What’s the world’s most sure-to-fail policy (as opposed to the world’s most sure-to-fail system, such as socialism)?

There are some crazy possibilities, ranging from grandiose schemes such as modern monetary policy to goofy little proposals such as city-run grocery stores.

But I’m not sure I’ve ever seen a more foolish policy than what the Labour Party is doing in the United Kingdom.

Motivated by class warfare, Keir Starmer’s government wants to drive rich people out of the country.

To be fair, I don’t think that’s the explicit goal, but it’s certainly the unavoidable effect of various tax grabs, especially the evisceration of the “non-dom” policy that made the United Kingdom (and especially London) an attractive place for high-net-worth taxpayers.

I’ve already written about this policy (see here and here), warning it will backfire.

Let’s look at some recent analysis to see if I was right.

We’ll start with an article for MoneyWeek by Jessica Sheldon. She highlights some of the adverse effects of the tax increase on the “non-doms,” while also providing a helpful description of who they are.

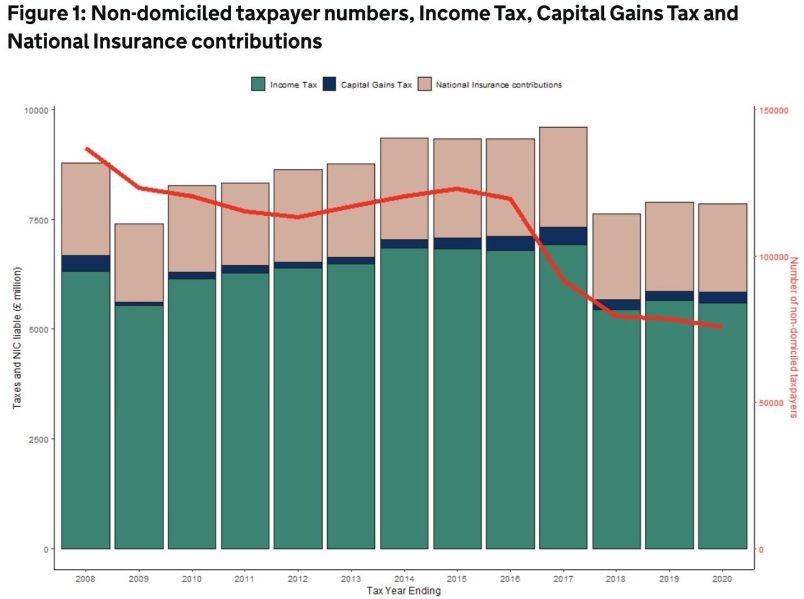

The multi-millionaire owners of an English castle are exiting the UK after the government scrapped non-dom tax status. Ann Kaplan Mulholland and her husband Stephen Mulholland are relocating to Italy, as it “doesn’t make any sense” for the entrepreneurs to stay living in the UK… The couple are among the tens of thousands millionaires who are said to be leaving the UK because of the tax changes. …The abolition of the non-dom tax status could cost the UK up to £111 billion by 2035, and 44,415 jobs by 2030, according to analysis by the Adam Smith Institute in April 2025. …A non-dom is a UK resident whose permanent home, or domicile, for tax purposes is outside of the UK. Previously, non-doms only had to pay UK tax on the money they earn in the UK, unless money made elsewhere in the world was paid into a UK bank account. …The Treasury estimates the further reforms to the non-dom tax regime, announced in Reeves’ 2024 Autumn Budget, will raise £12.7 billion over the next five financial years. Though a report by the economic consultancy Centre for Economics and Business Research (CEBR) estimates that if 25% of non-dom remittance basis taxpayers left the UK, the net gain to the Treasury would be zero.

Next, here are some excerpts from a recent Wall Street Journal editorial.

