***This is an excerpt from the June issue, a macro analysis of The Bitcoin Capitalist.

—

The emerging theme – perhaps timed by many participants to align with the big conference – is a veritable Cambrian explosion in Bitcoin treasury companies in the public markets.

Leading up to the conference we saw announcements from the Cantor Fitzgerald-backed, Jack Mallers-led Twenty-One Capital – ticker will be “XXI”, currently still “CEP” – we added that one as a supplemental.

There was also Bitcoin Magazine’s David F. Baily’s Nakamoto, which executed a reverse takeover of Kindly MD (Nasdaq: KDLY) and then went absolutely parabolic:

(We’ll wait and see if that one settles back).

Anthony Pompliano announced a SPAC of his own, currently PCAPU; he has yet to announce his merger target, but he’s raised $220 million (upsized from $200M) – this is one where I think we should pick up a few shares just on spec. As I’ve come to call him “Pump”, I think this one will probably move at some point and since it hasn’t blasted off yet, we could enter here.

Trump Media & Technology (Nasdaq: DJT) announced a $2.5 billion dollar capital raise to buy Bitcoin for their treasury – in this case the stock dumped on the announcement:

$2.5B worth of BTC on DJT’s balance sheet would put their market cap to BTC at under 2X at this level – but this is a pass for me.

Similarly, Gamestop (NYSE: GME) – the original memestock – had already announced a Bitcoin treasury strategy; and many were loading up on shares in anticipation of them actually following through and hitting the “smash buy” button .

At the Bitcoin conference, CEO Ryan Cohen announced a 4,710 BTC purchase (around a half billion dollars).

It underwhelmed expectations (GME is sitting on nearly $5 billion in cash), while Cohen’s address to the conference crowd was delivered via video and came across as uninspiring and tepid…

“If the thesis is correct, Bitcoin can be a hedge against global currency devaluation and systemic risk.”

It wasn’t exactly a “F*ck yeah!”-level dopamine hit.

GME shares also tanked – in this case in sharp contrast to the pump they enjoyed over the anticipatory run up:

Are “Bitcoin treasuries” the new “.COM” ? Or even before that… “Linux” (there was a period in the late 90’s after the VA Linux IPO, when penny stocks were simply changing their names to “Linux”-something and announcing a “new strategy” involving it, in order to garner truly moonshot (albeit short-lived) stock pumps.

Probably elements of both – some more opportunistic than visionary – and if I had to guess, I’d say DJT and GME are in the former camp.

I think the market sniffs this out and rewards the companies that have more of an ideological grounding in the space.

The Bitcoin maxis who did pile into GME bailed quickly.

I was just teasing the Bitcoin Therapist, but when it comes to this theme, what is the best way to play it?

I think MSTR is still the Big Kahuna here with an insurmountable head start – Metaplanet followed the strategy for the right reasons (Japan falling apart, fiat debasement), while Nakamoto and Twenty-One have the pedigrees. Pomp is Pomp, everything he touches turns to gold, so that will likely continue for now.

There is also a new pure play Bitcoin treasury company called Strive Asset Management and Asset Entities (Nasdaq:ASST) – the name I recognize there is Swan CIO Ben Werkman.

They’ve done a $750M private placement to acquire Bitcoin and look to be creating a vehicle into Bitcoin that can be accessed via 401Ks, ETFs (they operate a family of ETFs already) and direct indexing.

Then there are more under the radar plays like LQWD – which we added recently and has been on a good, sustainable run – now close to double from where we entered.

(I’ve lost track of who wanted info on the private placement so the details on that are included in this edition).

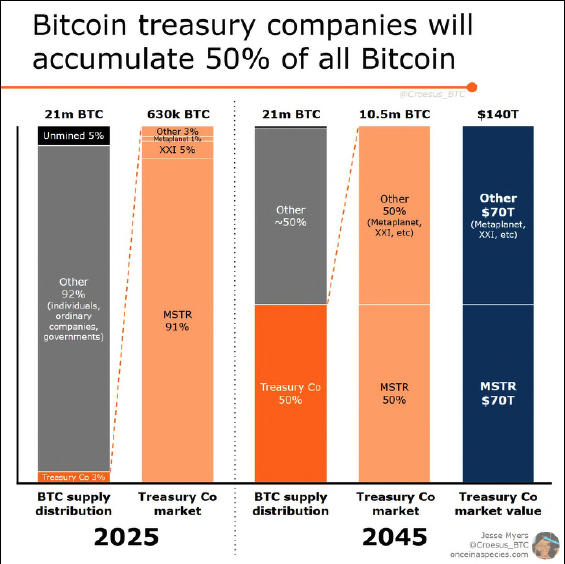

Jesse Myers, Head of Bitcoin Strategy for HK Asia Holdings Ltd., thinks that over 50% of all BTC will be held in corporate treasuries within 20 years:

This would not surprise me. As Bitcoin matures and grows into its role as a kind of financial bedrock, I’m expecting the vast majority of it to be held and financialized via collateralization.

As Lyn Alden likes to say “Nothing stops this train”, despite best efforts to derail it. By that I mean both Bitcoin as a base layer asset, and the emergence of crypto and fintech in general as a tectonic upgrade to the industrial-era monetary system.

The “Anti-Crypto Army” tried to derail the GENIUS stablecoin bill, citing possible ethics violations on the part of President Trump and his World Liberty Financial (WLF) stablecoin initiative.

In the end, the Senate voted 66-22 to advance the bill despite the aforementioned objections.

Trump seems to be inviting opposition: the Trump and Melania token launches, the WLF alt-coin pumps – I can see down the road should the Dems ever take back either chamber or even get the chance to reset the regulatory table, they’re probably going to have Trump & family in hearings and investigations for decades around all these maneuvers while in office.

—

Click this link for the original source of this article.

Author: Mark E. Jeftovic

This content is courtesy of, and owned and copyrighted by, https://bombthrower.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.