Key Points in This Article:

-

Lucid Group (LCID) aims to compete in the premium EV market with models like the Lucid Air and Gravity SUV, while planning to launch affordable mass-market vehicles to capture a broader audience.

-

The EV maker is exploring high-margin technology licensing to other automakers, potentially diversifying revenue streams beyond vehicle production.

-

Lucid faces intense competition, operational hurdles, and financial pressures that could impact its ability to scale and succeed in the evolving EV landscape.

-

Nvidia made early investors rich, but there is a new class of ‘Next Nvidia Stocks’ that could be even better. Click here to learn more.

Luxury electric vehicle (EV) manufacturer Lucid Group (NASDAQ:LCID) aims to carve a niche in the premium EV market with models like the Lucid Air and Gravity SUV. Despite a 48% drop from its 52-week high and a staggering 96% loss from its peak after its SPAC merger, Lucid holds the potential to become a significant player in the growing EV sector.

With ambitious plans for mass-market vehicles and technology licensing, Lucid could capitalize on the projected rise in EV sales, expected to reach 30% of U.S. vehicle sales by 2030. However, it still faces significant risks, so let’s examine Lucid’s millionaire-making potential.

Bull Thesis for Lucid Group

The bullish case for Lucid Group hinges on its strategic expansion and technological prowess.

Analysts highlight Lucid’s upcoming launch of two mass-market vehicles — a sedan and a crossover — priced under $50,000 by late 2026, directly competing with Tesla’s (NASDAQ:TSLA) Model 3 and Model Y. These models could drive exponential growth, with sales projected to surge 72% in 2025 and 97% in 2026, following the Gravity SUV’s debut.

Additionally, Lucid’s long-term vision extends beyond manufacturing EVs. By licensing its proprietary powertrain technology, as seen in its 2023 Aston Martin deal, Lucid aims to supply other automakers, potentially yielding higher profit margins and scalability.

Former CEO Peter Rawlinson’s ambition was to produce over a million vehicles annually by the 2030s while transitioning to a tech-focused business model. If Lucid maintains its timeline and secures more partnerships, it could mirror Tesla’s early growth trajectory, offering substantial upside for investors.

Bear Case for Lucid Group

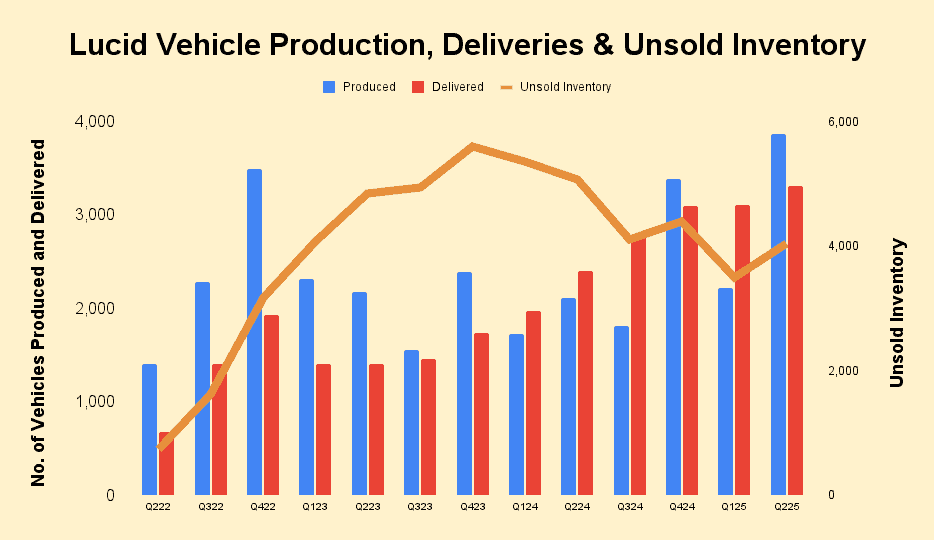

Despite recent progress, Lucid faces daunting challenges, as underscored by its second-quarter production and deliveries update that was released earlier this month (the EV maker reports Q2 financial results on Aug. 5).

While Lucid’s first-quarter revenue reached $235 million, up 36% year-over-year, the company remains unprofitable, albeit improved from the year-ago period. Net losses were $366.2 million, or $0.24 per share compared to $680.8 million, or $0.30 per share, in the same period last year.

Operating expenses, including $251 million in research and development, continue to strain its $5.76 billion in liquidity. Lucid’s 2025 production target of 20,000 vehicles — which management just reaffirmed — is ambitious but seems difficult even with the ramp up in Gravity SUV. Year-to-date, Lucid has produced only 6,075 vehicles, meaning nearly 14,000 EVs — more than double the first half of 2025 — need to roll off the production line.

The situation is exacerbated by Tesla’s price cuts and the looming Model Q, which is expected to be priced under $30,000. Competition, supply chain issues, and reduced EV subsidies under new policies could further erode demand.

With 60% ownership by Saudi Arabia’s Public Investment Fund, Lucid’s cash reserves may require further infusions by 2026, risking dilution. Scaling Gravity production will also spike costs, and without a clear path to profitability, Lucid’s financial stability remains precarious.

Key Takeaway: Millionaire-Making Potential

The prospect of Lucid Group turning an investor into a millionaire is highly unlikely, given its current trajectory and inherent risks. To achieve millionaire status from a modest $10,000 investment, LCID’s stock would need to skyrocket thousands of percent, requiring the company to scale production, achieve profitability, and dominate a competitive EV market.

With a 96% decline from its all-time high and persistent cash burn, Lucid’s path to such gains is fraught with obstacles. Production delays, fierce competition from Tesla, and reliance on external funding increase the risks.

While its mass-market vehicles and tech licensing offer long-term potential, execution risks and market uncertainties make a million-dollar outcome a speculative dream rather than a plausible reality. Investors seeking life-changing returns would need extraordinary patience and tolerance for volatility, with no guaranteed payoff.

The post Down 48%, Can Lucid Group Make You a Millionaire? appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Rich Duprey

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.