The Social Security Administration has released the yearly forecast of the program’s long-run finances. Per tradition (see 2024, 2023, 2022, 2021, 2020, etc), that means it is time for my annual explanation of why we have a grim fiscal future.

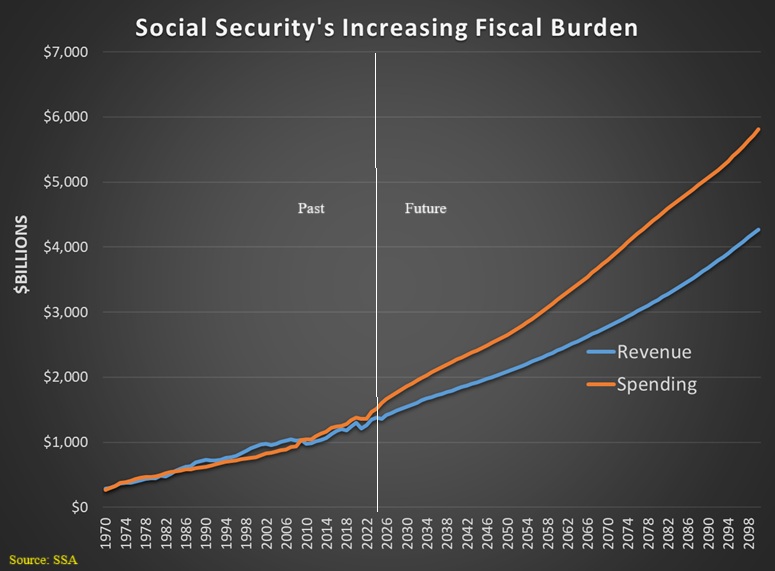

We’ll start with a graph showing estimates for future spending and revenue.

Keep in mind that these numbers are adjusted for inflation, so the real fiscal burden of the program is definitely rising.

The only mitigating factor is that we will have some future growth.

But since the program is projected to grow faster than the private sector, the net result is that the program will consume a larger and larger share of the economy’s output over time (and if politicians do thinss to hinder future growth, a bad situation will get even worse).

Now let’s look at the size of the future shortfall. Not a pretty picture.

If you add the annual deficits between 2025 and 2100, the cumulative shortfall is $65.8 trillion.

Yes, that trillion, not billion. And remember that these are inflation-adjusted numbers.

I’ll add two additional observations to close out today’s column.

- First, most news coverage focuses on the Trust Fund running out of money in 2033. That’s economically meaningless since the Trust Fund has nothing but IOUs. But it is politically significant since the law technically states that benefits must automatically be reduced when that happens. My guess is that politicians will simply enact a law turning Social Security into an open-ended entitlement.

- Second, while the U.S. faces a grim fiscal future because of Social Security’s flawed design, many other countries are in much better shape (at least in terms of retirement) because they have personal retirement accounts based on private savings. Kudos to jurisdictions such as Australia, Chile, Switzerland, Hong Kong, Netherlands, the Faroe Islands, Denmark, Israel, and Sweden.

P.S. For those who want to look at the source data for my two charts, see Table VI.G9 of the Supplemental Single-Year Tables.

P.P.S. While Social Security is in terrible shape, it’s not America’s biggest long-run fiscal challenge. The health entitlements (Medicare and Medicaid) are an even bigger fiscal burden.

P.P.P.S. Here are my ratings on which nation has the best pension system.

———

Image credit: 401kcalculator.org | CC BY-SA 2.0.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.