Live Updates

Live Coverage

Updates appear automatically as they are published.

Year-over-Year Look

Conference call will kick off in 20 minutes.

| Metric | Fiscal Period Ending 2025-07-31 | Previous Year (2024-07-31) | YoY |

|---|---|---|---|

| Revenue | $728.00M | $646.00M | 12.69% |

| Operating Income | $41.00M | $-19.00M | 315.79% |

| Net Income | $67.00M | $29.00M | 131.03% |

| Operating Cash Flow | $167.00M | $86.00M | 94.19% |

| Free Cash Flow | $162.00M | N/A | 0.00% |

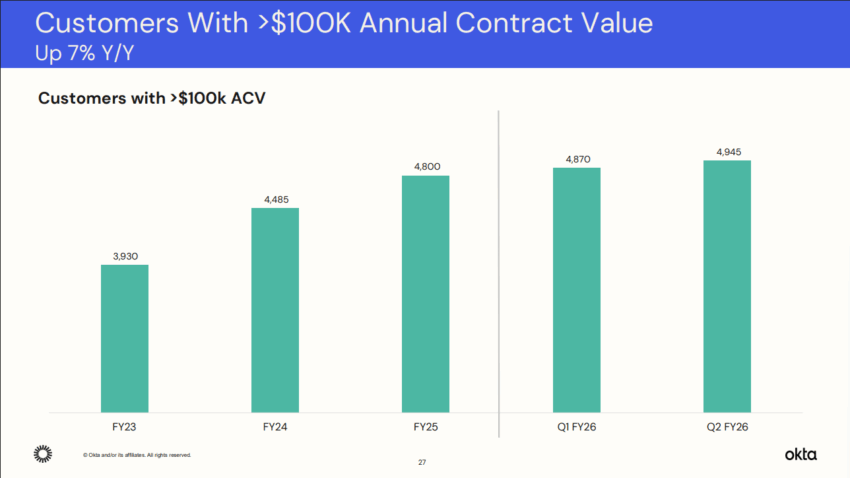

High Value Contractors 7% Y-O-Y Growth

My reaction on Q2

| Metric | Pre-Earnings Consensus | New Company Guide | Direction |

|---|---|---|---|

| FY26 Revenue | $2.86B | $2.875–$2.885B |  Slightly Higher Slightly Higher |

| FY26 EPS | $3.29 | $3.33–$3.38 |  Raised Raised |

Sentiment Bullets:

-

Bullish: Strong margins and raised EPS guidance signal durable efficiency gains.

-

Neutral: Revenue guide only modestly ahead, showing tempered demand momentum.

-

Bearish: Modest stock reaction suggests investor skepticism on pipeline acceleration despite RPO growth.

What Changed This Quarter

What has changed since Q1 earnings call:

-

Margins stronger: Non-GAAP operating margin jumped to 28% vs. 23% last year.

-

Guidance reset upward: EPS guidance raised while revenue outlook reaffirmed.

-

Cash flow breakout: Free cash flow margin at 22%, nearly doubling from 12% a year ago.

-

Federal demand durable: Public-sector exposure grew, even as management baked prudence into outlook.

Key Operating Highlights

| KPI | Q2 FY26 | YoY Change | Why It Matters |

|---|---|---|---|

| Revenue | $728M | +13% | Growth holding despite federal prudence. |

| Subscription Revenue | $711M | +12% | Core recurring base driving consistency. |

| RPO | $4.15B | +18% | Long-term demand visibility expanding. |

| cRPO | $2.27B | +13% | Next 12-month backlog shows pipeline durability. |

| Non-GAAP Op Margin | 28% | +500bps | Execution on efficiency while scaling. |

| FCF Margin | 22% | +1000bps | Strong cash generation. |

Shares moving higher

Shares of Okta are now up 3.92% after-hours as the guidance looks strong for FY 26. Here is the updated numbers:

| Period | Revenue | EPS (Non-GAAP) | Operating Margin | Commentary |

|---|---|---|---|---|

| Q3 FY26 | $728–$730M | $0.74–$0.75 | 22% |  Flat sequentially, implies single-digit growth but steady margins. Flat sequentially, implies single-digit growth but steady margins. |

| FY26 | $2.875–$2.885B | $3.33–$3.38 | 25–26% |  Raised EPS vs. prior guide; margins holding strong. Raised EPS vs. prior guide; margins holding strong. |

