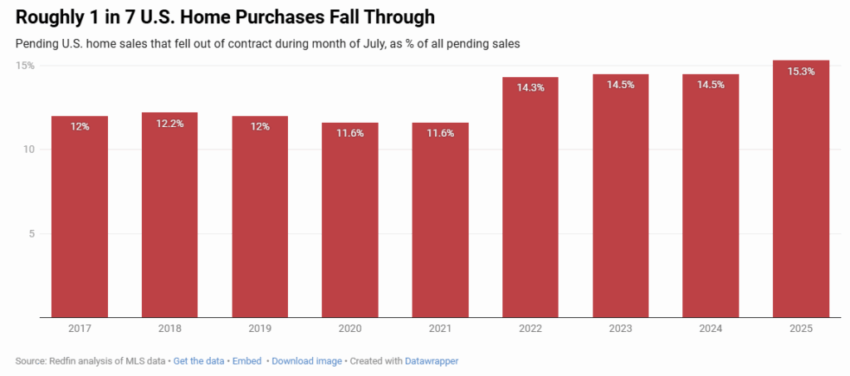

Roughly 1 in 7 U.S. Home Purchases Fall Through

After four years of Joe Biden, the economy still isn’t rebounding at a rate sufficient to inspire confidence in American consumers.

Buyers are not satisfied with their options given the current environment, characterized by high prices, high mortgage rates and economic uncertainty.

As Redfin reports:

5% of home purchases fell through last month—the highest July rate on record—as high homebuying costs made buyers skittish. Cancellations were most common in Texas and Florida.

Roughly 58,000 U.S. home-purchase agreements were canceled in July, equal to 15.3% of homes that went under contract last month. That’s up from 14.5% a year earlier and marks the highest July rate in records dating back to 2017.

This is based on a Redfin analysis of MLS pending-sales data. The data are seasonal, which is why we compare this July to past Julys. Please note that homes that fell out of contract during a given month didn’t necessarily go under contract the same month. For example, a home that fell out of contract in July could have gone under contract in June.

Home purchases are falling through more than usual because high prices, high mortgage rates and economic uncertainty are making buyers uneasy. Buyers also have more homes to choose from than in the past, which means they hold the negotiating power in many markets and often aren’t in a rush. They may back out during the inspection period if a better home comes up for sale or they discover an issue they don’t want to fix.

Cleveland Redfin Premier real estate agent Bonnie Phillips said the most common reasons buyers back out of deals are cold feet, high standards and issues with inspections, and she noted that cancellations are particularly common among buyers who use FHA and VA loans. But some would-be buyers have other reasons for backing out:

“I recently had an older first-time buyer get cold feet the week before the deal was supposed to close,” Phillips said. “It was a beautiful house, we got it for the price she wanted and there were no issues in the inspection, but her neighbors convinced her that owning is too much of a hassle and she should rent instead.”

It’s worth noting that the housing-market tides are starting to shift slightly. Mortgage rates have been coming down, which could bring some sidelined buyers back to the market, and supply is also ticking down, which could increase buyer urgency.

Home Purchases Are Most Likely to Fall Through in Texas and Florida

In San Antonio, 730 home-purchase agreements were canceled in July, equal to 22.7% of homes that went under contract last month—the highest percentage among the metros Redfin analyzed. Next came Fort Lauderdale, FL (21.3%), Jacksonville, FL (19.9%), Atlanta (19.7%) and Tampa, FL (19.5%). Redfin analyzed the 50 most populous metro areas, and included the 44 with sufficient data.

Florida and Texas have been building more homes than anywhere else in the country, prompting some buyers to back out of deals because they’re confident they will be able to find a different home that works better for them. Some buyers in the Sunshine State are also getting cold feet due to increasing natural disasters and soaring insurance and HOA fees.

Home purchases were least likely to fall through in Nassau County, NY (5.1%), Montgomery County, PA (8.2%), Milwaukee (8.3%), New York (9.5%) and Seattle (10.2%).

Virginia Beach, Newark See Biggest Upticks in Cancellations

In Virginia Beach, VA, nearly 500 home-purchase agreements were canceled in July, equal to 16.1% of homes that went under contract last month. That’s up 3.6 percentage points from 12.5% a year earlier—the largest increase among the metros in this analysis. Rounding out the top five are Newark, NJ (+3.3 ppts), Baltimore (+3 ppts), San Antonio (2.8 ppts) and Houston (2.8 ppts).

Virginia Beach has a higher share of homeowners with VA loans than any other major metro, according to a separate Redfin analysis, with Baltimore also near the top of the list.

Cancellations fell from a year earlier in 11 metros, with the biggest drops in Phoenix (-2.4 ppts), Orlando, FL (-1.4 ppts), Tampa (-1.3 ppts), Sacramento, CA (-1.3 ppts) and Philadelphia (-1.2 ppts).

You can read the full report here.

The post Fearful Buyers Cancel Home Purchases at Record Rate appeared first on National File.

Click this link for the original source of this article.

Author: Noel Fritsch

This content is courtesy of, and owned and copyrighted by, https://nationalfile.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.