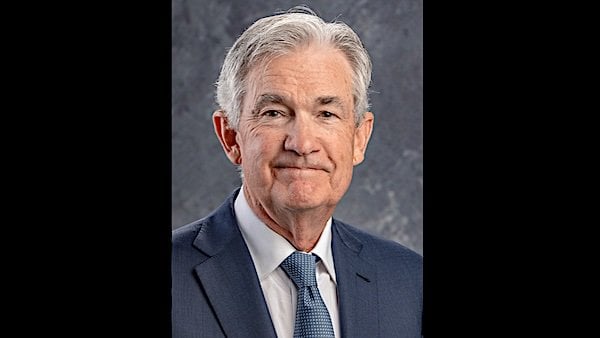

The American stock market on Friday surged upward, with the Dow Jones Industrials gaining more than 900 points at one point for an all-time high of 45,757, after Jerome Powell dropped a hint that circumstances are changing.

He’s been adamant in keeping interest rates for Americans high, despite good jobs and inflation reports in the months since President Donald Trump took office.

Trump has dubbed Powell “Too Late” for his repeated delays in lowering rates that Trump believes should be changed.

Powell wasn’t explicit about rates, but said, during a conference in Jackson Hole, Wyoming, “Over the course of this year, the U.S. economy has shown resilience in a context of sweeping changes in economic policy.

“In terms of the Fed’s dual-mandate goals, the labor market remains near maximum employment, and inflation, though still somewhat elevated, has come down a great deal from its post-pandemic highs. At the same time, the balance of risks appears to be shifting.”

The Fed next meets in September. Key during the August meeting, at which he maintained higher rates that deprive Americans of the ability to buy homes, two of the board members sought a rate cut, but they were overruled by the majority, led by Powell.

Trump long has called on Powell, in light of the huge improvement in America’s financial position, to lower rates. It was during June that the nation reported its first trade surplus in many years.

“In the near term, risks to inflation are tilted to the upside, and risks to employment to the downside—a challenging situation,” Powell said. “When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate.

“Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” he added. “[Federal Open Market Committee] FOMC members will make these decisions, based solely on their assessment of the data and its implications for the economic outlook and the balance of risks. We will never deviate from that approach.”

Based on his comments, the Dow Jones Industrial Average soared 903 points, or 2%.

Meanwhile, the S&P 500 gained 1.6% and the Nasdaq Composite climbed nearly 2%, according to CNBC.

Trump informed Powell as recently as this week, “There is no inflation, and every sign is pointing to a major rate cut.”

Inflation actually exploded to more than 9% under Joe Biden.

Click this link for the original source of this article.

Author: Bob Unruh

This content is courtesy of, and owned and copyrighted by, https://www.wnd.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.