By Taxpayers Association of Oregon Foundation,

14 TAX CUTS ARE INCLUDED IN THE NEWLY-PASSED ONE BIG BEAUTIFUL BILL ACT

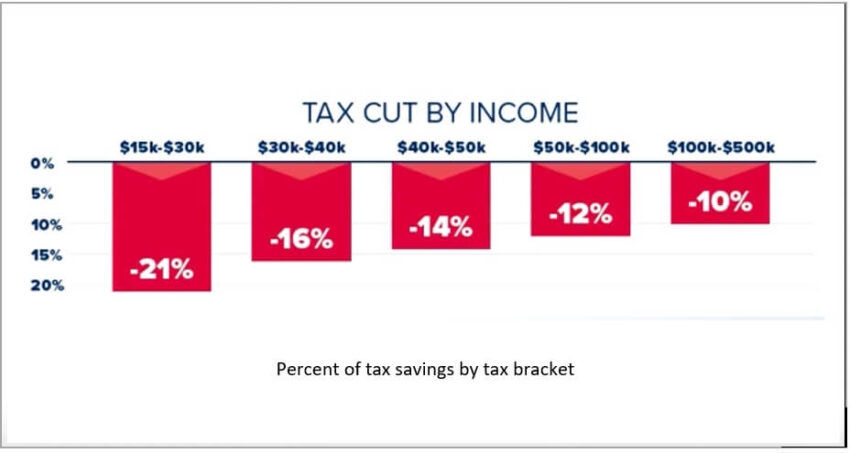

• Income tax cuts: The One Big Beautiful Bill didn’t just extend the 2017 income tax cuts, it cut them deeper. The chart above shows how much your tax bracket saved.

• Creates new deductions for tips and overtime pay — The first $25,000 in tips and $12,500 in overtime pay may be deducted. The overtime tax exemption applies to “half” of the “time and a half” portion. Expires in 2028.

• Senior deduction — A new $6,000 deduction for those over 65 with incomes below $75,000 (single) or $150,000 (married). Expires in 2028.

• Estate Tax exemption — The estate exemption is increased from $13.99 million (single) and $27.98 million (married) to $15 million and $30 million respectively.

• Increases the Standard Deduction — From $15,000 (single) and $30,000 (married) to $15,750 and $31,500, beginning this tax year.

• Child tax credit — Increases from $2,000 to $2,200 per child. For low-income families, only the first $1,700 is a refundable credit for 2025.

• Car loan interest deduction — A new deduction of up to $10,000 in car loan interest for cars assembled in the United States. Expires in 2028.

• Creates Child Savings Account — Babies born from January 1, 2025, to December 31, 2028, are eligible to receive a $1,000 seed fund from the government to be placed into a specific account of low-risk investments. After turning 18, funds may be accessed under a variety of conditions.

• State and Local Tax deduction (SALT) — Raises the State and Local Tax deduction cap from $10,000 to $40,000 (staggered). This mostly benefits high income-tax states (Oregon, New York, California, New Jersey, Vermont) by allowing them to deduct their high state income taxes from their federal income tax. Expires in 2030 and returns to the $10,000 limit.

• Charitable deduction increases — Taxpayers who do not itemize can now deduct up to $1,000 (individuals) or $2,000 (married) for charitable donations (they previously couldn’t). Enacts modest limits on both corporate and high-income taxpayers (those who earn $600,000 or more) who make charitable donations.

• Business Research and Development — Allows a 100% deduction of research and development expenses. Current law required a 5-year amortization period for these expenses. This is a massive boost to businesses that wish to make large investments in new ideas.

• Repeals COVID-era Employee Retention Credit — This free government handout to employers was overwhelmed by fraud, abuse, and businesses that did not need it.

• Increases college endowment tax — Previously, all college endowment investment returns were taxed at 1.4%. New rates range from 1.4% to 8%, depending on endowment size. For instance, Harvard earns substantial profits from its $50.7 billion investments in stocks and bonds.

• Donors to school choice programs — Up to a $1,700 non-refundable tax credit for lower-income and middle-income taxpayers who donate to scholarship programs, including parochial and charter schools.

The post 14 big tax cuts in Big Beautiful Bill first appeared on Oregon Catalyst.

Click this link for the original source of this article.

Author: In the news

This content is courtesy of, and owned and copyrighted by, https://oregoncatalyst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.