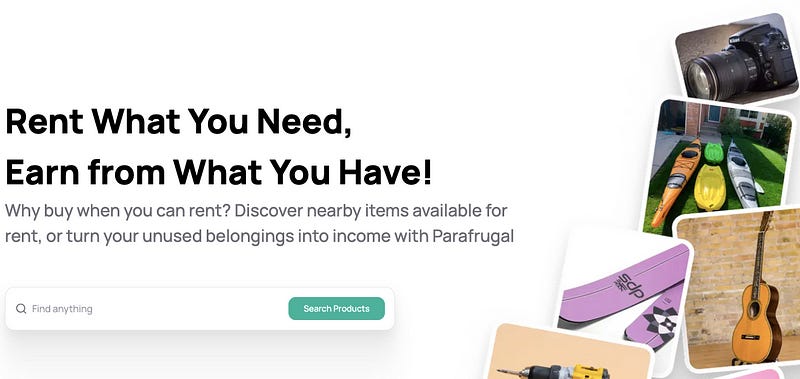

A Surviving Tomorrow reader saw an ad on social media and sent me a screenshot.

It’s for a website that lets you list all your belongings and rent them out for cash.

Five years ago, in writing, I predicted this would happen.

The parasite landlord economy is taking over.

On the surface, renting instead of owning sounds like a good idea for some ideas, but today I want to briefly help you explain why all forms of profit on lending — whether it’s renting out money for interest, lending out houses for rent, or leasing stuff for cash — actually help destroy civilizations at a compounding rate.

Lending as a business is anti-productive

Let’s first note that money doesn’t create more money.

Money doesn’t do anything.

If we put a $100 bill on a table and return in five, ten, twenty years, there won’t magically be piles of money on the table.

The same is true of a house.

Or a canoe.

Or a guitar.

Lending doesn’t create anything new, ever.

People create new stuff by applying their time-work to stuff.

When we lend stuff to others and expect back more (in the form of money-interest, rent-interest, etc), we’re just forcing borrowers to create and sell new stuff somewhere elsewhere in the economy, so we can make a gain despite not creating any new stuff.

The time it takes them to create and sell new stuff elsewhere to pay interest almost always means they don’t have time to meet their own needs, so they have to borrow again.

Lending stuff for profit engineers ever-increasing levels of debt.

The rich get richer off the work of the poor. Of the engineered $330 trillion in global debt, most of it is owed by the bottom 90% to the top 10%. This is a massive, ongoing wealth transfer in the wrong direction, leading to vast amounts of suffering for the poor and inequality for all. Debtors will never own the underlying $330 trillion in assets, because what they have to repay in interest will always outpace their wealth-creation abilities.

It gets worse.

Turning anything — money, houses, scotch — into investment products skyrockets the price of things.

Financialization… the process of turning anything into an investment… skyrockets prices.

Think Taylor Swift concert tickets, Beanie Babies, baseball cards, cryptocurrency, etc.

Turning an item into an investment increases its price.

We’re currently witnessing this with the financialization of classic cars, high-end wine and scotch, and fractional investment in paintings.

A rare piece of canvas covered in colored paint is only “worth” $100 million if the investor knows he can rent that painting to a museum and re-sell it for $110 million in the future.

Because it’s more profitable to get rich by monopolizing stuff and lending it for a profit instead of actually working to create new stuff to sell, the rich are actually incentivized to bid up prices instead of creating new useable goods and services for others. Shareholders are actively trying to destroy our wellbeing for profit.

So what will happen when rent-seeking websites like one take off and everyone gets involved in the rental game instead of the working game?

Let’s play this out:

1. The purchase price of financialized goods will soar.

You think guitars and skis and power tools and kitchen appliaces will come down in price when rent-seekers realize they can lease them out for a profit?

Are you out of your mind?

We’ve seen it happen with houses.

We’ve seen it happen with cottages.

We’ve seen it happen with high-end jewelry for fashion shows and the Oscars.

