“While on the surface, this may be in the best interest of trimming national debt and so forth, the implication for North Carolina is severe and very real.”

Dr. Devdutta Sangvai, Secretary of the North Carolina Department of Health and Human Services (NCDHHS), commented at the end of a Zoom call with reporters on Tuesday, describing what would happen in North Carolina to Medicaid expansion and SNAP recipients if President Donald Trump’s “Big Beautiful Bill” is passed into law.

The bill passed in the Senate on Tuesday after a tie-breaking vote 51-50 vote from Vice President JD Vance after Republican senators, including North Carolina’s Thom Tillis, Rand Paul, Kentucky, and Susan Collins, Maine, all voted no.

Tillis has been adamantly against the bill, stating that it would hurt thousands of North Carolinians with the loss of their Medicaid coverage. His disapproval also led to him stating that he would not seek re-election next year.

The bill cleared the House Rules Committee Wednesday morning and now heads to the House floor for a vote. If it passes, it will head to the president’s desk for his signature.

Dr Sangvai said the changes would hurt not only individuals and families, but also North Carolina’s economy and workforce, and that there are smarter ways to control healthcare costs, like investing in prevention and primary care so people don’t end up in the emergency department.

“We will not save money by creating barriers to food and to healthcare,” he said. “Instead, those costs will show up elsewhere: in our schools, our justice system, and our housing programs.”

Snap

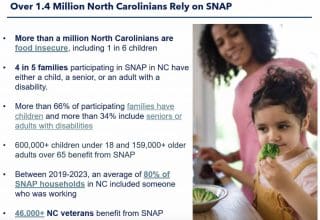

Officials first gave an overview of how the bill would affect the over 1.4 million people in the Supplemental Nutrition Assistance Program (SNAP), including older adults, veterans, individuals with disabilities, and children.. Eighty percent of the recipients come from working families.

SNAP benefits have been 100% federally funded since the program’s creation 50 years ago.

Under the bill, the state’s payment error rate would be used to calculate the payment error rate, which measures how accurately the state and counties determine eligibility and benefit amounts for SNAP recipients.

The primary contributor is usually an overpayment or underpayment of the benefit amount. The state’s current rate is just above 10%. The House proposal would require North Carolina to cover 25% or $700 million per year, and the Senate version would require the state to cover 10% or $420 million.

Both proposals also further shift administrative costs away from the federal government and onto the state and local governments, which are now split 50/50 between the state and federal governments.

The proposals would require states to cover 75% going forward, resulting in an extra $65 million in costs that North Carolina would have to absorb annually, which would result in over 100,000 North Carolinians losing benefits.

Three options

The bill would leave North Carolina with three options:

- Find the funding to cover the amount being shifted from the federal government to the state, which would be up to $700 million annually.

- Reduce enrollment to lower costs.

- The state’s complete withdrawal from the SNAP program.

In addition to the 1.4 million who would lose the benefit, NCDHHS officials said North Carolina would lose $2.8 billion in annual federal funds, which generate $4.2 billion in economic impact. Rural grocery stores that depend on SNAP for revenue would be at risk of closure, and over 7,000 jobs created by the program across the state would be eliminated.

Medicaid

Jay Ludlam, Deputy Secretary for the state’s Medicaid program, said if the bill becomes law, changes to the program would hit rural communities the hardest. More than 50% of the population of many rural counties relies on Medicaid.

PROVIDER TAXES and State directed payments

He next talked about the changes to Provider Taxes and State Directed Payments (SDPs).

Provider Taxes are used to fund the state’s share of Medicaid and help with expenses like improving provider rates and maintaining services. Currently, 98% of Provider Taxes go to the provision of services, with the federal and state governments chipping in, along with hospitals, facilities, and other providers.

Ludlam said changes to that will most likely result in the loss of billions of dollars to the state.

State Directed Payments are used to fund particular Medicaid programs, including the Hospital Access and Stabilization Program (HASP). He said it has been a lifeline for rural hospitals in North Carolina by providing for them and helping keep them open. Proposed changes will result in the loss of $6.5 billion.

WORK Requirements

Ludlam said they also anticipated the changes in work requirements, which will now take place twice a year instead of yearly, in the bill, but not the rapid timeframe that they would go into effect.

The new requirements were originally proposed to take effect in 2029 but are now scheduled for the end of 2026. He said those changes, including eligibility determination and re-verification, must be implemented in 100 different county offices, and it will be very hard to build the new systems to hire and train workers in such a short timeframe.

“I think the concern here is that there are going to be a lot of administrative and bureaucratic additional requirements that are going to fall largely on working North Carolinians who again live in predominantly rural counties,” Ludlam said. “Our worry is that this timeline that will be required to implement these changes will be too fast for us to have the appropriate systems and the hiring and that training that I was talking about in place and that otherwise eligible individuals will lose their eligibility because we were rushed to put in this in these administrative burdens.”

He anticipates 255,000 people will lose benefits due to the change in work requirements.

In summary, Ludlam said they anticipate 70% of the proposed cuts will come from cuts to the state’s hospital expenditures, with nearly $40 billion in lost funding from the federal government over the next 10 years.

He also mentioned that the proposal to set up a rural healthcare provider looks insufficient and will only cover 1/3 of the cost that they’re currently covering.

“The work requirements and the freezes on provider taxes could be a recipe for disaster and result in losing Medicaid expansion,” Ludlum told reporters.

He ended by saying the program uses provider taxes to help pay for the administrative costs of Medicaid expansion. They are not permitted under local statute to pay for those costs using state general funds; they need to come from provider taxes. Without access to the provider taxes because of the freezes that Congress is proposing, there is no other way to pay for it, and it will result in the loss of coverage for 673,478 expansion enrollees.

“(The bill) will undo the largely bipartisan efforts that we have put in over the last 8 to 10 years in trying to expand access, to be good stewards of the financing that we were provided, create budget predictability for our local legislature, and in the end, improve the health of North Carolinians,” Ludlam stated.

The post NCDHHS warns of drastic changes to SNAP, Medicaid under ‘Big Beautiful Bill’ first appeared on Carolina Journal.

The post NCDHHS warns of drastic changes to SNAP, Medicaid under ‘Big Beautiful Bill’ appeared first on First In Freedom Daily.

Click this link for the original source of this article.

Author: Theresa Opeka

This content is courtesy of, and owned and copyrighted by, https://firstinfreedomdaily.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.