Guest Post by Peter Reagan

Your News to Know rounds up the most important stories about precious metals and the overall economy. This week, we’ll cover:

- Trump shoots down gold bar tariffs, restoring global gold market stability…

- …but might he also have designs for the dollar’s future?

- Investors will price in anything except the national debt…

- …and gold would run far above any forecast if they did that

- Dominic Frisby reminds us why gold ownership matters

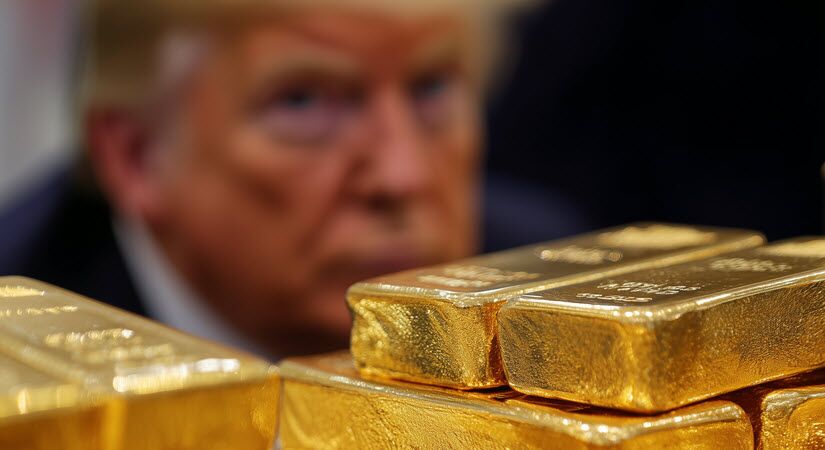

Trump saves global gold market – can he do the same with the U.S. dollar?

Of course President Trump said no gold bullion will be subjected to tariffs. Consistent with the original Liberation Day tariff announcement.

The Customs & Border Patrol opinion on Swiss gold bars was just a mistake. Story’s over, nothing to see here, move along.

So let’s zoom out…

Twice now, Trump has inherited a bad economy from the previous administration. Once from Obama and once from Biden. Given that Obama had two terms, Trump is working against 12 years of Modern Monetary Theory (MMT)-inspired, aimless money printing.

That’s the key word here: Aimless.

Here in the U.S., the left generally and the Democratic party particularly are known to prefer loose money. Look at the primary proponents and supporters of MMT and you’ll find them on the left side of the political spectrum.

When I think about both Obama’s and Biden’s terms in office, I don’t see much thought of our future economic prospects. Not much consideration of the dollar itself. (Cynics will tell you that’s a deliberate tactic in pursuit of some globalist goal – I disagree, but that’s a discussion for another time.)

In contrast, Trump has always had a vision for both the U.S. economy and the dollar. He’s stuck to his goals from the start. Yes, he wants to devalue the dollar, but with a specific purpose of countering other nations, who do the same to their currencies to gain advantages in international trade.

It’s hard to claim Trump wants to “destroy the dollar.” He is a known proponent of the gold standard, as are his top appointees. So it’s very likely that, somewhere in the back of his head, our President has the goal of re-tethering the U.S. dollar to gold. Like he said back in 2015:

Interviewer: Can you envision a scenario in which this country ever goes back to the gold standard?

Trump: I like the gold standard. There’s something very nice about the gold standard. There’s something very nice about having something solid, you know we used to have a very very solid country because it was based on a gold standard. We don’t have that anymore. There is something very nice about the concept of that.

How, when and whether this is even feasible are all good questions. But just that the thought is there tells us a lot about his designs.

Consider: When have Obama or Biden spoken highly of the gold standard? They, like any fan of MMT, see currency as something to be printed and spent. Not enough? Just print more!

Trump, on the other hand, does yearn for a time when the U.S. dollar was convertible into gold. Feasible? The answer depends on your optimism. I’m concerned we’re on a one-way trip to currency collapse without it…

By this point, neither the dollar nor the national debt are likely salvageable. But at least we have a leader who’s willing to try, compared to the alternative. Our nation was built on a willingness to try to make things better, after all!

Because he’s spoken publicly about how great the gold standard was, Trump has opened the door to a new avenue of mockery from the media. Take, for example, this piece that likens Trump’s interior decoration to Saddam Hussein’s?

Photos taken over the past month show that Trump, 79, has found even more places to add gaudy accents, including gold-plated moldings and designs on the room’s doors, bookcases, and above its fireplace.

I wonder… Could he be trying to emphasize the importance of gold? To remind the us that gold matters? I mean, there’s a reason the phrase “Golden Age” comes up so often in his social media posts and even in official White House communiques:

Personally, I don’t think it’s a coincidence.

Expert: If the national debt was correctly priced in, we’d see a much higher gold price

“Priced in” is a phrase you often in the context of financial news. Literally, it means that current or breaking news is already reflected in an asset’s price (this news could be anything that impacts its value in any way).

Financial analysts really love to price things in, especially in the context of the price of gold.

Remember when interest rates were going up? Talking heads constantly reminded us that multiple interest rate hikes (that hadn’t yet happened) hadn’t already been “priced in” for gold. It was their convoluted, economic-jargon method of saying, “The price of gold is too high.”

That was a while back… Today, the conversation has mostly switched to whether or not gold buyers have “priced in” delays in rate cuts based on the latest consumer and economic data. Again, this is meant as an accusation that gold’s price is too high. Which is nuts!

