Live Updates

Updates appear automatically as they are published.

Conference Call Has Ended

Very Bitter Call!

The Q&A with KULR is full of largely angry (frustrated?) questions. Someone asked a pretty good question why the company doesn’t host a call the next morning so investors can ask about the most recent quarter.

I’ll Give Management Credit

They’re taking some hard questions from shareholders. The most recent question is about the company dilluting shareholders and treating its shareholder base as an ‘ATM.’

On KULR’s Call

We’re listening in to KULR’s call right now.

Shares are currently up 17%. The company announced a 1 to 8 reverse stock split to get its price comfortably above delisting issues.

In addition, revenue growth exceeded expectations.

We’ll post notes from their call shortly.

More Details on KULR’s Quarter

KULR | KULR Technology Group Q2’25 Earnings Highlights:

- EPS: $0.22 [

]

] - Revenue: $3.97M (Est. $3.50M) [

]; [UP] +63% YoY

]; [UP] +63% YoY - Adj. Gross Margin: 18% [

]; [DOWN] -600 bps YoY

]; [DOWN] -600 bps YoY - Net Income: $8.14M [

]; [UP] +$14.03M YoY

]; [UP] +$14.03M YoY - Operating Loss: $9.45M; [DOWN] +77% YoY

- SG&A Expenses: $6.94M; [UP] +51% YoY

- R&D Expenses: $2.44M; [UP] +86% YoY

- Cash and Accounts Receivable: $24.73M

Q2’25 Outlook:

- Revenue: $4.50M ±10% (Est. $4.00M) [

]

]

- The outlook reflects continued growth in product sales and strategic investments in R&D.

- Management expects to leverage its Bitcoin holdings to support operational expansion and product development.

Q2 Segment Performance:

- Product Sales Revenue: $1.98M (Est. $1.75M) [

]; [UP] +74% YoY

]; [UP] +74% YoY

Other Key Q2 Metrics:

- BTC Holdings: 1,021 BTC; [UP] +$101M in acquisitions

- BTC Yield: 291.2%;

CEO Commentary:

- Michael Mo: “KULR is in its strongest financial position to accelerate its growth and continue its innovations. Alongside the increased revenue in Q2, our Bitcoin holdings provide a solid financial balance sheet that enables us to invest confidently in developing new KULR ONE battery products, expand our R&D efforts, and drive towards the next phase of our growth.”

CFO Commentary:

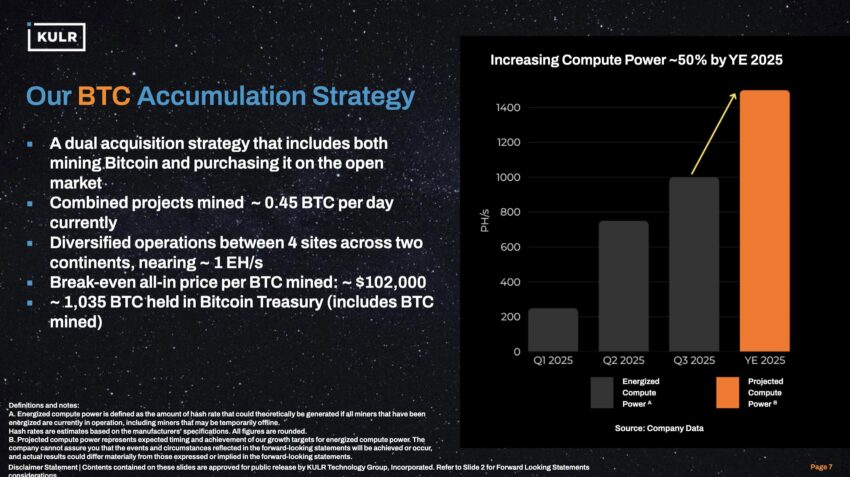

- Shawn Canter: “We are proud to deliver another revenue record quarter – the highest in KULR’s history. Revenue rose 63% year-over-year. We continue to invest for KULR’s long-term growth and scalability. In parallel, we are executing on our Bitcoin treasury strategy. We hold over 1,035 BTC and a yield approaching 300%. We remain confident in our ability to build shareholder value through our energy management, exoskeleton and BTC strategies.”

A Good Day for KULR Investors

KULR has reported and shares are up 15%. We’ll post more analysis shortly.

KULR Shares Down 2.7% Today

KULR Technology reports after the bell today and shares have sold off slightly. As of 3:35 p.m. ET they’re down 2.7%.

The company has sold off throughout 2025 even while Bitcoin performed well. We’ll see if there’s enough business momentum announced today to turn the story around.

KULR Technology Group (NYSE: KULR) reports afte the bell today. Shares soared across 2024, eventually hitting $43.92 at the end of 2024.

Yet, it’s been an awful 2025 so far. Shares are down 78% even while the price of Bitcoin continues to rise. The company currently has a market capitilization of a little more than $200 million while recently reporting its Treasury had reached 1,021 BTC. In other words, the value of its Bitcoin today stands at about $120 million, or 60% the company’s total value.

Investors will be watching for progress recording revenue. While sales are still small, Wall Street does expect $19.5 million in revenue in 2025 and growth to $34.75 million in 2026.

Key Areas to Watch for In Q2

KULR is currently followed by only two analysts who provide estimates. Here’s what they expect from last quarter:

- Revenue: $3.45 million

- EPS (GAAP): -$.12

- EPS (Adjusted): -$.08

Here are some key themes to watch from the company’s call tonight:

- What deal progress will be announced?

- The comapny discussed mutliple partnerships and potential deals last quarter including ones with UPS. What updates will the company offer on moving these deals toward generating revnue?

- Will the company stick to its expectations of doubling sales in 2025?

- Last year KULR generated sales of $10.74 million. In the first quarter it produced $2.45 million and analysts expect $3.45 million in the second quarter. Those numbers imply significant revenue acceleration happening in the back half of the year. Will KULR stick to this projection?

The post Live: KULR Shares Skyrocket 17% After Earnings appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Eric Bleeker

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.