By Nicholas Anthony, CATO Institute

The evidence shows that the CBDCs in both Jamaica and The Bahamas have failed to gain traction with either consumers or businesses.

Central bank digital currencies (CBDCs) were launched in Jamaica and The Bahamas with ambitious promises: to promote financial inclusion, to stabilize the monetary system, and to foster competition.1 These same promises have also been made in the United States and abroad as jurisdictions debate whether to launch a CBDC.2 For example, in the United States, Department of the Treasury official Nellie Liang has said, “A retail CBDC could contribute to a more competitive and innovative payment system; support financial inclusion; and help preserve the singleness of the currency.”3

Yet several years in, the evidence shows that the CBDCs in both Jamaica and The Bahamas have failed to gain traction with either consumers or businesses.4 Instead, the CBDCs have become little more than vehicles for government handouts—distributed through limited-time giveaways and incentive programs, with little lasting use. These early experiments provide a cautionary tale for other governments weighing whether to launch a CBDC.

Jamaica

A Brief Primer on Jamaica’s CBDC

The Bank of Jamaica officially launched its CBDC (known locally as JAM-DEX) in July 2022.5 However, the CBDC was introduced with a running start. As will be described in detail, the central bank gave its staff J$1 million ($6,330) in CBDC in August 2021.6 It was only in July 2022 that the wider public could access the CBDC through a mobile app.7

To use the CBDC, a person must join a bank—a requirement that undermines the idea that the CBDC would help with financial inclusion.8 Although the Bank of Jamaica has announced that additional banks will enter the market, accounts can currently only be opened with one bank: National Commercial Bank.9 National Commercial Bank is therefore responsible for upholding the know-your-customer requirements, account maintenance tasks, and customer service complaints for every CBDC account in the country.

Once an account is opened, the CBDC can be spent as long as both parties have the app with an open account. However, how widely it can be used is an open question. When it comes to paying bills, the frequently asked questions section of the CBDC wallet says to convert the CBDC to standard Jamaican dollars and then send the money.10

Measuring CBDC Adoption

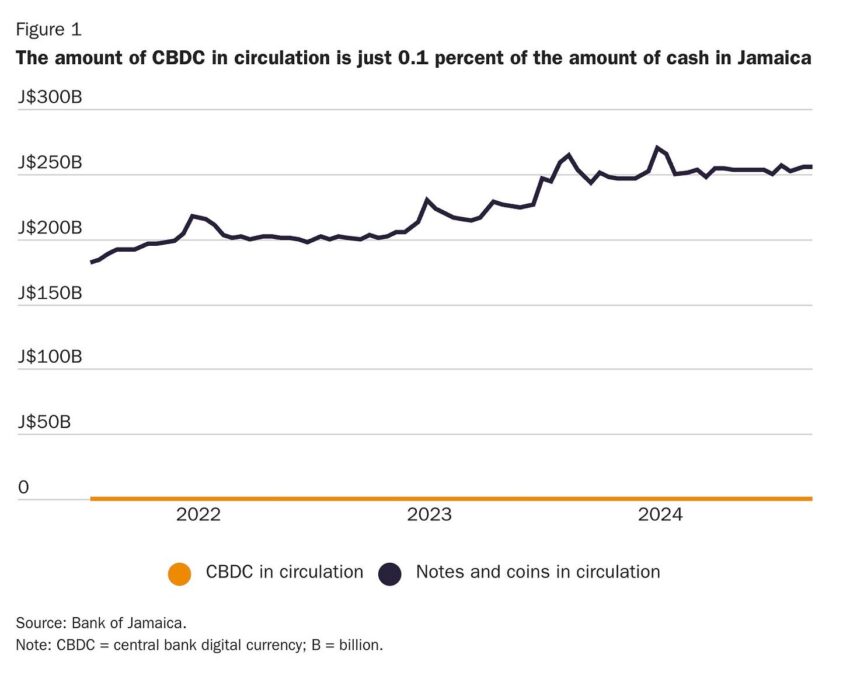

Because of limitations in the available data, the best data point to consider is the amount of CBDC in circulation.11 In contrast to the robust and fluctuating supply of cash in circulation, the supply of CBDC in circulation remains negligible—suggesting near-zero consumer reliance (Figure 1).12 However, limiting the focus to the CBDC alone reveals there is more to the story (Figure 2). Whereas the amount of cash ebbs and flows because of changes in demand and other factors, the amount of CBDC has only increased with sudden, abrupt changes. The dramatic nature of these changes suggests that the numbers reflect government activity, not genuine consumer adoption.13

