Key Points

-

These dividend stocks pay high yields monthly.

-

And they do so very consistently.

-

Their underlying businesses are solid.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; learn more here.(Sponsor)

September is approaching fast, and if the market is right, interest rate cuts will start once more. This means income investors now have to make a decision: either buy and lock in Treasuries before rates keep going down, or switch to dividend stocks. Specifically, dividend stocks that pay high yields.

The latter is more attractive for many reasons. For one, dividend stocks appreciate in the long run with the broader market. If you buy into a business that has been paying rising dividends, you’ll be in a much better position in the future than if you sat on Treasuries. Plus, dividend stocks tend to rise as interest rates go down. Lower interest rates cause an increase in people looking for higher yields, and dividend stocks are often the first on the list.

Monthly dividend stocks are especially attractive at the moment, as they give income investors significant flexibility. Here are three to look into:

Realty Income (O)

Realty Income (NYSE:O) is the go-to monthly income stock for most people for a reason. This real estate investment trust (REIT) has a solid footing, and its client base consists mostly of retailers, who themselves are stable. This has resulted in Realty Income’s occupancy rate staying around 98% to 99%, even through recessions. As such, the “REIT” tag shouldn’t turn you away from this reliable cash cow.

The company has had 662 consecutive monthly dividend payments and over 30 years of consecutive annual dividend increases. Revenue grew 5.38% to $1.41 billion in Q2 2025 and beat analyst estimates of $1.33 billion. The occupancy rate is at 98.6%, and the company’s adjusted funds from operations (AFFO) payout ratio is at 74.4%. This leaves room for dividend increases down the line.

O stock comes with a dividend yield of 5.48%. The stock itself hasn’t performed too well over the past few years. This is due to higher interest rates and the fear surrounding real estate, but I expect it to deliver strong upside in the coming years as interest rates come down.

LTC Properties (LTC)

LTC Properties (NYSE:LTC) is another real estate investment trust. The company operates in a field that is arguably even better than that of Realty Income’s: senior housing. Look at any demographic chart, and it should become apparent why LTC Properties could not only get you good dividends but also great upside over the long run. LTC Properties derives a significant amount of revenue from the 80+ age group. It is currently 14.7 million strong and projected to double by 2035.

The megatrends are strongly in your favor, and LTC Properties should easily come out of a downturn or a recession. Revenue increased 20% to $60.24 million in Q2 2025. Long-term growth can be very aggressive, as there is a growing shortage of senior care infrastructure in the U.S. Demographics are a very predictable trend, and 560,000 new senior housing units are needed by 2030. Only 191,000 units will be built at current development rates, so we’re looking at a shortage of nearly 370,000 units. If such an acute shortage happens, LTC Properties can capitalize on it and increase its margins on existing properties significantly.

LTC Properties posted $31.4 million in core funds from operations, up from $29.3 million in the year-ago quarter. This easily covers the $26.25 million in quarterly dividend payments.

LTC stock yields 6.2% and pays dividends monthly.

Northland Power (NPIFF)

Northland Power is a Canadian clean energy producer and infrastructure operator. It manages 3.2 GW in gross operating generating capacity and is developing 10 GW more. The company operates in seven countries and has tripled its capacity since 2015. NPIFF stock today trades at nearly the same price it did back in 2011. The stock price declined after an initial post-COVID boom when clean energy was all the hype, though it has normalized since then. I expect it to hover near $20.

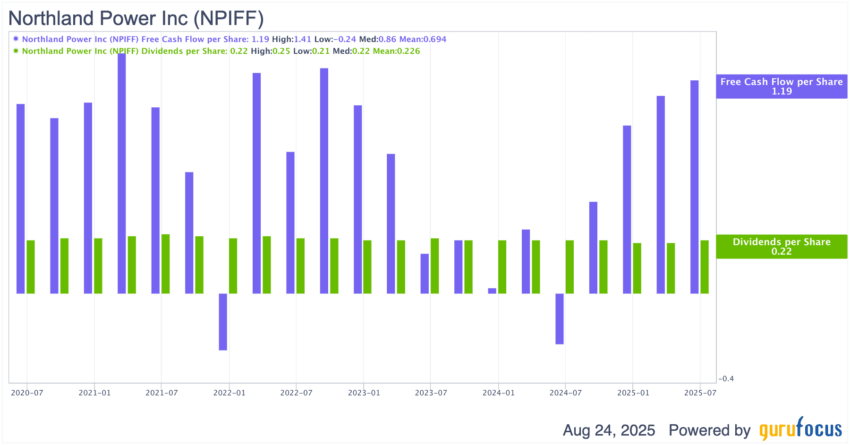

The free cash flow comfortably covers dividends and is rebounding.

I see significant long-term potential here as the rest of the generating capacity comes online. The company derives most of its revenue from the Netherlands at 25.7%, followed by Germany at 24.7%. Spain also constitutes 15.2% of its sales. These countries are weaning off Russian energy and are aggressively pivoting towards clean energy.

NPIFF stock gets you a 5.38% annualized dividend yield, paid monthly. It is one of the handful of companies paying a high monthly yield that aren’t in real estate or finance. Cardinal Energy is another one (yields 9.72%), though the oil and gas focus makes it risky.

The post 3 Dividend Stocks to Buy if You Want $5,000 in Monthly Income appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Omor Ibne Ehsan

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.