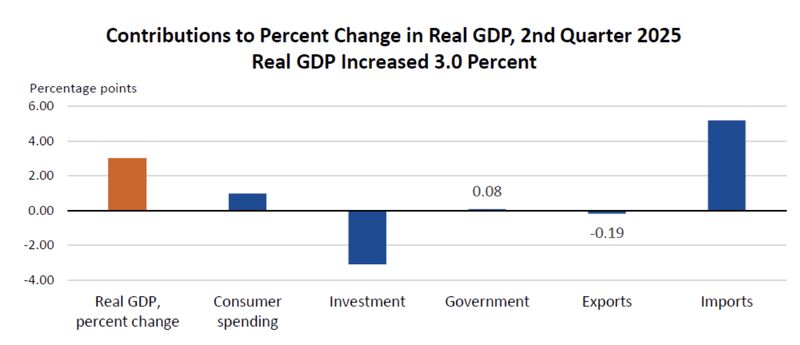

A couple of days ago, I had an email exchange with some Trumpie friends who asserted that the recent GDP report (3 percent inflation-adjusted growth) was proof that Trump’s protectionist trade policy has been successful.

Given the underlying details of the report from the Commerce Department, I don’t think they should be celebrating. After all, business investment fell and there was an artificial shift in imports because of Trump’s chaotic trade taxes.

That being said, many people seem to think the report is good news.

So it is appropriate to ask whether the people warning against protections (like me) were playing Chicken Little.

Before I give my answer, let’s look at what President Obama’s top economist had to say. Here are some excerpts from a column by Jason Furman in yesterday’s New York Times.

…when President Trump unveiled his plans for steep tariffs against the United States’ trading partners, some Democrats were publicly gleeful about what they thought was the beginning of a Trump recession. …Nearly four months later, with the economy still largely intact, …some Democrats are secretly disappointed. …So were the models wrong? Was the concern misplaced? …Well, it’s not that simple. Just as the models predicted, growth has indeed slowed, and inflation has risen. …the latest forecasts from the Yale Budget Lab…see a 0.5-percentage-point reduction in growth this year and a gross domestic product that is persistently 0.4 percent lower than it would have been without the tariffs. …Half a percentage point may not sound like much, but in an economy as huge as the United States’, it amounts to a loss of about $150 billion. That’s the equivalent of every household in America taking around $1,000 and lighting it on fire — then doing it again every year. Forever. …Still, for all that waste, it’s a far cry from some of the dire warnings about recessions, economic crises and stock market collapses that we heard in April. Why?

I think his framing of the issue is reasonable.

Now let’s look at his explanation.

…even at the height of tariff mania I thought a recession was unlikely, for a few simple reasons. First, imported goods account for only 11 percent of the U.S. G.D.P. …In addition, the U.S. economy has extraordinary strength and momentum, which gave us some of the highest growth rates of any advanced economy both before Covid (in Mr. Trump’s first term) and after the start of the pandemic (during Joe Biden’s term). …The United States is lucky. We have tremendous natural resources, a broad and skilled work force, the world’s best universities and cutting-edge technology companies, and we issue what is the closest thing to a global currency. This gives us a lot of resilience in the face of even very large-scale policy shocks and mistakes.

To summarize, Furman is basically saying that it takes a lot of bad policy to push the U.S. economy into recession.

That’s probably true, so I largely agree with what he wrote.

However, I think he is guilty of a sin of omission.

He does not acknowledge that Trump has some good policies to offset bad policies. And that plays a role in my explanation for why Trump’s trade policy hasn’t sunk the economy.

More specifically, the president’s tax cuts and deregulation are good for growth, so it’s unclear whether the net effect of Trump’s presidency will be good of bad for prosperity. Especially since we don’t know what Trump will do on trade from one month to the next.

For what it’s worth, I graded Trump’s first term as mildly negative (and Economic Freedom of the World came to the same conclusion).

I won’t be surprised if we see something similar for his second term.

P.S. There’s one additional reason why Trump’s trade taxes haven’t crippled growth.

Here’s a chart showing that the actual tax rate on trade has risen, but by much less than headlines suggest.

P.P.S. Since this morning’s jobs report was very grim, the Trumpies who are celebrating the GDP report should probably put the corks back in their champagne bottles. However, my oft-stated view (both domestically and internationally) is that one should never fixate on one month or one quarter of data. The bottom line is that we actually don’t know whether 2025 will be a good year or bad year for prosperity.

———

Image credit: Michael Vadon | CC BY-SA 2.0.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.