The Bank of Jamaica reported both figures biweekly from 2021 to 2024. However, the changes to the amount of CBDC in circulation occurred only seven times.14 Cross-referencing these seven changes with public reports, the source for these isolated changes begins to emerge: government handouts (Table 1).

Consider first the initial increase to J$1 million ($6,330) in September 2021. As reported by the central bank in the Jamaica Information Service, this early jump was due to the Bank of Jamaica giving J$1 million ($6,330) in CBDC to its staff.15 Similarly, the next increase—in November 2021—occurred because the Bank of Jamaica issued J$5 million ($31,650) to National Commercial Bank.16 However, in this instance, National Commercial Bank paid for the CBDC transfer through Jamaica’s real-time gross settlement system in a manner similar to requesting physical cash.17

The amount of CBDC in circulation did not increase again until after the government offered J$2,500 ($15) to each of the first 100,000 people to open a CBDC account after April 1, 2022.18 The total payout of J$250 million ($1.58 million) appears to have been delivered within two months.19 First, in May 2022, the amount of CBDC in circulation jumped by J$209.18 million ($1.32 million). Then, in June 2022, the amount jumped again by J$40.81 million ($258,365).

The next increase occurred in January 2023 when the Bank of Jamaica reported a J$1 million ($6,330) jump in the amount of CBDC in circulation. Once again, it appears to be centered on government activity. The Jamaican government paid more than 100 workers with the CBDC in December 2022 as part of an “employment generation programme.”20

After another stagnant period, an increase of J$208,000 ($1,316) took place in September 2023. This time, it’s likely that three incentive programs were responsible for the jump. The first program offered J$25,000 ($158) to each of the first 10,000 merchants who opened a CBDC account.21 Had this incentive program been successful, the payout would have been J$250 million. However, it is reasonable to assume this strategy was unsuccessful considering that only 2,379 merchants had opened CBDC accounts by September 2024—a full year later.22 The second program was aimed at consumers.23 The program gave consumers 2 percent back on all purchases made with the CBDC. This program had a monthly maximum payout of J$5,000 ($31). Finally, the third program gave J$2,500 ($15) to the first 60,000 customers who signed up for an entry-level account.24

The only increase that cannot be accounted for with publicly available information was in May 2024. However, the Bank of Jamaica confirmed via email that the J$200,000 ($1,273) increase occurred because of a request by a wallet provider.

When viewed in a vacuum, some people may consider it impressive that the amount of CBDC in circulation went from zero to more than J$257 million ($1.64 million) in three years. When viewed in context, however, the reason for this increase is not because the CBDC had solved the issues that had been weighing on Jamaican citizens. Rather, the reason was that the Jamaican government had given the money away.

Reflecting on the lack of genuine consumer adoption in 2024, Bank of Jamaica Governor Richard Byles said the central bank would continue to push forward with its CBDC to try to get people to use it.25

The Bahamas

A Brief Primer on The Bahamas’ CBDC

The Central Bank of The Bahamas officially launched its CBDC (known locally as the SandDollar) in October 2020.26 The CBDC runs on an intermediated system in which financial institutions provide front-end services (onboarding, customer service, etc.) and the central bank maintains the back end.27

To use the CBDC, a person must contact one of seven currently authorized agents.28 These agents include four money transmitter businesses and three payment service providers (often referred to as MTBs and PSPs, respectively). Yet as of this writing, only four agents even mention the CBDC on their websites—and one of them offers services only through a waiting list.29 There are some differences among the apps the various agents provide, but the apps generally rely on QR codes to initiate payments.30

