In a much anticipated move the State Health Plan Board of Trustees voted unanimously to approve premium increases for the more than 750,000 members of the State Health Plan (SHP) on Friday.

In February the board met to try and find a solution to the plan’s projected deficit—$507 million in 2026 and between $800 million and $900 million in 2027.

On May 20th, the board reconvened and approved changes to the SHP benefits, raising annual deductibles for singles and families under the 70/30 (Standard PPO) and 80/20 (Plus PPO) plans starting in the 2026 benefit year.

State Treasure Brad Briner whose office oversees the SHP said this was necessary to keep the plan functional in the future.

“I walked into office in January with a half a billion-dollar deficit and that’s just for 2026. Today, we’re going to take the last step to filling the hole by finalizing premiums,” said Briner. “I know that few people are going to be happy about that. But it is necessary. We want to have a state health plan in the future.”

Former State Treasurer Dale Folwell maintained a policy of not increasing premiums, and Treasurer Briner did not hesitate to point out how that decision contributed to the current dire financial situation.

“Simply put, we’re here because of the short-sighted decisions of my predecessor. Premiums were frozen for years. And members were made to believe it could be that way forever,” Briner told the board. “But the plan was actually spending more than it took in each and every year. That meant cash reserves for the plan were being used to keep prices stable rather than doing the hard work with providers and making adjustments to get better services at low prices for our members. Now those cash reserves are nearly gone.”

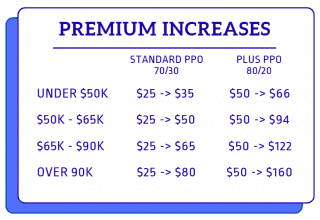

Plan premiums for the first time are on a sliding scale based on income, with the smallest increases going to the lowest-paid state employees. The scale is broken down into four income brackets: Under $50,000; $50,001 to $65,000; $65,001 to $90,000; and $90,001 and over.

For employees earning under $50,000, monthly premiums for a single subscriber will rise by either $10 or $16, depending on the plan. In the top income tier over $90,000, that increase will be $30 or $110 per month.

Retirees on the plan will see their monthly premiums remain the same.

“The approach to fixing this crisis will not only preserve affordability but will also put the state health plan on a sustainable path, ensuring this valuable benefit will be available in the future as well,” said Briner.

In June, an audit of the SHP confirmed the finical situation using actuarial projections from 2024, which were used for financial forecasting by the State Treasurer’s Office, showed net losses for the SHP of $199 million, $507 million, and $862 million for 2025 through 2027. Ultimately, the projections showed the State Health Plan having a $949 million cash deficit by the end of 2027.

Deductibles under the Standard PPO Plan will see their annual deductibles go from $1,500 for singles and $4,500 for families to $3,000 and $9,000, respectively. Under the Plus PPO Plan, deductibles will go from $1,250 for singles and $3,740 for families to $1,500 and $4,500 respectively.

“Today’s vote was not easy, but these increases were necessary to keep the Plan solvent and to keep this benefit in place for those that serve and have served the state of North Carolina,” said Briner. “The goal now is to move forward and focus on ways to improve benefits through transparency and better partnerships and programs to keep our members healthy.”

The 2026 Open Enrollment period, will take place Oct. 13-31, 2025.

The post Premium increases ahead for State Health Plan members first appeared on Carolina Journal.

The post Premium increases ahead for State Health Plan members appeared first on First In Freedom Daily.

Click this link for the original source of this article.

Author: NIck Craig

This content is courtesy of, and owned and copyrighted by, https://firstinfreedomdaily.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.