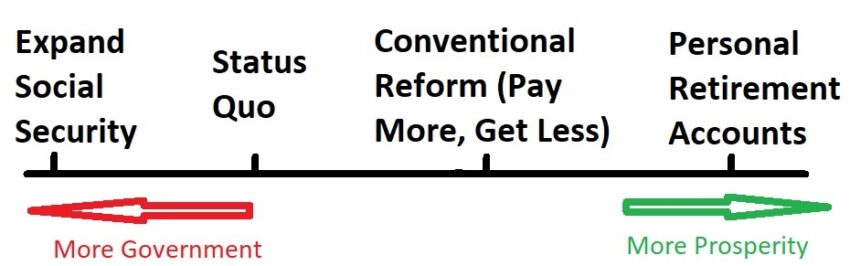

I recently wrote about the five potential ways of dealing with Social Security’s simmering crisis and noted that most supposed solutions moved us in the wrong direction on the spectrum.

And I wrote less than two months ago about the program’s shaky finances.

So I was interested to see a column in the New York Times by Mark Miller about “six oft-repeated myths about Social Security.”

Was this going to be an insightful contribution to the discussion? Would Mr. Miller be a potential ally in the fight for a better system? Was he as least willing to tell hard truths?

But when I looked his list of myths, I shook my head in disappointment.

Let’s look at each of his supposed myths and consider whether he is being accurate and honest.

1. Here’s what he wrote about whether the program is running out of money.

Enough payroll tax revenue would be coming in…to pay 77 percent of benefits. …But many experts see little or no chance that Congress will allow cuts of that magnitude to occur. …Congress could decide to inject general revenue to keep benefits whole.

So he’s basically admitting that the program has a huge shortfall. But he wants us to believe that truth is a myth because future politicians presumably will grab more money from taxpayers.

That may be an accurate prediction about future events, but it doesn’t change reality. The program is running out of money.

2. What about his second supposed myth? Here’s some of what he wrote.

An aging population has accelerated the drawdown of the trust fund, but that was always anticipated. …Lower birthrates also play a role, translating into fewer new workers coming into the system. … And payroll tax rates have not changed since 1990.

So he actually admits that population aging is and issue, but wants to pretend that truth is a myth because falling birth rates are also part of demographic change.

What a hack.

Oh, and he also wants readers to think truth can become a myth if politicians grab more money from taxpayers.

3. His third supposed myth is about Social Security and red ink. Here are some excerpts.

Social Security is self-funded mainly by the Federal Insurance Contributions Act, or FICA, better known as the payroll tax. The FICA rate for Social Security is 12.4 percent… By law, Social Security cannot borrow money to pay benefits or tap the federal government’s general coffers — one reason the shortfall is projected for 2033.

Now I’m wondering if his problem is stupidity instead of hackery. Nothing he wrote in that section of the column actually addresses Social Security’s fiscal balance.

It’s as if you were asked for your net worth and only shared some income data.

4. His most absurd supposed myth deals with the so-called Trust Fund.

President George W. Bush…falsely claimed in 2005 that there was no trust fund, just a pile of I.O.Us. …says Richard W. Johnson, director of the program on retirement policy at the Urban Institute. “It’s hard to say they are imaginary, since they’ve been used to pay benefits for a number of years now.”

Miller is basically saying the IOUs are not IOUs because they were redeemed.

That’s like me saying I don’t have a mortgage because I’ve been making my payments.

But don’t believe me. Here’s what the Clinton Administration wrote in 1999.

5. Now let’s look at his fifth supposed myth, which deals with whether reforms are needed to stabilize the system.

Here’s some of what he wrote.

Politicians sometimes argue that cutting benefits is the only way to preserve the program for younger generations. Very often, that involves a call to raise the full retirement age… raising the retirement age, Dr. Johnson said, “would harm many low-income retirees who wouldn’t be able to work longer — and they have not experienced the same longevity increases as high-income people.”

As usual, he does not actually dispel a supposed myth. Instead, he simply uses the opportunity to say that the system shouldn’t be salvaged by spending restraint.

He wants higher taxes, preferable of the class-warfare variety.

6. The good news is that I don’t have any big objection to what he wrote about the sixth myth, dealing with waste and fraud.

…less than 1 percent of the more than $1 trillion the agency pays in benefits each year are considered improper payments.

I suspect the actual numbers is more than 1 percent, but I’m sure it is trivial compared to rampant fraud in other entitlement programs such as Medicare, Medicaid, food stamps, and the EITC.

The bottom line is that Mr. Miller obviously has an agenda. He wants to defend and expand Social Security.

That’s not my preferred approach, but my objection to his column is not that we have different preference.

What irks me is that he listed six myths and only one of them could possibly be categorized as false.

Seems like he took lessons from the infamously sloppy Robert Reich.

———

Image credit: 401kcalculator.org | CC BY-SA 2.0.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.