The thing these self-described experts don’t understand is where prices come from. In free markets, prices are the result of all available information about the asset itself as well as the economy generally. To say something isn’t “priced in” is simply nonsense in the first place.

But that doesn’t mean these imaginary oversights don’t get discussed at great length…

Here’s an example on the opposite side. Ryan McIntyre, managing partner at Sprott Inc, spoke to Kitco about what might happen to gold if the U.S. government’s debt situation was accurately “priced in.”

Put simply: Debt necessitates inflation, and inflation translates to higher gold prices.

Noting that 4% annual GDP growth is the accepted baseline, here’s what McIntyre had to say:

“If interest is three plus percent of GDP, it’s basically consuming over three-quarters of the growth. We’re not that far away from it actually consuming what the economy’s going to grow at – just in interest alone, let alone new borrowing required – which is an absolutely scary proposition. Once you get to the point where interest is basically overwhelming the growth, that to me is an obvious signal that the debt cannot be repaid.”

Interest payments alone entirely consuming the economy of a global superpower… What a thing to consider.

McIntyre continues:

“The government has taken on an inordinate amount of extra expense relative to GDP. The government is actually supplementing the economy now, and has been since the COVID crisis, so that deficit we’re running at 6% to 7%, could easily be close to 10% without that government support.”

“Supplementing” in this context means that government spending has replaced productive economic activity, just so we’re clear.

These are the things that aren’t being “priced in” for gold. Because if they were, who knows what might happen to the price? Would there even be a point in posting a gold price in dollars anymore? Or would we just revert to saving and spending American gold eagles?

Either way, McIntyre and Sprott are highly bullish on gold and silver. To an investor with a typical, high-risk portfolio that’s heavily exposed to economically-sensitive growth-only assets, they recommend a minimum 10% allocation to gold. That’s the bedrock of their diversification approach. I can see the logic there, but I think it’s a mistake to talk about “rules of thumb.”

I’m concerned about the dollar’s future. I believe it’s a mistake to rely on dollars beyond their pure necessity for everyday transactions. Dollars still function as a medium of exchange and a unit of account. When it comes to store of value, though, there are much better choices.

Did you know Spain once sent its gold reserves to Russia?

As we witness gold repatriation after gold repatriation, Dominic Frisby takes us to a ride through history that reminds us that the only gold you own is the gold you can pick up and hold in your hands. The essay is well worth reading in its entirety. It begins with a great title – Trust Me, I’m Stalin – and gets even better.

I’ll just recap the highlights: During the Spanish Civil War in 1936, the opposing factions each believed the nation’s gold reserve was a vital strategic consideration. Whoever controlled the gold reserve would ultimately control the country. (Yes, exactly like Venezuela today.)

The Spanish Republican faction were on the verge of defeat. With revolutionaries just 20 miles from the capital, the nation’s gold reserves were in jeopardy. Republican leaders decided to disappear the entire 635-ton stockpile to keep it out of the rebels’ hands. They quickly arranged to sell 20% to fund their war efforts. They needed a safe harbor for the remaining 510 tons (representing the world’s 7th-largest gold reserve by itself).

The gold clearly wasn’t secure in Spain, so they looked outside Spain. And settled on their steadfast ally against the revolutionaries – the USSR:

[Prime Minister] Caballero actually wrote to Stalin asking if he would “agree to the deposit of approximately 500 tonnes of gold.” Two days later, he got a reply from the Soviet leader, not previously known for his prompt responses. No surprise: Stalin would be “glad” to take the gold.

The Spanish got busy, loading some 200 trucks with almost 8,000 extremely heavy crates marked Munitions. Four Russian ships arrived at the port of Cartagena and were loaded over three nights. And when the gold arrived in Russia, Stalin celebrated his good fortune with an epic party. During which he uttered one of his many infamous quotes:

“They will never see their gold again,” he laughed.

Russian clerks took the time to meticulously calculate for a receipt to Spain. It’s interesting to note that Spain’s gold reserve dated from the era of the gold standard – so a lot of it was composed not of gold bullion bars:

There were gold coins from across Europe and Latin America, especially those British sovereigns and Portuguese escudos, but also Spanish pesetas, French, Swiss and Belgian francs, German marks, Russian rubles, Austrian schillings, Dutch guilders, and Mexican, Argentine and Chilean pesos. The numismatic value of the coins was higher than their gold content.

The following year, Spain was hit with a currency crisis – shocking, right? And the very same government that exiled the nation’s gold reserves blamed the crisis on the free market! Maybe they were hoping no one would notice that all the real money was gone?

But it gets even weirder. With all that gold on deposit with the USSR, Spanish Republican forces then used it to purchase “planes, tanks, machine guns, artillery, rifles, cartridges, food and fuel from Russia.” Since they already had payment, Stalin was able to charge well above market rates (in some cases double the going price) for Soviet arms. Just two years later, the Spanish gold reserve was essentially exhausted – and the USSR owned another 510 tons of gold outright.

So the Spanish Civil War continued for at least two years longer, citizens were left destitute, the nation’s currency collapsed… Ultimately, nobody won. Except Stalin.

Ever notice how prices keep climbing but your paycheck stays flat? That’s what happens when more dollars chase the same goods. A physical gold IRA lets you own real metal that holds its value even as the dollar weakens. You get all the tax perks of an IRA plus the security of tangible assets you can count on. Click below to grab your FREE Gold IRA info kit from Birch Gold Group and learn just how simple it is to add real metal to your retirement plan.

Click this link for the original source of this article.

Author: Administrator

This content is courtesy of, and owned and copyrighted by, https://www.theburningplatform.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.