Government borrowing during the 2024-25 fiscal year (which ended in March) hit nearly £152 billion, the government Office for Budget Responsibility reported Wednesday—£14.6 billion above its previous forecast. Blame disappointing tax receipts for much of the gap, as revenue increases fall short of predictions. Particular weaknesses emerged in the income-tax returns filed by high earners, and in capital-gains tax revenue. …A likely explanation is the flight of high earners amid a big tax raid. …the abolition of a provision that had shielded the global investment income of temporary residents from high British taxes…prompted a rush for the exits by wealthy foreigners even before it took effect this month… News flash: Once a wealthy taxpayer has left the jurisdiction, the maximum rate he or she pays there is zero.

Here’s some further analysis from Patrick O’Donnell of GBN.

A new report has revealed that at least 10 per cent of non-domiciled residents have already left the UK following Labour’s abolition of non-dom tax status. New analysis from former Treasury economist Chris Walker estimates that significantly more departures are expected in the coming years. …The new report…examined only the behavioural response of long-term resident non-doms who were likely to have greater attachment to the UK. …Notably, the report highlights how international tax competition has intensified as the UK tightened its non-dom regulations while other countries loosened theirs. Italy and Greece have introduced measures specifically designed to attract British non-doms to relocate there.

Speaking of which, here’s a story by Conor Wilson for the U.K.-based Express about how one city is benefiting from the Labour Party’s mistake.

The plan, known in private wealth circles as “svuota Londra” or “empty London” has seen a flurry of arrivals in the Italian city as they seek relief from Labour’s decision to scrap the preferential tax regime for non-domiciled taxpayers. Milan is Italy’s commercial capital… Those settling in Milan are able to pay a flat rate tax of €200,000 (£168,000) to avoid additional taxation, in a scheme similar to that offered by the UK for over a century. The favourable tax system combined with the sun and simplicity of Italian life is making the country an attractive proposition… It is not only a preferential non-dom status attracting Brits to the country, with favourable inheritance tax laws and low flat tax rates adding to the appeal. Even a foreigner who becomes an Italian resident is still only liable to pay an 8% inheritance levy as opposed to the UK’s 40%. There are currently 75,000 non-doms who contribute more than £8 billion into the UK treasury each year, according to official data. …the Government’s policy shift on non-doms could lead to a loss of up to £12.2 billion in Treasury revenue by 2030, placing as many as 40,000 jobs at risk.

Even the Washington Post has noticed (perhaps because it’s now owned by someone who escaped to Florida because of taxes).

Here are some excerpts from a report by Karla Adams.

Not long after the Labour Party swept to power last summer, Charlie Mullins, a British entrepreneur who made his millions in plumbing, packed up and left. …He now splits his time between two sun-soaked destinations: Spain and Dubai. …Mullins…is part of a number of prominent, very rich people who are eyeing the exits or threatening to do so, including because of recent tax changes. …some of U.K.’s very richest residents are decamping to countries like Spain, Italy, Switzerland and the United Arab Emirates, places where taxes are lower or where the rich can pay a flat tax to shield their global income. …Alfie Best, founder of a company that operates residential and holiday parks, said he quit Britain for Monaco because of what he described as stifling tax and regulatory burdens. …Critics of the tax changes say it could amount to what British soccer enthusiasts call an “own goal.” According to the Institute for Fiscal Studies, the top 1 percent of U.K. income taxpayers pay 29 percent of all tax. If too many of those taxpayers leave, the government could end up with less, not more. …“Many of us may be uncomfortable with the very idea of a billionaire, but I think future generations will not thank us if we are blasé about the departure of people who create jobs,” [Watts] said.

The quote from Robert Watts is very relevant.

Some folks on the left are not just uncomfortable with billionaires. They actively despise rich people.

But rich people pay a huge share of the tax burden in the United Kingdom (same with the U.S.A.), so they will definitely notice if they disappear.

In the United Kingdom, politicians may finally learn that lesson.

P.S. I wonder if some leftists are so consumed with hate and envy that they would support this satirical proposal?

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.