The amount of money that can be held and spent with the CBDC depends on whether the person provides the authorized agents with identification issued by the Bahamian government. With identification, people can hold up to B$8,000 ($8,000) in CBDC and spend up to B$10,000 ($10,000) a month.31 Without identification, people can only hold B$500 ($500) and spend B$1,500 ($1,500). Registered businesses, however, have a holding limit of between B$8,000 ($8,000) and B$1 million ($1 million).32

Measuring CDBC Adoption

The Bahamas has struggled with CBDC adoption. Much like in Jamaica, the Bahamian CBDC seems almost nonexistent compared with cash (Figure 3).33 Again, however, limiting the focus to the CBDC alone reveals there is more to the story (Figure 4). Although the amount of CBDC in circulation does not change with the same fluidity as cash, the changes taking place appear to be slightly more organic than what occurred in Jamaica (Figure 2). Yet, even then, cross-referencing these changes with other reports suggests that much of the activity is government activity.

Although the changes over time resemble the experience in Jamaica, changes in the amount of CBDC in circulation in The Bahamas have been more frequent. Those changes ranged from less than negative 15 percent to more than 156 percent.34 Upon assessing this spread, it appears that large changes may be more reflective of government giveaways, whereas small changes are consumer based.

The CBDC was officially launched in 2020, but the story really starts in 2019 when the Central Bank of The Bahamas first put B$48,000 ($48,000) of the CBDC into circulation.35 This injection was given to “various retailers” to test the CBDC.36 But it wasn’t long before questions in the accounting emerged. The Central Bank of The Bahamas reported that it later gave “limited amounts” of the CBDC to authorized financial institutions and “closed the year with a total value” of B$130,000 ($130,000) of CBDC in circulation.37 However, that same report states that only B$75,125 ($75,125) was in circulation—explicitly noting that the circulation had increased by B$27,125 ($27,125) since the initial injection in 2019.38 The Central Bank of The Bahamas did not respond to questions, but I assume for the sake of this paper that the correct amount of CBDC in circulation in 2020 was B$75,125 ($75,125) and the increase was in line with what was given to institutions.

Over the course of the next four years, the amount of CBDC in circulation increased by more than B$1.8 million ($1.8 million). Like in Jamaica, some of the activity can be directly traced to government giveaways, promotional events, and incentive programs. For example, the Central Bank of The Bahamas committed to giving away B$1 million ($1 million) to “early adopters” of the CBDC.39 As detailed in the limited reporting available, the central bank gave away B$156,310 ($156,310) at what it called CBDC “wallet-seeding events.”40 These giveaways occurred at charity events, festivals, and other social gatherings (Table 2).41 Elsewhere, officials regularly appeared on the radio to give away up to B$200 ($200). Venturing beyond events and entertainment, the central bank also sought out consumers with a CBDC rebate program.

Fortunately, the analysis of the Bahamian CBDC can go beyond assessing changes to the amount of CBDC in circulation. In April 2023 (nearly three full years after the CBDC had been introduced), the Central Bank of The Bahamas began to publish a monthly series of reports to “keep the public more informed of initiatives to promote digital currency adoption.”42 This series was ultimately shut down before hitting its one-year anniversary, but it did offer several insights during its limited run.43 Notably, the series included information regarding the number of wallet providers, merchant wallets, and consumer wallets (Table 3).

This dataset reveals a few things. First, it seems The Bahamas may have the highest sign-up rate for any CBDC.44 With a population of 399,440 people, the opening of 118,955 consumer wallets means that the central bank achieved a sign-up rate of 30 percent.45

Yet CBDC proponents should not be too quick to celebrate that achievement. The second thing the data set reveals is that signing up to use a CBDC and actually using a CBDC are two very different things. The gap between approved and active wallets underscores this disconnect. Unfortunately, the central bank never reported the number of active consumer wallets and quickly stopped reporting the number of active merchant wallets. However, the fact that only 30 percent of merchant wallets were active in March and April 2023 suggests consumers had limited options if they wanted to use the CBDC.

