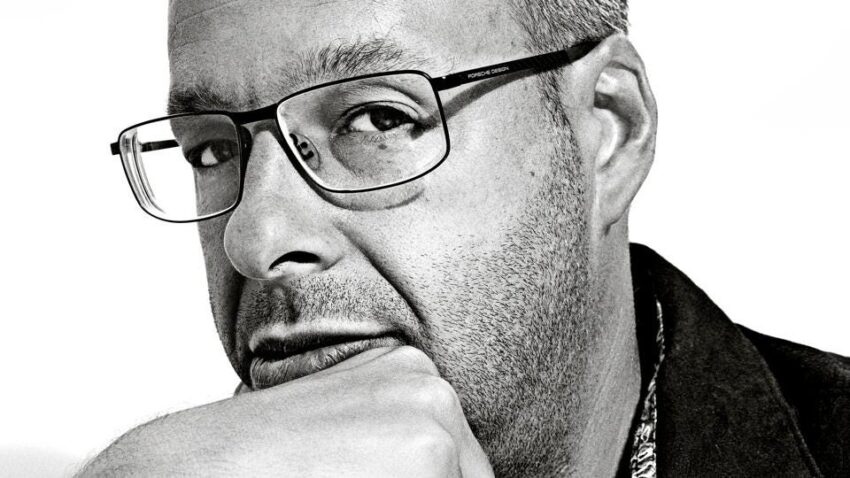

I’ve long admired Harris Kupperman, the founder of Praetorian Capital, for his ability to cut through noise and spot big-picture themes before they become consensus.

He has a knack for finding opportunities where others aren’t looking, blending a sharp macro perspective with a pragmatic investor’s mindset.

Whenever I come across his work, I find myself challenged to think differently, and this latest piece is no exception.

In his latest, he makes his case for why the AI revolution may just be a rerun. I know my subscribers will benefit from his perspective and wanted to share it with you all this morning.

Global Crossing Is Reborn…

I’ve been at this investing game a long time. Long enough to see cycles repeat themselves, cycles that I literally thought I would never again see. Yet in finance, everything repeats. You just need to keep your discipline and recognize things for what they are.

Let’s take a step back and start with a bit of a disclaimer. I’m an old-school investor. If you called me a boomer in my mentality, I wouldn’t really disagree. I still believe that things like cash flow and return on capital matter. In fact, they’re my north star. As a result, I often miss new trends, as I refuse to pay up for profitless prosperity. Sometimes, a hyper-growth company amazes me when it actually grows into its valuation, though that’s rarer than you’d think. Usually, cash flow is king, ROIC is the queen and everything else is simply stock promotion. Hence, my strong sense of skepticism towards anything new.

With that in mind, I’ve watched as AI went from an interesting parlor trick for making memes, to something that’s increasingly integrated into my daily workflow. I use it a lot and get huge value from it. I am not here to belittle AI, it’s the future, and I recognize that we’re just scratching the surface in terms of what it can do. I recognize all of this. I also recognize massive capital misallocation when I see it. I recognize an insanity bubble, and I recognize hubris.

I’m going to use a bunch of numbers here that I believe to be directionally correct, I’ve spoken with industry players who have somewhat confirmed these numbers. I fully expect that other industry insiders will quibble with these numbers, but if I feared criticism, then this blog would be no fun.

Click this link for the original source of this article.

Author: Quoth the Raven

This content is courtesy of, and owned and copyrighted by, https://quoththeraven.substack.com feed and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.