Smart money isn’t always smart, and following it blindly is unlikely to pay off. However, when you have institutional investors, politicians, and insiders all pile into an equity or an exchange-traded fund, there’s likely a reason behind it. In many cases, this sort of buying ends up being the prelude to an aggressive jump in price.

Watching where that so-called smart money lands is more than a parlor game. It is often the simplest way to discover which themes, sectors, or risk controls are about to matter most.

Institutions have far more resources than individual retail investors doing research on their own. So, when they decide to bet big on an ETF, they have a good rationale for it and are often not looking for a quick pop.

As a final note, we will be looking into ETFs with the most inflow. Looking into the direct buying of ETFs by specific insiders is not possible, nor is it required to be made public in most cases. Still, this is a good metric to gauge Wall Street’s interest in certain ETFs.

So here are three ETFs to look into with smart money buys.

Key Points

-

These ETFs are seeing significant interest from investors.

-

These are more niche names compared to ETFs with the most inflow.

-

However, smart money is increasingly warming up to them.

-

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; learn more here.(Sponsor)

ARK Innovation ETF (ARKK)

ARK Innovation ETF (BATS:ARKK) is an actively managed fund. It is led by Cathie Wood, who became one of the most recognizable names on Wall Street as tech stocks went vertical during the 2021 boom. Unfortunately, the triple-digit gains turned into a huge decline as the pendulum went the other way. ARKK declined by 42% from even its pre-COVID price by late October 2023.

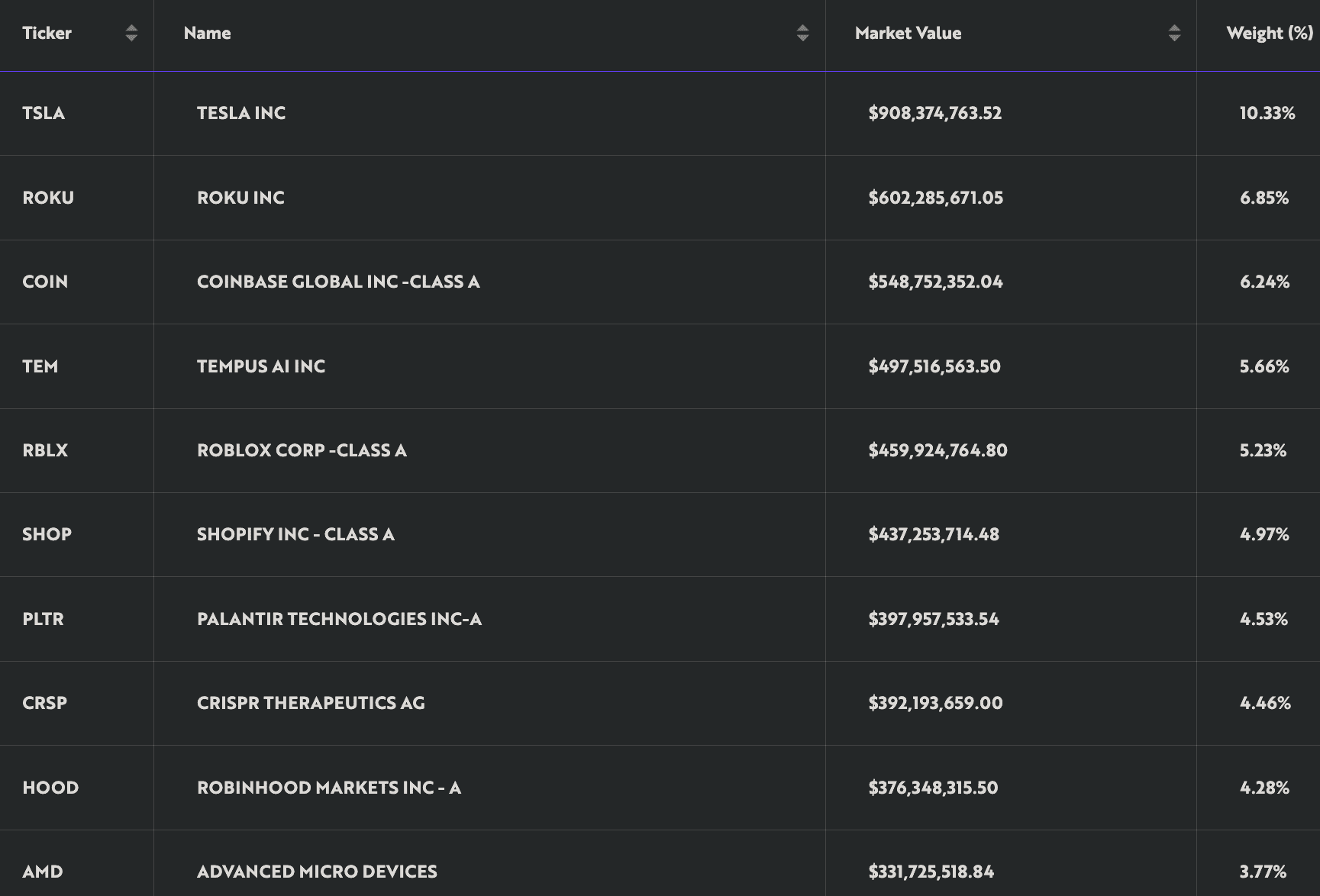

Some investors may have lost faith in Cathie, but she seems to have learned from her mistakes. ARKK has delivered more consistent gains recently. Her portfolio is more susceptible to downturns due to its tech-heavy nature, but a sustained AI rally will make ARKK one of the biggest beneficiaries. Here are its top holdings:

ARKK comes with an expense ratio of 0.75%, or $75 per $10,000 invested. There are no dividends being paid out. The inflows have broken even 2021 records and peaked at $1.4 billion on Tuesday last week. The day before, ARKK took in $1.1 billion.

iShares Ethereum Trust ETF (ETHA)

Ethereum is now the hottest crypto on the block. It has been hot for a very long time, but the current cycle was quite disappointing for those invested in Ethereum instead of Bitcoin. Ever since Ethereum’s inception, it has outperformed Bitcoin during bull markets. This time around, Bitcoin trounced Ethereum’s gains and kept dominating, especially with support from ETFs.

