Key Points

-

This stock is down over 60% from its peak in 2021.

-

It has struggled to recover and its competitors have raced ahead.

-

But the Trump admin seems to be marrying it to a strategically important cause.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; learn more here.(Sponsor)

Senior officials inside the White House are weighing a plan that would make the United States government the largest single shareholder in Intel (NASDAQ:INTC). This would convert billions of dollars in CHIPS Act grants into roughly a 10% stake. The scheme would not only rewrite the rules of public-private partnership, but it may also pluck a battered Silicon Valley icon back from the brink of doom.

INTC stock is down by over 60% from its 2021 peak due to blunders during the AI boom, repeated manufacturing delays, and a severe loss of market share to Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD). The chipmaker now trades at levels last seen during the dot-com bust, and management has already warned of more serious layoffs after posting six straight quarterly losses.

The Trump administration sees both a national security imperative and a political opportunity. Treasury Secretary Scott Bessent believes the investment will prevent Taiwan from becoming a single point of failure in the global semiconductor supply chain. On the other hand, Commerce Secretary Howard Lutnick believes taxpayers deserve equity for the subsidies they provide.

Although all of this seems bullish, INTC stock still cratered by nearly 7% as of this writing. This has wiped out earlier gains from when news first broke out about this tentative investment.

Why the White House is interested in Intel

On August 7, President Trump posted on Truth Social that Intel’s newly installed CEO, Lip-Bu Tan, was “highly CONFLICTED and must resign, immediately.” The broadside cited Tan’s personal venture investments in Chinese semiconductor companies and a previous export-control settlement at Cadence Design, where he had served as CEO.

INTC stock immediately tumbled.

CEO Lip-Bu Tan then met Trump in the Oval Office and managed to convince him otherwise. Trump said, “The meeting was a very interesting one. His success and rise is an amazing story.” And earlier this week, Intel got a $2 billion investment from SoftBank. The company’s CEO, Masayoshi Son, is well-connected to Trump and the government.

A turnaround is now much more likely

Wall Street doesn’t seem as happy as one would expect from the Federal Government aiding Intel’s recovery, but I see this as an opportunity. I initially expected Intel to take many years to make a turnaround. But now that it is getting cash infused by the government and companies close to Trump, it may take just a few quarters for the stock to start recovering.

It wasn’t worth it to buy INTC stock and miss out on the gains other semiconductor stocks were providing. However, if the government takes a partial stake in Intel, it becomes much more attractive long-term. The enterprise value to forward EBITDA is just 11.55 times. Future contracts from the government would lead to a sharp increase in EBITDA.

Is it time to buy INTC stock?

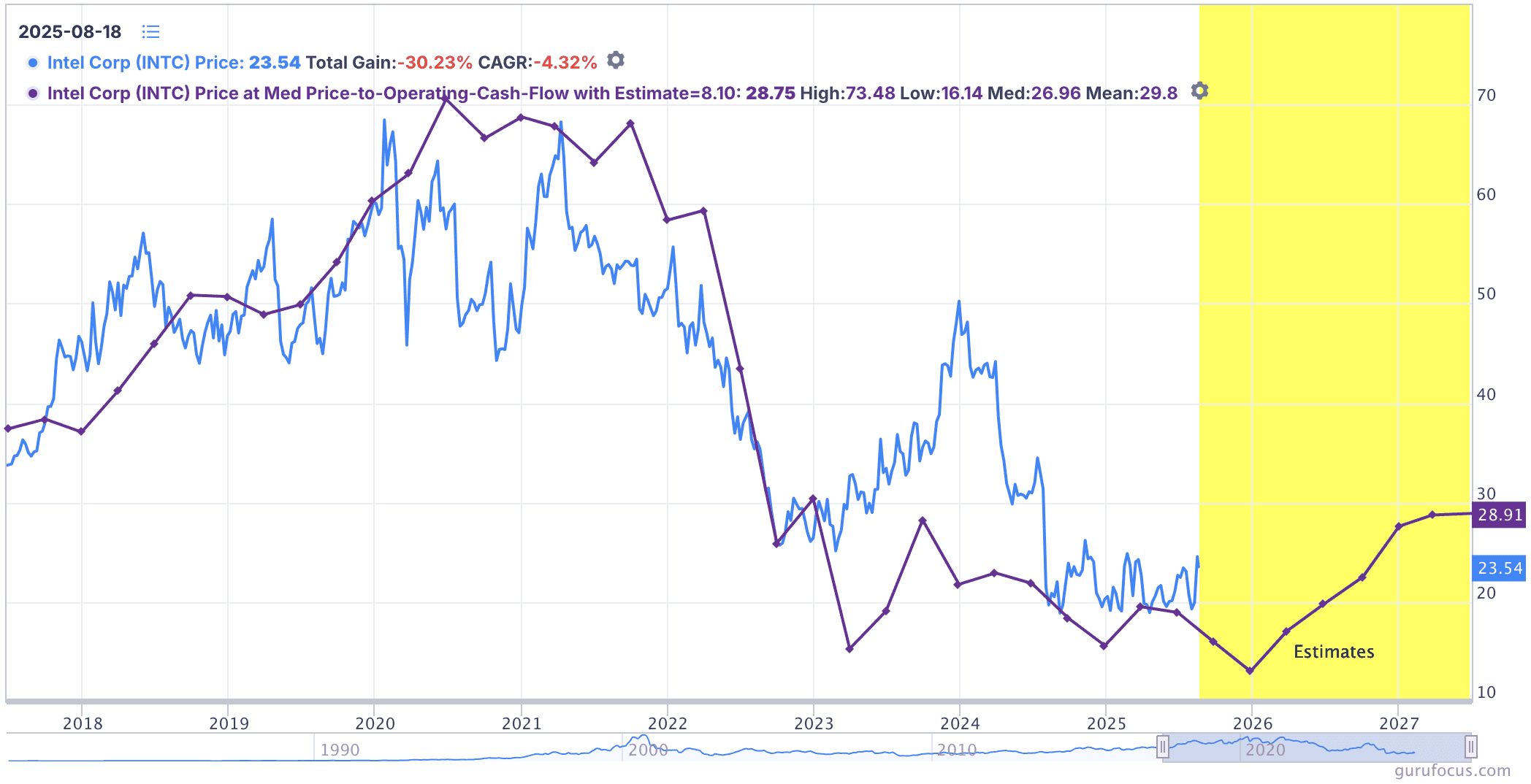

Current estimates don’t take the potential government investments into account going forward. But even then, the future looks positive for Intel. If we look at operating cash flow estimates, INTC stock may reach $30 sometime in 2027. That’s if the company manages to achieve the higher end of estimates.

If Intel gets more investments, that may happen much earlier.

The biggest factor here is the opportunity cost. A 30% gain a year or two for now is something NVDA or AVGO can easily surpass. This was my principal rationale for being bearish on Intel over the past year.

But now that the government is marrying Intel to its pursuit of reducing reliance on Taiwan, I expect more good news for Intel over the three and a half years the Trump administration has in office.

The post Trump May Soon Invest in This 1 AI Stock Down Over 60% appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Omor Ibne Ehsan

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.