After yesterday’s mediocre, if solid, 3Y auction nerves were less on edge ahead of today’s sale of $39BN in 10Y paper. And with good reason: moments ago the Treasury announced the result of today’s benchmark auction and they were nothing short of stellar.

The auction priced at a high-yield of 4.421%, up from May’s 4.350% but down from April’s “freak out” 10Y sale when the bond priced at 4.465%. The auction also stopped through the When Issued 4.428% by 0.7bps, the 4th consecutive through in a row, if more modest than last month’s 1.2bps, and certainly April’s 3.0bps.

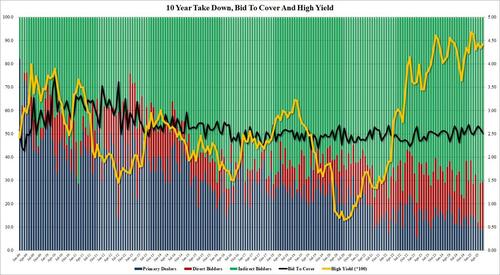

The bid-to-cover was a bit on the weak side, at 2.52, down from 2.60 last month, and the lowest since February; it was also below the six-auction average of 2.59.

The internals were solid, with Indirects almost unchanged from last month, as foreigners took down 70.6% of the auction, vs 71.2% last month. And with Directs awarded 20.5%, up from 19.9% in May and the highest since January, Dealers were left holding 9.0%, up ftactionally from 8.9% last month and the 3rd lowest on record.

Overall, this was an impressive auction, coming at a time when the global surge in duration supply has made it very dangerous to sell debt (especially in Japan). But in the US, animals spirits are back right now, and the market is clearly buying anything and everything, which is why 10Y yields slumped to session lows, just north of 4.40% after the auction and the lowest in the past week.

Tyler Durden

Wed, 06/11/2025 – 13:23

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.