But now, Bitcoin has slowed down, and we may enter a period called the altseason, where crypto alternatives to Bitcoin gain stratospherically.

In anticipation, investors are piling into Ethereum and other altcoins. iShares Ethereum Trust ETF (ETHA) has seen weekly net inflows of $2.2 billion, as it gives investors exposure to Ethereum’s native token.

It comes with an expense ratio of 0.25%, or $25 per $10,000.

iShares Expanded Tech Sector ETF (IGM)

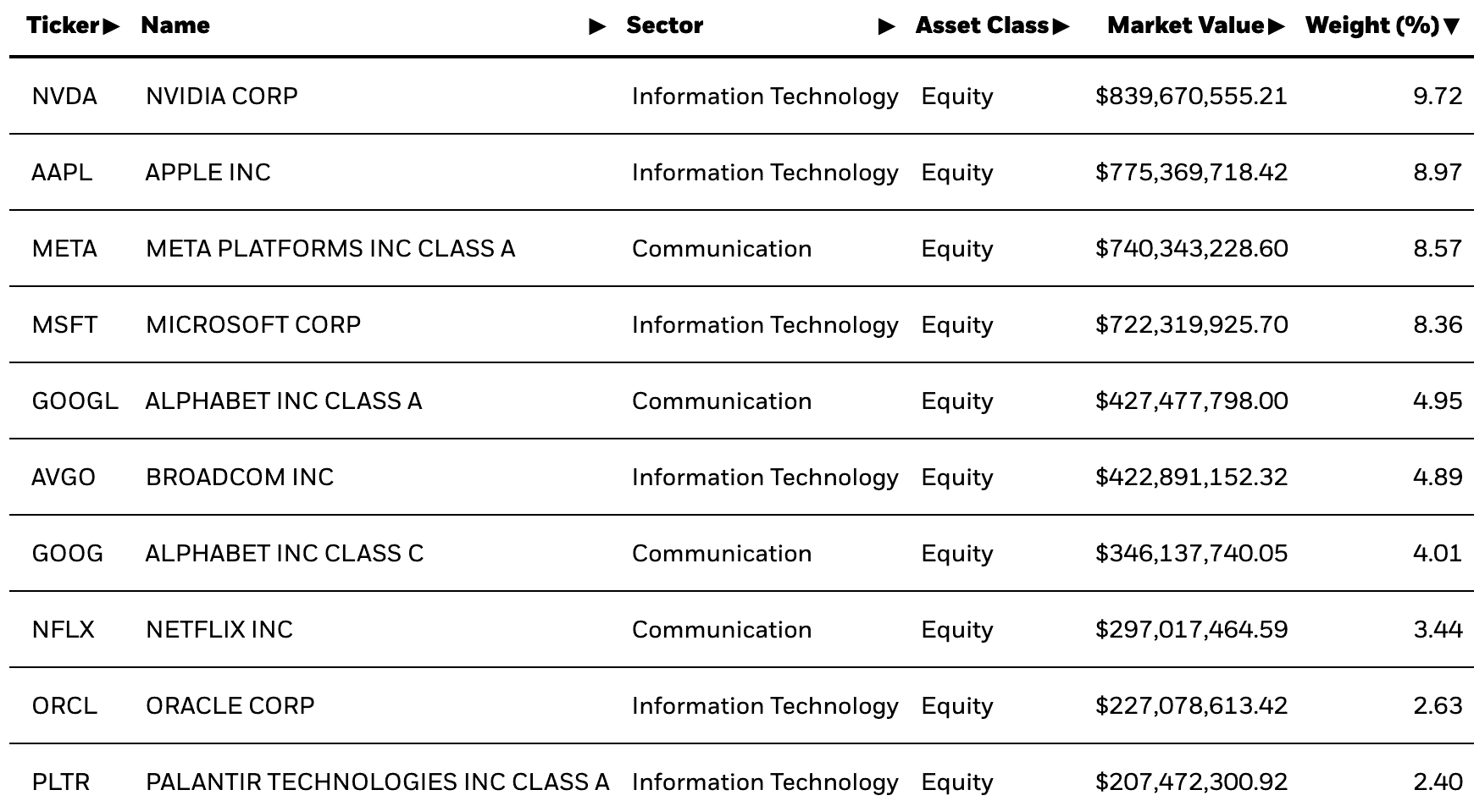

iShares Expanded Tech Sector ETF (NYSEARCA:IGM) tracks the S&P North American Expanded Technology Sector Index. The index focuses on tech stocks, including most of the hot Magnificent Seven stocks and other software and semiconductor stocks.

This one ETF gives you solid exposure to the most well-performing group of tech stocks, all for an expense ratio of 0.39%, or $39 per $10,000. This is an attractive expense ratio for an ETF that beat the Nasdaq.

Here are its top holdings:

Having tech exposure is essential in the current environment, so it makes sense that institutions and retail alike are clamoring to get a bigger stake in AI and semiconductor stocks. IGM had $1.47 billion in weekly net inflows.

The post 3 ETFs Smart Money Is Loading up on Right Now appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Omor Ibne Ehsan

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.