By John A. Charles, Jr.

Governor Tina Kotek has called a special session of the legislature to secure more funding for the Oregon Department of Transportation (ODOT). She wants to raise gas taxes by six cents per gallon, double vehicle registration fees, and increase titling fees.

Both the governor and legislative leaders claim that ODOT revenue has been declining due to the improved fuel economy of cars, but ODOT financial reports online show the opposite, as does the Legislative Revenue Office presentation from March of this year. In 2024, revenue from motor fuel taxes, vehicle registration taxes, driver’s license fees, business license fees, and investment income reached record levels. Total ODOT revenue increased by 30 percent between 2018 and 2024.

It’s not a revenue problem; it’s a spending problem.

Since 2001, as part of by the Oregon Transportation Investment Act bond program (OTIA), the legislature has forced ODOT to spend most new gas tax monies on construction projects while ignoring highway maintenance. Thus, while gas tax revenue has increased, the amount going to operations has decreased.

The legislature also voted to sell nearly $4 billion in bonds backed by gas tax revenues. While ODOT revenue increased by 30 percent from 2018 to 2024, debt service increased 41 percent. As a result, ODOT paid $358 million in debt service last year, consuming 55 percent of its gas tax revenue. In 2007 debt service was only $70 million.

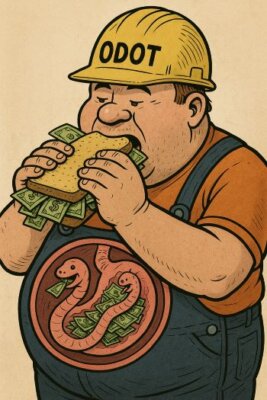

To paraphrase Warren Buffett, debt service is the tapeworm eating ODOT’s gas tax money.

When legislators meet on August 29th, they should repeal gas tax restrictions put in place by OTIA Programs I, II and III, allowing ODOT management the discretion to spend money where it’s needed the most. They should also begin paying down ODOT’s remaining bond debt of $3.9 billion with lottery funds. This would free up gas tax revenue to be spent on road maintenance and avoid the need for any new tax increases.

John A. Charles, Jr. is the President and CEO at Cascade Policy Institute, Oregon’s free market public policy research organization.

The post The Tapeworm Eating ODOT’s Record Gas Tax Revenue first appeared on Oregon Catalyst.

Click this link for the original source of this article.

Author: Cascade Policy Institute

This content is courtesy of, and owned and copyrighted by, https://oregoncatalyst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.