It was not included in every update, but the reports also shared some data about transaction volumes. This information confirmed again that much of the activity taking place was due to government activity. For example, a particularly revealing line from the August 2023 update stated that CBDC use was “impacted by the significantly reduced levels of Government transfer payments.”46 The total value of wallet top-ups had fallen from B$38.4 million ($38.4 million) to B$7.1 million ($7.1 million).47 The October 2023 update revealed that the trend had continued.48 The report shared, “During the first seven months of 2023, a more than four-fold reduction in wallet top-ups to $10.2 million was registered, in comparison to the previous year when government transfer payments significantly influenced retail activity.”49

Both the August and December updates focused on the rebate programs. The August update reported that the CBDC “rebate program remained an essential aspect of adoption efforts.”50 The rebate program gave individuals B$20 ($20) for showing up at promotional events and an additional B$5 ($5) for spending at least B$18 ($18) in CBDC at those events. Similarly, the December update highlighted the “SandDollar Holiday Rebate program.”51 However, the central bank still said usage of the CBDC was “dampened by reduced government transfer payments.”

Reflecting on the lack of consumer adoption in 2024, Central Bank of The Bahamas Governor John Rolle said commercial banks would soon be forced to distribute the CBDC—suggesting a shift from incentives to mandates.52

The Lessons

When asked why central banks have struggled to get people to adopt CBDCs, government officials have provided several possibilities.53 In Jamaica, the central bank said people were not interested in adopting a new system when they can already make digital payments.54 In The Bahamas, the central bank said the COVID-19 pandemic made it difficult to promote CBDC use.55 Reflecting on these statements, it seems that the common thread is that a CBDC is not an effective policy tool. Governments may build CBDCs, but that does not mean people will use them. People are served well by cash, prepaid cards, debit cards, credit cards, payment apps, and cryptocurrencies. They don’t need the government to reinvent the wheel.

If governments are to ignore this warning and push forward with CBDCs anyway, they need to start operating with more transparency. Where CBDCs have been made available to the public, so too should consistent, monthly reports on data surrounding the CBDC. That means reporting more than just the amount of CBDC in circulation. Ideally, those reports would include the following data:

-

CBDC in circulation

-

CBDC transaction volume

-

CBDC allocated for giveaways

-

CBDC given away

-

Number of CBDC accounts or wallets (consumer, merchant, and provider)

-

Number of active CBDC accounts or wallets (consumer, merchant, and provider)

-

Money spent to build the CBDC system

-

Money spent to maintain the CBDC system

It is important that all these data points are provided, and provided consistently. A significant distinction exists between people being open to using a CBDC, people onboarding to use a CBDC, and people using a CBDC. Each level offers new insights, and the information that has been made available only scratches the surface.

By using this information, the public will be able to assess whether resources are being allocated optimally. For example, consider a scenario in which CBDC demand is naturally low because the existing digital payment options—debit cards, mobile apps, even cryptocurrencies—already serve consumer needs. In such a case, government giveaways may briefly push a CBDC into circulation, but actual usage will still depend on whether merchants and consumers find value in the new system. Without that value, the CBDC functions as little more than a digitized voucher system. In that sense, one can expect to see some activity (seen in transaction volume) as the CBDC is given away, individuals spend it (seen in wallet activity), and merchants transfer it for cash or balances at a bank. However, the activity is unlikely to last. Wallets will go unused and transaction volume will fall.

Governments also need to clearly establish which factors will mean success or failure and what will happen if the CBDC proves to be a failure. Ideally, CBDC adoption should be measured by the number of people who have opened CBDC wallets and used the CBDC in a manner that closely rivals or exceeds existing payment options (e.g., credit cards, debit cards, cash). This use should be independent of government incentives. If a CBDC fails to meet objectives, there should be a clear path for winding down the system.

Conclusion

Facing challenges with adoption has been a common issue in the CBDC experience. This paper has focused on the Caribbean experience. However, in their efforts to spur demand, the Chinese government has generated even grander giveaways and the Nigerian government created a cash shortage.56 Whether by carrot or by stick, governments want their citizens to adopt CBDCs. Yet the real question they should be asking is “What do our citizens want?” Based on the experience thus far, it’s not a CBDC.

