It’s a pivotal week for the U.S. housing market, with key June home sales data due just as the Federal Reserve enters its pre-meeting blackout ahead of the July 30 FOMC.

The upcoming housing data is “the canary in the coal mine, and it’s looking queasy,” Bloomberg Economist Anna Wong wrote in a note. Existing home sales for June will be released on Wednesday, followed by new home sales on Thursday.

While interest rate swaps still aren’t pricing in a 25bps cut, political pressure is mounting. President Trump has renewed his attacks on Fed Chair Jerome Powell, accusing him of playing politics. He’s been vocal about the urgent need to begin a rate-cutting cycle, claiming Powell is “late as usual.”

Treasury Secretary Scott Bessent stated earlier…

*BESSENT: RATE CUTS WILL OPEN UP HOUSING MARKET

— zerohedge (@zerohedge) July 21, 2025

Ahead of the mid-week data dump, Goldman Sachs Chief Economist Jan Hatzius and his team of analysts published a note highlighting that the housing market slowdown is broadening. The analysts point out that construction is being scaled back, demand is cooling, and price growth is nearly flat. They expect further weakness into year-end, with tight monetary policy and affordability remaining key headwinds.

Goldman Sachs Mid-Year 2025 Housing Outlook — Summary

Residential Investment Falls Sharply:

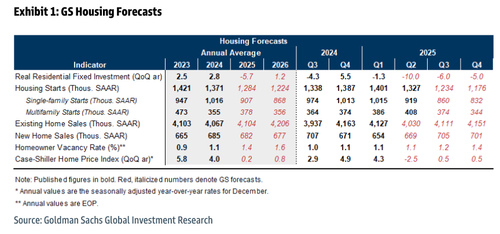

- After a modest 1% annualized decline in Q1, residential fixed investment is estimated to have dropped 10% in Q2. Full-year 2025 RFI is forecast to fall 5.7% (Q4/Q4), reversing 2024’s +2.8% growth.

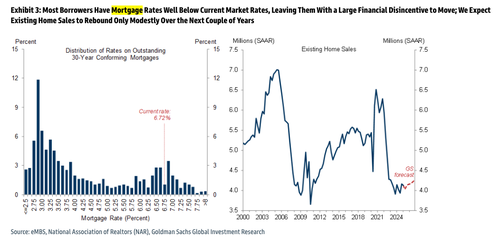

Mortgage Lock-In Freezes Market:

- With 87% of borrowers holding mortgage rates below market levels, housing turnover remains depressed. Existing home sales are expected to total 4.1 million in 2025—23% below 2019.

Single-Family Resilience Cracks:

- Despite elevated rates, single-family starts had held up early in the year but are now declining—down 20% (starts) and 13% (permits) since February. Starts are projected to fall 11% YoY to .91 million.

Demand Cooling:

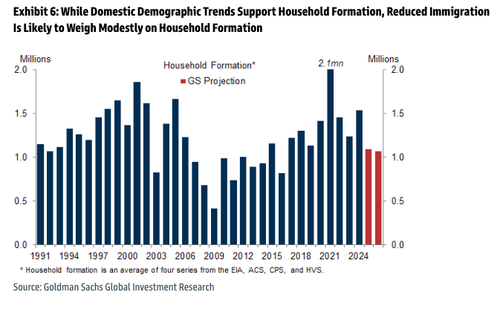

- Strong demographics and a healthy labor market support demand, but reduced immigration and affordability issues—evidenced by widespread use of mortgage-rate buydowns—are acting as constraints.

Home Prices to Stall:

- National home prices are forecast to rise just .2% YoY in 2025 and .8% in 2026, as elevated supply and softening demand push homeowner vacancy rates up to 1.6% by end-2026.

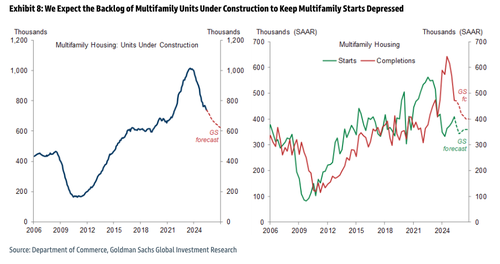

Multifamily Sector Weakens Further:

- Construction backlog has shrunk 26% but remains above pre-pandemic levels. Starts are expected to stay low as developers work through completions, now at a 40-year high.

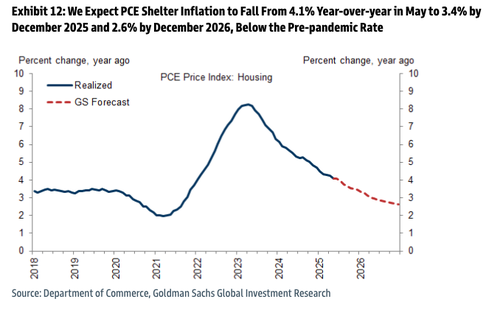

Shelter Inflation Moderates:

- With rent growth slowing to 2–3% and the rent gap between new and existing leases now closed, Goldman expects PCE shelter inflation to fall from 4.1% to 2.6% by December 2026.

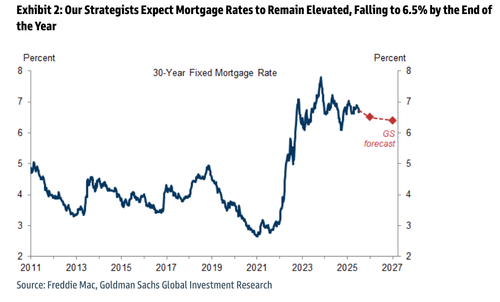

In a separate housing note last week, Goldman analyst Vinay Viswanathan expects “mortgage rates will likely grind lower” and open the door for “modest affordability relief over the next 2 years.”

Pro subscribers can read the full housing note here…

Tyler Durden

Tue, 07/22/2025 – 07:45

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.