Now watch what happens to the price of cars as the industry shifts to an Uber/Lyft/Waymo robo-taxi model.

Watch what happens to to the price of furniture and clothing when they become hoarded by “landlords” and leased for top dollar.

The cost of purchasing goods will soar.

2. Fewer people will be able to own stuff.

This makes sense.

If a fridge is $500 today, but in the future where fridges rent for $50/month, new fridges will cost $5,000.

So few people will be able to afford fridges that demand for rentals will skyrocket.

More demand = higher rental prices.

Higher rental prices = higher purchase prices.

Higher purchase prices = more demand for rentals.

Rinse and repeat.

Landlording and stufflording are doom loops.

3. Lenders will monopolize stuff.

Some builders are selling all of the houses they build to landlord corporations.

In the future, expect builders to partner with private equity to never sell houses to anyone, but simply build-to-lease.

Car manufacturers will start making cars for their own leasing company to rent to people in need of transportation.

Companies like Netflix have already formed just to rent out movies you can never own.

Companies will form that just rent out fridges.

Companies will form just to rent out clothes.

Same for TVs, phones, mattresses, furniture, you name it.

Those companies will eventually monopolize their industries.

Those companies will get so big and profitable that hedge funds and private equity firms and big banks will buy them out.

Soon, deca-trillion-dollar monopolies like Blackrock and State Street will own hundreds of trillions of dollars worth of companies, whose entire business model is to own all the world’s assets and lease them back to use for WAY more than it once cost to own.

You will own literally nothing.

You will not own a house.

You will not own a car.

You will not own any appliances or furniture.

Eventually, you will not even own the clothes on your back.

You will work three gig jobs for garbage pay with no benefits, so you can pay five or six dozen monthly payments to borrow the things you need to survive.

Eventually, the rental periods will drop from years to months to weeks to days. (And don’t forget AI-assisted surge pricing — shareholders are happen to squeeze you for every last penny when demand outstrips supply.)

At this point, you are simply a slave by another name.

How to prove this is true: Simply stop working to create profit for shareholders and watch how quickly you are made homeless and starving.

Parasitic rent-seeking shareholders will continue to extract rental profits at a compounding rate until the majority can’t afford to eat, at which point, society will collapse like every civilization in history that let lending flourish.

Even the rich cannot fight math.

What must change

The world needs Christian economics instead of this neo-feudal Mammonomics nightmare.

Society must ban lending at a profit.

It’s that simple.

The incentives of profit-based lending are aligned against civilizational wellbeing.

Enough is enough.

Ban it.

In the 1800s, a British Christian named William Wilberforce had a blazing vision of the horrific injustice of slavery, and battled Establishment Christianity for 46 years before slavery was legally ended AND made morally repulsive.

We need a generation of people who see lending profit in the same light — as slavery by another name.

What you can do today

-

Sell all your stocks, bonds, commodities, and rental properties. Stop being a parasite. Stop profiting from lending instead of working to create new stuff for others. Stop making life more expensive for others. Stop being part of the doom-loop that’s compounding us toward collapse.

-

Start working. Create new stuff for others. Sell it at a price that makes it harder to lenders to turn a profit.

-

Buy everything you need while you still can, and stop renting wherever you can. Help others do the same. Because the more we rent, the quicker society collapses.

-

Stop being selfish and just lend without profit. This isn’t rocket science and it isn’t hard. Screw the rent-seeking parasites; undermine their entire business model by lending freely what you have and expecting nothing in return. Do it right now. Make a list of things you own, post it on your Facebook wall or a WhatsApp group chat and let your family and friends know you’d be happy to let them borrow it if it blesses them, helps them, and/or saves them time and money. Get in the mindset of lending without profit. Get ready for how the kingdom of heaven operates.

Abolishing profit on lending is the only way to reverse the doom-loop.

Otherwise, you will own nothing.

-

Please share this article with others.

Click this link for the original source of this article.

Author: Jared A. Brock

This content is courtesy of, and owned and copyrighted by, https://www.surviving-tomorrow.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.