End Notes

1. The Bahamian and Jamaican CBDCs are known locally as the SandDollar and JAM-DEX, respectively. For simplicity and consistency, they will be referred to as CBDCs in this report. Furthermore, the symbols J$, B$, and $ will be used for the Jamaican dollar, Bahamian dollar, and US dollar, respectively. Finally, an analysis of Caribbean CBDCs would include the Eastern Caribbean Currency Union. However, the Eastern Caribbean Currency Union shut down its CBDC in January 2024 after opening it to the public for 34 months. Human Rights Foundation, “Jamaica CBDC Tracker”; Human Rights Foundation, “The Bahamas CBDC Tracker”; and Human Rights Foundation, “ECCU CBDC Tracker.”

2. Human Rights Foundation, “CBDC Tracker.”

3. Nellie Liang, remarks at a workshop on “Next Steps to the Future of Money and Payments,” Washington, March 1, 2023.

4. Credit goes to monetary historian Franklin Noll for first conducting an analysis of Caribbean CBDC adoption in April 2024 for the Federal Reserve Bank of Kansas City and inspiring this paper. Franklin Noll, “Observations from the Retail CBDCs of the Caribbean,” Federal Reserve Bank of Kansas City, April 10, 2024.

5. Human Rights Foundation, “Jamaica CBDC Tracker.”

6. Bank of Jamaica, “Bank of Jamaica’s CBDC Pilot Project a Success,” Jamaica Information Service, December 31, 2021.

7. Lynk, “JAM-DEX: Jamaica’s Digital Currency,” December 22, 2024.

8. Douglas McIntosh, “BOJ Hopeful More Persons Will Join Banks to Get CBDC Accounts,” Jamaica Information Service, June 16, 2022.

9. The Bank of Jamaica is careful to note, “You don’t need to have, or open, a bank account to get a CBDC wallet.” However, people still need to go to a bank and get onboarded to open a CBDC account. Chris Patterson, “Third Digital Wallet Provider Expected to Enter the Market Soon,” Jamaica Information Service, August 24, 2023; “NCB Says Use of JAM-DEX Low,” Radio Jamaica, August 12, 2024; and Bank of Jamaica, “CBDC FAQs,” 2025.

10. The FAQs page says, “To pay bills or purchase mobile top up from your JAM-DEX balance, follow these steps to convert your JAM-DEX to JMD and complete your transaction.” Lynk, “FAQs,” 2025.

11. In an email, the Bank of Jamaica confirmed that “CBDC in circulation” is defined as the amount of CBDC held “in the hands of the public.”

12. The data on cash and CBDC in circulation were sourced from reports on the Bank of Jamaica’s balance sheet. The numbers are reported in Jamaican dollars (J$). Ideally, adoption analysis would also incorporate transaction volumes, account ownership, and account activity. However, the available data are limited. Bank of Jamaica, “BOJ Balance Sheet,” June 2025.

13. For the purposes of this paper, CBDC adoption should be thought of as consumers opening CBDC wallets and using them consistently in a manner that rivals or exceeds existing payment options. This activity should be independent of government incentives and should occur across a broad population. True adoption would also involve sustained growth in usage and wallet activity, not sporadic bursts tied to state-issued incentives.

14. The seven times that the amount of CBDC in Jamaica changed occurred in September 2021, November 2021, May 2022, June 2022, January 2023, September 2023, and May 2024.

15. Bank of Jamaica, “Bank of Jamaica’s CBDC Pilot Project a Success,” Jamaica Information Service, December 31, 2021.

16. Bank of Jamaica, “Bank of Jamaica’s CBDC Pilot Project a Success,” Jamaica Information Service, December 31, 2021.

17. This information was confirmed in email correspondence with the Bank of Jamaica.

18. Douglas McIntosh, “$2500 Incentive for Jamaicans to Get Digital Wallet,” Jamaica Information Service, March 10, 2022.

19. The Bank of Jamaica confirmed in an email that the full J$250 million was given away.

20. Bank of Jamaica, “JAM-DEX Facilitates Government Wage Payment Employment Generation (Christmas Work) Programme,” December 2022.

