California News:

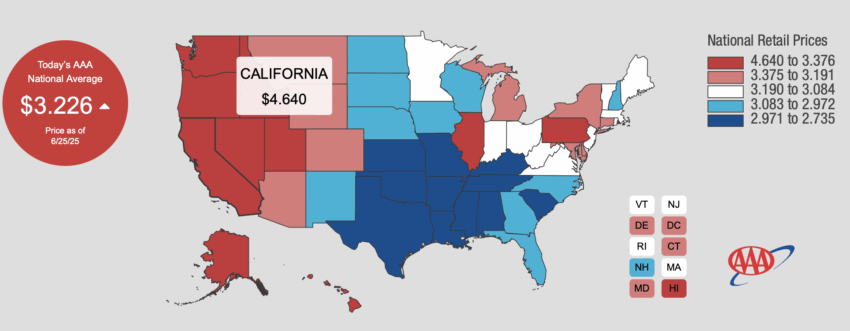

California gasoline already costs approximately $1.50 above the national average, and we are getting another gas tax hike next week.

The gas tax increase coming July 1st that CalTax explained in our previous article is the gasoline excise tax, as opposed to the low-carbon fuel standard tax changes. The amounts are very similar, which has caused confusion.

An excise tax is a specific type of tax levied on certain goods or services at the time of their purchase including gas, tobacco, and airline tickets, imposed by local, state, and federal government.

The California Air Resources Board voted in November to approve new gas regulations (taxes) which will result in as much as a 65 cent per gallon increase in California’s gas prices. The vote made significant updates to the low carbon fuel standard (LCFS), which requires the state to reduce the environmental impact of gas and other transportation fuels by incentivizing producers to cut emissions.

The excise tax — the per-gallon tax that was increased substantially by the Legislature several years ago, with a provision that requires the CDTFA, the California Department of Tax and Fee Administration to adjust the rate annually for inflation — is increasing from the current 59.6 cents per gallon to 61.2 cents per gallon, starting July 1. The CDTFA, which is part of the governor’s administration, is required to increase the gas and diesel excise tax rates every year, effective July 1.

The excise tax rate on diesel fuel will increase from 45.4 cents per gallon to 46.6 cents per gallon, likely leading to higher costs for consumers for many goods and services.

Adding to the confusion is the California Department of Tax and Fee Administration, which was created by Gov. Jerry Brown in 2017 to take over many of the duties of the Board of Equalization. The California Department of Tax and Fee Administration, CDTFA, is now responsible for administering many of the taxes formerly handled by the BOE, including sales and use, fuel and cigarette taxes. The CDTFA will also handle the auditing of taxpayers with regard to these taxes.

Notably, when the State Board of Equalization was responsible for the annual inflation adjustment for the gas tax rate, it was handled very transparently – the tax issue was placed on the agenda in advance and it was voted on during a public meeting. As elected officials, they were accountable to their constituents.

The Department of Finance used to recommend the tax increase amount, but the BOE had to approve it – publicly.

Now, the California Department of Tax and Fee Administration tries to avoid mentioning the gas tax increase – a real lack of transparency. Their website is a nightmare with no easy or clear link for the gas tax increase.

But the CDTFA social media does list all of the ways you can be taxed. And they are celebrating Pride Month:

Although the agency has “public information officers” who post a lot of stuff on X/Twitter and other social media pages, it is evident that they avoid posting anything about the gas tax increase, even though this is the one tax Californians historically are focused on like a laser beam.

One of the CDTFA X posts warns that you may need a temporary seller’s permit for a garage sale? Are you kidding?

The media also is interested in this tax in order to notify Californians. But nowhere can I locate a press release on the CDTFA website to inform the media.

“Making life better for Californians by fairly and efficiently collecting the revenue that supports our essential public services,” is the CDTFA motto.

Instead, the agency posts a “special notice” for retailers listing the old and new rates and making every attempt to downplay the tax hike. We assume they have a legal obligation to issue this notice.

But small home businesses can link to information about sales tax information.

