By George Lei, Bloomberg Markets Live reporter and strategist

Expectations of policy actions to bolster the housing sector have helped real estate stocks close the gap with the broader CSI 300 benchmark over the past few sessions. That has some market participants referencing 2015 and Beijing’s housing-rescue efforts that pulled the world’s second-largest economy out of a deflationary trap. But economic and market circumstances are vastly different now, leaving policymakers neither willing nor able to repeat what they achieved a decade ago.

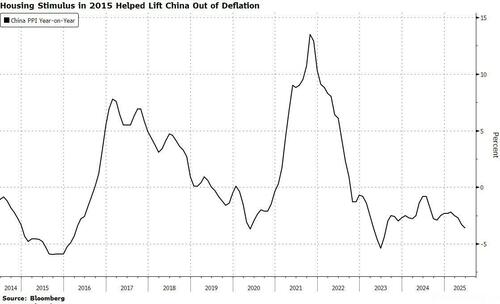

Rumors are circulating that a new round of shantytown renovation — a catchphrase used a decade ago as part of the rescue package — could be in the works, according to Clocktower Group LP, an asset management and advisory firm based in Santa Monica, California. Back then, Beijing flexed its financial muscles to help a slumping real estate market, with a series of policies putting an end to falling producer prices.

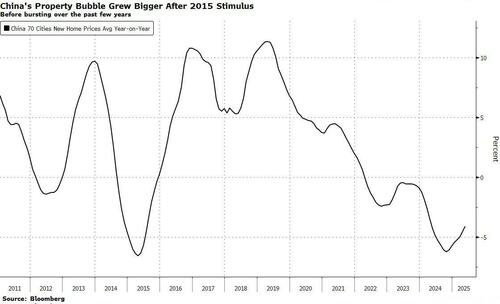

The stimulus, however, resulted in double-digit home price growth in the following years, and the aftermath of that property bubble has haunted China up to this day. With the country’s population poised to keep declining in the years to come, homeowners have grown more bearish on the price outlook. The threshold for Beijing to turn things around is much higher now than a decade ago.

The expectation of renewed shantytown renovation “is likely to prove wishful thinking,” Clocktower said in a client email on Thursday. Ten years ago, PBOC’s pledged supplementary lending program enabled local authorities to redevelop land and then quickly sell to homebuilders.

The resulting land-sale revenue allowed local governments to service their PSL loans and sustain the cycle. With nationwide land-sale revenues falling last month to a decade low, market conditions are “fundamentally different” and new PSL loans could increase risks of new, hidden local debt, Clocktower cautioned.

China’s housing slump – which has shown no signs of ending – could emerge as a major growth drag in the rest of 2025. Investors, meanwhile, have also shifted their focus “to the domestic economy and policy” amid fading tariff concerns, Macquarie said in a research report after a series of meetings in the past few weeks.

Policymakers could act to stabilize the property sector after disappointing data, though any aid will be measured and taylored to containing risks only, according to Macquarie analysts Larry Hu and Yuxiao Zhang. Since 1H growth is set to exceed 5%, “stimulus will stay modest until exports fall, as Beijing will do just enough to hit the 5% GDP target,” the Australian bank argued.

Back in 2015, the housing boom engineered by Beijing helped absorb overcapacity in steel and cement. This time, however, it is much harder to cut capacity — and end deflation — as oversupply is more concentrated in consumer sectors such as auto, solar panels and batteries, Macquarie noted. Another housing bubble will only do more harm than good.

Tyler Durden

Thu, 07/10/2025 – 21:55

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.