21. Chris Patterson, “Gov’t Provides Incentives to Boost JAM-DEX Use,” Jamaica Information Service, March 9, 2023.

22. Bank of Jamaica, “Merchants That Accept JAM-DEX as Payment,” 2024.

23. Chris Patterson, “Gov’t Provides Incentives to Boost JAM-DEX Use,” Jamaica Information Service, March 9, 2023.

24. Chris Patterson, “Gov’t Provides Incentives to Boost JAM-DEX Use,” Jamaica Information Service, March 9, 2023.

25. Karena Bennett, “Byles Set on Riding Out CBDC Challenges,” Jamaica Observer, February 28, 2024.

26. Human Rights Foundation, “The Bahamas CBDC Tracker.”

27. “Key Players,” SandDollar website, 2025.

28. The authorized agents currently include Omni Financial Group Limited, SunCash, MoneyMaxx, Cash N’ Go, Kanoo, Mobile Assist, and Island Pay. “Key Players,” SandDollar website, 2025.

29. Of the seven authorized agents, only Omni Financial Group Limited, Kanoo, Mobile Assist, and Island Pay mention the CBDC on their websites as of June 2025.

30. SandDollar Bahamas, “Sand Dollar—How to Send Funds by Custom Name,” YouTube video, December 23, 2020.

31. “Individual,” SandDollar website, 2025.

32. “Merchants,” SandDollar website, 2025.

33. The data on cash and CBDC in circulation were sourced from reports on the Central Bank of The Bahamas’ balance sheet. The numbers are reported in Bahamian dollars.

34. The amount of CBDC in circulation decreased by 4.78 percent in February 2023 and increased by 156.67 percent in July 2021.

35. Central Bank of The Bahamas, “2019 Central Bank of The Bahamas Annual Report,” April 27, 2020.

36. Central Bank of The Bahamas, “2019 Central Bank of The Bahamas Annual Report,” April 27, 2020.

37. See Central Bank of The Bahamas, “2020 Annual Report,” April 26, 2021, p. 15. Also see Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency SandDollar,” April 3, 2023.

38. For additional references, see Central Bank of The Bahamas, “2020 Annual Report,” April 26, 2021, pp. 59, 99, 106.

39. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency SandDollar,” April 3, 2023.

40. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency SandDollar,” September 8, 2023; and Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency–SandDollar,” April 3, 2023.

41. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” May 25, 2023; Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” December 15, 2023; and Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” February 1, 2024.

42. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency SandDollar,” April 3, 2023.

43. A spokesperson from the Central Bank of The Bahamas confirmed in an email that the updates would not continue after the February 2024 update. The spokesperson also clarified inconsistencies among the reports.

44. Human Rights Foundation, “CBDC Tracker.”

45. This number should be taken with a grain of salt as it assumes each wallet is owned by one individual.

46. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” August 3, 2023.

47. These values represent wallet top-ups from January to May in 2022 and 2023. The phrase “wallet top-ups” refers to the amount of money someone added to the CBDC wallet after previously spending the balance. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” August 3, 2023.

48. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” October 13, 2023.

49. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” October 13, 2023.

50. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” September 8, 2023.

51. Central Bank of The Bahamas, “Public Update on The Bahamas Digital Currency—SandDollar,” February 1, 2024.

52. Elizabeth Howcroft and Marc Jones, “Bahamas to Regulate Banks to Offer Cbank Digital Currency,” Reuters, July 1, 2024.

53. Franklin Noll, “Observations from the Retail CBDCs of the Caribbean,” Federal Reserve Bank of Kansas City, April 10, 2024.

54. Karena Bennet, “Byles Set on Riding Out CBDC Challenges,” Jamaica Observer, February 28, 2024.

55. Central Bank of The Bahamas, “2022 Annual Report,” May 8, 2023.

56. Human Rights Foundation, “CBDC Tracker.”

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Click this link for the original source of this article.

Author: Quoth the Raven

This content is courtesy of, and owned and copyrighted by, https://quoththeraven.substack.com feed and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.