It was only through the CDTFA Instagram page was I able to link to fuel taxes:

CDTFA’s X page has posted everything BUT the gas tax increase since June 4, as we posted above.

Low Carbon Fuel Standard

In 2024, the Globe reported that the California Air Resources Board mandated an additional 50 cents per gallon be added to the price of gas in California. It is important to note that all tax increases are legally required to be voted on by the California Legislature, the elected representatives of the people. But the CARB – a state agency made up of political appointees – has been bypassing the Legislature for years and passing their own “clean air” and “climate change” taxes – obviously with the implicit approval of the Legislature, which clearly abdicated its agency oversight.

Senate Republican Leader Brian Jones is the author of Senate Bill 2, which would have repealed the Low Carbon Fuel Standard gas tax increase of 65 cents a gallon, and end the new LCFS Low-Carbon Fuel regulations that were adopted last year.

Stunningly, CARB Chair Liane Randolph admitted that the Board does not consider how its regulations affect prices at the pump, essentially confirming that there was little consideration for the economic consequences when LCFS regulations were adopted, the Globe reported.

“That admission is stunning,” said Senate Leader Jones. “CARB is making billion-dollar decisions that hit every family at the pump, and they’re doing it without even asking what it will cost. That level of arrogance and detachment from reality is exactly why we need SB 2.”

But Senate Bill 2 was killed in the Senate in June following a forced floor vote.

It is evident that Democrats want Californians to pay the highest gas prices in the country, while they get their gas paid for by taxpayers.

California’s State Assembly members and Senators get state-issued-cars and gas cards. So while they have been passing devastating laws resulting in the highest gas taxes and price-per-gallon in the country, their cars and gas are paid for by the people.

California’s total gas tax includes excise taxes and sales and use taxes:

California’s total gas tax was approximately $1.43 per gallon in 2024 – on top of increasing gas prices, and will be nearly $2.00 per gallon by 2026.

The 2023 CARB Low Carbon Fuel Standard amendments document unabashedly outlines in black-and-white, the new gas tax increases through 2042 (page 57):

A brief history of the Low Carbon Fuel Standard (LCFS), according to the Senate Environmental Quality Committee:

The LCFS was born out of Assembly Bill 32, the California Global Warming Solutions Act of 2006 by Assemblyman Fabian Nunez (D-Los Angeles).

AB 32 did not explicitly contemplate an LCFS, the bill represents the only statutory authority or direction that has been provided for the program. AB 32 was signed by Governor Schwarzenegger on September 27, 2006, and in June of 2007, CARB adopted the first three (of a total of nine) discrete early action measures pursuant to AB 32, including the LCFS. Since its adoption in 2009, the LCFS has been amended (2011), readopted (2015), amended again (2018), and is currently in the process of being amended once more (2024- 2025) all through actions initiated and taken solely by CARB.

The original LCFS set a goal of reducing the CI of fuels in the state to 10% below 2010 levels by 2020. Since the original LCFS was adopted, CARB set a new goal to reduce the CI of fuels in the state to 20% below 2010 levels by 2030. CARB is currently in the process of setting an even more ambitious target because of the extent to which the program is exceeding expectations for overall reduction of fuel CI.

CARB keeps moving the goal posts so they can keep increasing the LCFS tax. Specifically, in November 2024, CARB “increased the stringency of the program to more aggressively decarbonize fuels and thereby reduce our dependence on fossil fuels.”

This is what Senator Jones tried to repeal with SB 2.

So, the California Department of Tax and Fee Administration excise tax will go into effect July 1st, as will the CARB Low Carbon Fuel Standard tax.

“Any increase in the gas tax is a surefire way to put the California economy on the road to ruin,” Clint Olivier, CEO, Central Valley Business Federation, told the Globe.

“Business owners who move goods to market won’t simply eat the increased cost, they’ll pass it along to the consumer. Sacramento is playing with fire.”

Click this link for the original source of this article.

Author: Katy Grimes

This content is courtesy of, and owned and copyrighted by, https://californiaglobe.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.