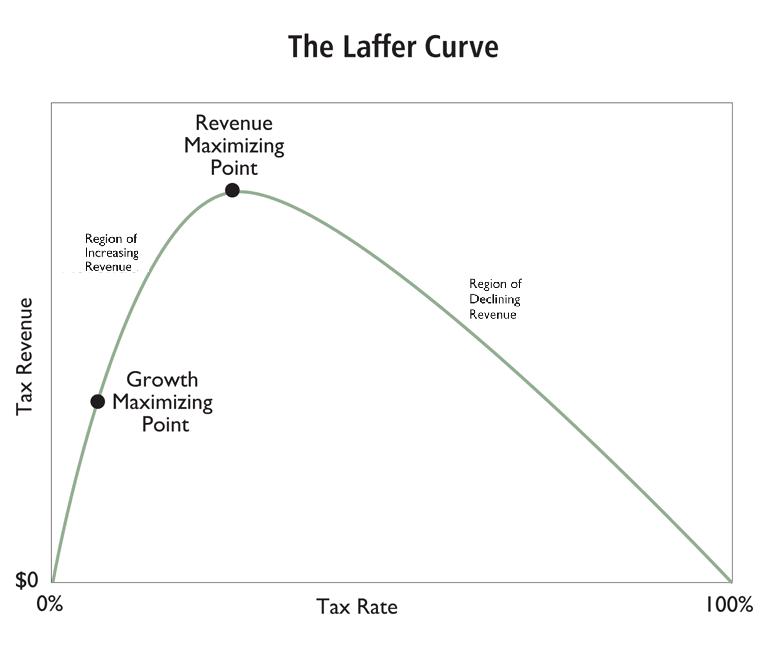

The Laffer Curve provides incredibly important insights about tax policy.

Most important, it informs us that you don’t measure the revenue impact of tax policy changes merely by looking at what is happening to tax rates.

You also have to consider whether changes in tax rates will alter incentives to earn and report income.

Or, in the case of sales taxes and trade taxes, incentives to buy things.

Or, in the case of capital gains, incentives to sell assets.

And that last example is our topic today.

The economic luddites in the United Kingdom have been engaging in class-warfare fiscal policy, including tax increases on investors.

That approach, to put it mildly, has backfired.

Here are some excerpts from a story in the U.K.-based Financial Times by Emma Agyemang.

The UK’s efforts to increase revenues from capital gains tax have backfired, with receipts plummeting in the wake of big cuts in allowances. The government’s CGT take fell 18 per cent from the previous year to £12.1bn in the 2023-24 fiscal year, even as the annual tax-free allowance was halved from £12,300 to £6,000, according to data released by HM Revenue & Customs on Thursday. Separate provisional figures — calculated using a different methodology and published earlier in the week by HMRC — indicated a further 10 per cent drop in CGT receipts in 2024-25. …The slashing of allowances by the previous Conservative government in 2023-24 made an additional 87,000 taxpayers potentially liable for CGT, taking the total number exposed to the tax to 378,000. The tax-free allowance was halved again to £3,000 a year in 2024-25. Reeves also increased CGT rates in her Budget last October to between 18 and 32 per cent — up from the previous rates of between 10 and 28 per cent.

And here’s part of Temie Laleye’s report for GB News.

CGT receipts fell to £11.8 billion in the first half of 2025, down from £13.5 billion during the same period in 2024. This marks a £1.7 billion drop in Government income. The fall follows the Chancellor’s October 2024 Budget, which introduced immediate changes to CGT rates. Basic rate taxpayers saw their CGT rate rise from 10 per cent to 18 per cent, while higher rate taxpayers faced an increase from 20 per cent to 24 per cent. …Annual CGT revenues have already been falling. In 2022 to 2023 they stood at around £17 billion, dropping to £14.5 billion in 2023 to 2024 and just £13.1 billion in 2024 to 2025. …the CGT increases have led to taxpayers rearranging their finances to avoid higher bills. …Wealthier individuals, in particular, have responded by adjusting the timing and structure of their asset disposals to minimise tax exposure. The Government had projected that the CGT changes would raise £90 million in 2024 to 2025 and £1.44 billion in 2025 to 2026. But the latest data suggests those forecasts are likely to fall far short.

If there was a prize for understatement, “likely to fall far short” would win a prize.

It’s not just that the tax increases are not producing as much revenue as politicians hoped. All the evidence is that the government is actually losing money.

That being said, it’s quite possible that the long-run effect won’t be as harmful as the short-run effect, at least with regard to tax revenue (as you can read here, here, and here, I’m a big advocate of prudence over exaggeration when considering the Laffer Curve and its consequences).

But even if the tax increases eventually collect additional revenue, the real issue is whether letting politicians have more money is worth the damage to the private sector.

I’ll close by explaining the real problem in the United Kingdom, which is that politicians from both parties have been squandering money at a reckless rate (see chart).

As the burden of government spending climbs, they invariably think of different ways of diverting more money from the productive sector of the economy.

I don’t expect that self-destructive cycle to end anytime soon.

The United Kingdom needs another Margaret Thatcher, or the British version of Javier Milei. I’m not optimistic.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.