The private sector is more efficient than the government because businesses know they have to please customers if they want to make profits.

Governments, by contrast, simply rely on coercion. People generally don’t have choices and they typically comply with diktats since the alternative is prison.

But there is an exception. When people can “vote with their feet,” they can decide where to live based on which governments provide value compared to the amount of taxes that are required.

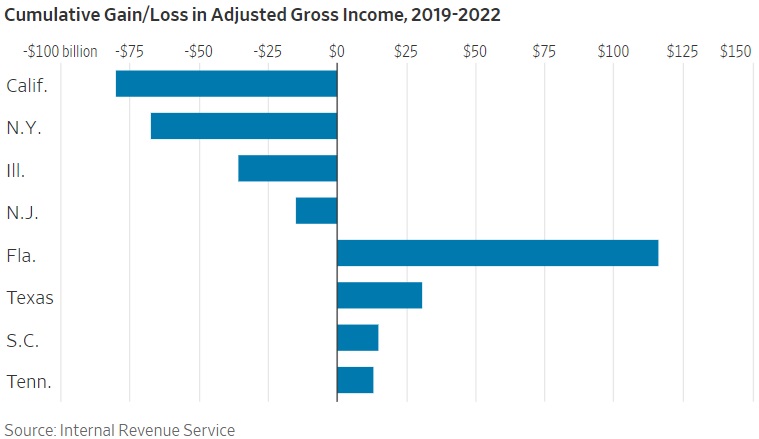

It’s not just that they can decide. They do decide. Hundreds of thousand of Americans have migrated from high-tax states to low-tax states in recent years.

This is – or should be – a signal to state governments that high tax rates are bad and low tax rates (or zero income taxes!) are good.

The same thing happens globally. I’ve written recently about successful people moving across national borders to escape confiscatory tax policies in nations such as Norway and the United Kingdom.

As in the United States, this is a form of feedback that should encourage politicians to enact better policy.

Unfortunately, European politicians are going in the other direction. They want Soviet-style exit taxes to make it more costly for taxpayers to emigrate.

Bloomberg has an article on this issue authored by Alice Kantor. Here are some key passages.

The wealthy are exiting the UK in droves for tax havens such as Monaco, Switzerland and Dubai. But many well-heeled Europeans with similar dreams of escape are finding they can’t leave quite so easily. High-tax nations across the continent are seeking to slow the departure of rich residents by hitting them with a levy on the value of their assets when they depart. Known as exit taxes, the idea is to make them think twice before leaving… Germany, Norway and Belgium have all expanded exit taxes in recent months or are weighing proposals to do so… Within Europe, Norway and Germany are two of the strongest proponents of exit taxes. …The US, Canada, Australia and other European countries also have varying forms of extracting cash from departing residents.

The article includes a chart showing Canada is the worst country for exit taxes (part of a pattern).

It’s also very embarrassing that the United States is on the list.

And here are some excerpts from a report in the U.K.-based Economist.

Germany’s collapsing “traffic-light” coalition…flashed green for one change: an exit tax. Since January 1st anyone with over €500,000 ($520,000) in investment funds has had to pay income tax on gains earned in Germany if they wish to extract their money from the country. …Norway’s government also brought in changes for the new year. In a second stiffening of the rules in as many years, rich Norwegians will now pay levies on dividends if they plan to remain outside their fatherland. A doomed French budget would have tightened an exit tax that left-wing lawmakers complain has been gutted. Dutch parliamentarians have instructed their government to investigate introducing an exit tax of its own. …how much money do exit taxes actually bring in? Not much. The well-heeled are well-motivated to find loopholes. European laws further complicate matters. Germany’s new rules may violate EU legislation protecting the free movement of capital… This dysfunction shows up in revenues that are collected. Norway’s Ministry of Finance estimates its amended exit charge will raise $120m a year once its 12-year tail has run out, an amount equivalent to 0.04% of the state’s total revenue.

While exit taxes are morally reprehensible, I’ll conclude with an observation about the economic effect.

Like death taxes and wealth taxes, exit taxes impose a harsh burden on saving and investment. They add a layer of tax to income that already has been taxed (in some cases, many times). And the levy directly drains capital from the private economy, which is a recipe for lower productivity and lower wages.

As is so often the case, politicians aim at the rich, but the rest of us pay the price.

P.S. You won’t be surprised to see which American politician proposed to make exit taxes even worse.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.