I wrote last December to share the results of a study Robert O’Quinn and I wrote for Canada’s Fraser Institute on pension systems in OECD nations.

Our main goal was to show that personal retirement accounts are now surprisingly common, even in supposedly socialist Europe.

Denmark, Sweden, Estonia, Greece, Switzerland, Iceland, Latvia, and the Netherlands all have successful systems based wholly or partly on private savings.

Today, however, I want to focus on Australia’s private system. Known as superannuation, workers set aside 12 percent of their income into private retirement accounts (similar in magnitude to the 12.4 payroll tax imposed on American workers).

Sadly (for Americans), Australians may pay about the same as Americans, but they get a much better system.

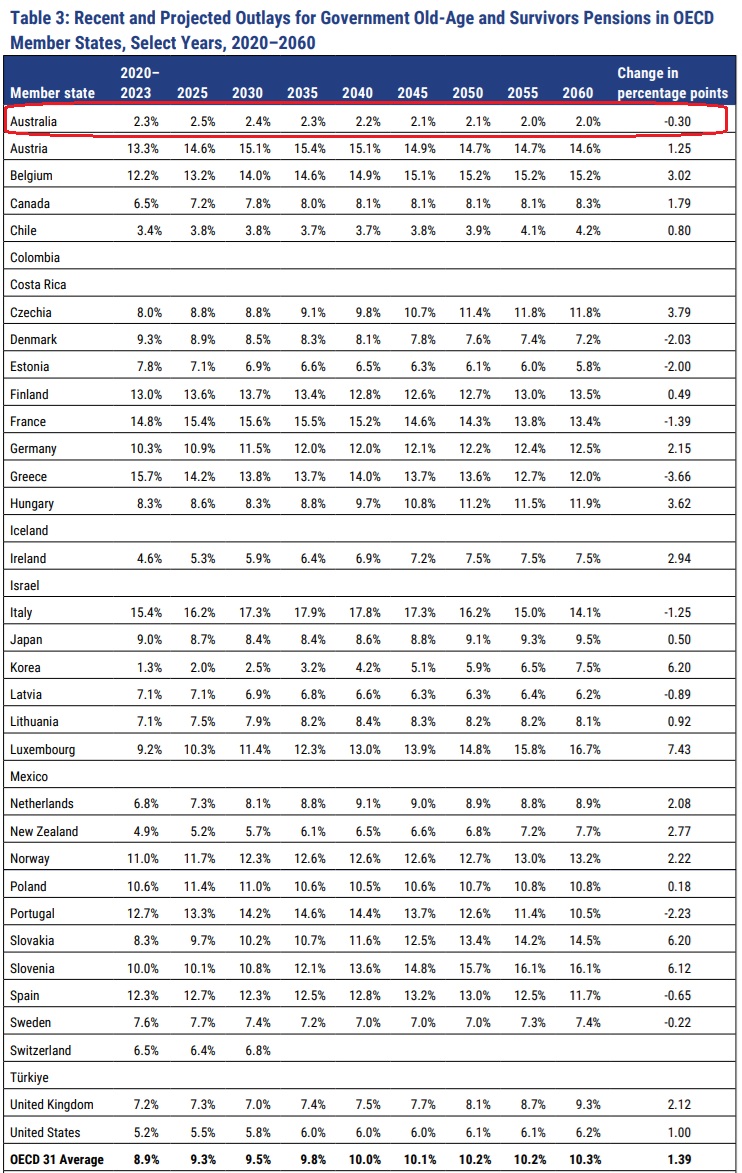

Here’s a chart from the Fraser study showing the projected burden of government pension spending in OECD nations. Notice that Australia (highlighted in red) easily is in much stronger shape than the United States.

Heck, the Aussies are in a stronger position than every other OECD member state.

There is some good news for the United States. The burden of Social Security spending is below the average of all OECD nations.

But, 30 years from now, we still will have about three times as much government pension spending as the Australians.

So, from a taxpayer perspective, Australians are definitely win. But what about retirees?

I decided to write this column because of an article I saw in the U.K.-based Telegraph by Rob White. It compared Australian retirees and British retirees.

You can probably guess who is doing better.

…the average inheritance is more than AUD $700,000 (£341,000), compared to less than £50,000 in Britain. …thanks to more sophisticated private pension schemes, Australians…become richer in retirement. …Australia started automatically enrolling people into pensions 30 years ago. A decade later, employers were required to contribute 9pc to their workers’ pensions – known there as “superannuations” – and this has now hit 12pc. …Australia pension funds are well known for pooling, which allows them to make bigger investments, cut costs and improve returns for members. …In Australia, a pension follows the worker when they change jobs. This helps them keep track of it, and ultimately enhance their returns.

By the way, Australia has another advantage.

No death tax.

Australia abolished inheritance and estate taxes at federal level in 1979, with all six states following suit by 1982. …According to Martin Willis, of Barnett Waddingham, …“In Australia, the focus can be on building those assets without constantly looking over their shoulder. People in the UK might think they’re making the right decision, only to have the rug pulled out from under them.” …Britain remains firmly behind Australia’s curve.

So the Australians are way ahead of the Brits.

But what about Australia vs. the U.S.?

Back in 2012, I compared the two nations and noted that the U.S. system had a big unfunded liability while the Australian system was generating a big pile of savings.

This next visual shows what has happened over the past 13 years.

The bottom line is that we keep going further into debt while the Australians continue to get richer.

No wonder I’m a big fan of Australia’s system (as are others).

———

Image credit: Pedro Ribeiro Simões | CC BY 2.0.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.