Following last month’s collapse (-6.3% MoM), analysts expected May pending home sales to bounce very modestly (+0.1% MoM).

New home sales plunged, existing home sales ticked up very modestly, and so pending home sales breaks the tie with a 1.8% MoM increase…

Source: Bloomberg

That modest rebound (though better than expected) dragged the YoY change in pending home sales up to just a 0.34% decline, but the index remains near record lows…

Source: Bloomberg

Signings picked up in all four US regions, most notably in the West, which rose by the most since December 2023.

NAR Chief Economist Lawrence Yun attributed May’s rise to resilience in the US labor market, with wage gains outpacing home price appreciation.

However, “mortgage rate fluctuations are the primary driver of homebuying decisions and impact housing affordability more than wage gains,” Yun said in a prepared statement.

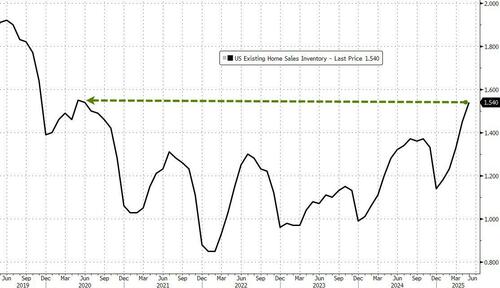

The supply of existing homes for sale has reached an almost five-year high, as more people list their homes for sale, but the extra inventory isn’t yet pushing prices down.

Source: Bloomberg

Pending-homes sales tend to be a leading indicator for previously owned homes, as houses typically go under contract a month or two before they’re sold.

Tyler Durden

Thu, 06/26/2025 – 10:07

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.