigger government becomes, just as the marginal benefits of more spending are likely to shrink, the marginal cost of taxation or borrowing is likely to expand, and the more likely it is that the last dollar spent was wasted or did not generate sufficient benefit to justify the extra dollar of taxation or borrowing needed to finance it. The costs of ever increasing government expenditure can be considered as both economic and societal. The economic costs may come from a rising debt burden if spending is financed by deficits and borrowing. But even if this is avoided through increasing taxation, the rising tax burden also does economic harm by eroding incentives for productive work, saving and investment. …Expanding government also directs resources away from more productive economic activity in the private sector. That is, it can be a drag on productivity through inefficient resource allocation.

On the topic inefficient resource allocation, here’s a look at the size (blue bars) and cost (red line) of the central government bureaucracy in Australia.

Looks like the pandemic was an excuse for a permanent expansion in the burden of government (just as we saw in the U.S. and U.K.).

I’ll close with some “public choice” analysis.

Bureaucrats are just one of many groups that have a vested interest in bigger government.

When we add public and quasi-public employment to the substantial part of the population that relies heavily on government welfare payments for their income, it is likely that more than half of voters rely on government for most of their income. This dependence poses a formidable opposition for any politician trying to curb the growth in public expenditure.

All of which is captured by these two cartoons. Of by my 17th Theorem of Government.

———

Image credit: Chris Samuel | CC BY 2.0.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.