In 1972, Ohio politicians made the mistake of imposing a state income tax.

That first tax had a top rate of 3.5 percent, but politicians quickly became addicted to this new source of tax revenue. By 1984, the top rate had jumped to 9.5 percent.

That’s the bad news.

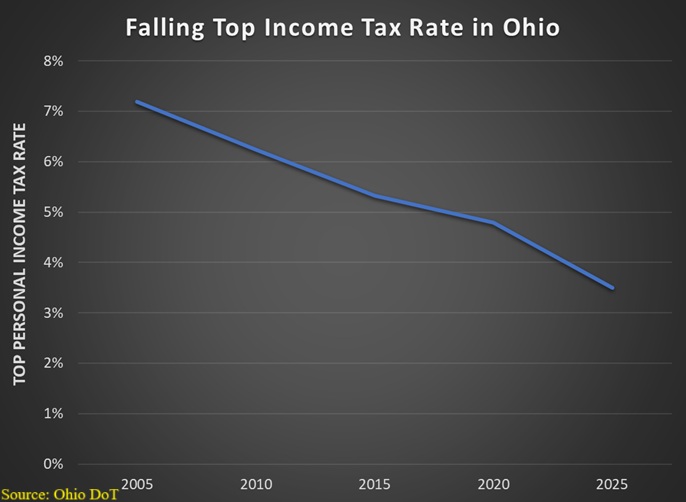

The good news is that Ohio has been moving in the right direction over the past two decades.

The top tax rate was over 7 percent in 2005. This year, it’s less than half that level.

But the even-better news is that Ohio is shifting to a low-rate flat tax.

Here are some excerpts from a report by Mike Gaunter for WFMJ.

Ohio Gov. Mike DeWine on Monday approved the state’s new two-year spending plan, which includes a major shift in how Ohioans pay state income taxes. This change, pushed by Republican lawmakers, aims to make the tax system simpler and reduce the amount of money people owe. The thrust of the tax plan is a move towards a 2.75% flat income tax rate… This flat rate is set to be fully in place by the 2026 tax year. Before the flat rate officially starts, the budget also lowers the highest income tax rate immediately. For the 2025 tax year, the top rate, which currently stands at 3.5%, will go down to 3.125%. A benefit for many Ohio residents is that if their income, after certain deductions and exemptions, is $26,050 or less, they will not pay any state income tax at all.

Kudos to Buckeye State lawmakers.

They have joined the tax cut/tax reform revolution that has led to better tax policy over the past few years.

As such, it’s time to update my table showing the type of income taxes that exist (or don’t exist!) in the 50 states.

As you can see, this table is much better than the first one I created back in 2018.

What Ohio now needs is to copy Mississippi and begin the process of totally repealing the income tax. It’s very feasible if lawmakers follow one simple rule.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.