Management Commentary

“Our solid Q2 results are highlighted by continued strength in new product adoption, the public sector, Auth0, and cash flow. In the age of AI, Okta’s independence and neutrality will continue to give organizations the freedom to innovate securely and on their own terms.” — Todd McKinnon, CEO

McKinnon is emphasizing product breadth and neutrality as differentiators in the AI security landscape — reinforcing Okta’s positioning as the independent identity layer.

Key Highlights

Revenue Forecast

• Q3 2026 revenue of $728 million to $730 million

• Full year fiscal 2026 revenue of $2.875 billion to $2.885 billion

Product Segments

• Subscription revenue grew 12% year-over-year

Performance Drivers

• Strength in new product adoption and public sector

Growth Initiatives

• Continued strength in Auth0 and cash flow

Earnings Are In, shares up 1.58%

Okta earnings are in with a beat across the board and raised guidance.

| Metric | Reported | Consensus | Beat/Miss |

|---|---|---|---|

| Revenue | $728M | $711.9M |  Beat Beat |

| EPS (Non-GAAP, Diluted) | $0.91 | $0.85 |  Beat Beat |

| FY26 Revenue Guide | $2.875B–$2.885B | $2.86B |  Slight Beat Slight Beat |

| FY26 EPS Guide | $3.33–$3.38 | $3.29 |  Raised Raised |

A steady quarter — Okta outperformed on both revenue and EPS, expanded operating margins to 28%, and raised full-year EPS guidance. Guidance implies 10–11% growth and strong FCF at 28% margin. Shares are only modestly higher, signaling the Street largely priced in execution but still values the durability in margins and RPO growth.

Earnings History & Price Reaction

The average price movement over the past year was a -4.85% drop.

| Quarter | EPS Surprise | 1-Day Move | 7-Day Move | 14-Day Move |

|---|---|---|---|---|

| Q1 2026 (May 27, 2025) | +11.69% | −16.16% | −16.99% | −20.89% |

| Q4 2025 (Mar 3, 2025) | +5.41% | +24.27% | +24.80% | +30.50% |

| Q3 2025 (Dec 3, 2024) | +15.52% | +5.38% | +2.69% | +2.31% |

| Q2 2025 (Aug 28, 2024) | +18.03% | −17.64% | −26.18% | −23.46% |

Okta (NASDAQ: OKTA) reports after the close. The setup hinges on two threads: (1) whether sales specialization keeps pipeline building without dinging cRPO and (2) how new products—Identity Security Posture Management, Privileged Access, and Auth for GenAI—translate into upsell/new logo momentum while margins stay tight. Management reiterated prudence on macro/federal while keeping investment levels intact.

Estimates Snapshot

- Q2 EPS: $0.85

- Q2 Revenue: $711.9M

- FY2026 EPS: $3.29 | FY2026 Revenue: $2.86B

- FY2027 EPS: $3.58 | FY2027 Revenue: $3.14B

Keys to Watch Tonight

-

Go-to-market specialization results – Early signs are positive; management says Q1 metrics tracked well despite field changes. Watch NRR “channel” and new-business mix.

-

AI/Agentic push (Auth0 + Okta platform) – “Auth for GenAI” usage-based pricing; growing focus on securing agent workflows via OAuth/MCP. Look for GA timing and deal anecdotes.

-

Securing non-human identities (NHIs) – ISPM + Privileged Access positioned as end-to-end fabric; investors want proof points and monetization.

-

Public sector & cRPO cadence – Strong Q1 federal deals but prudence in outlook; cRPO modeling implies Q2 dip with recovery later in the year.

-

Margin guardrails – Guide calls for ~26% non-GAAP op margin in Q2 and ~25% for FY26 while investing behind product breadth.

The post Live: Will Okta Move Higher After Q2 Earnings? appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Joel South

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.