Back in 2020, I created a simple visual to explain potential options for Social Security.

My goal was to help readers understand that politicians have the ability to make the current system better, but they also could make it even worse.

But I’m not satisfied with that visual since some people may think “Status Quo” is an option.

It isn’t. Social Security has a gigantic long-run financing gap, driven in large part by demographics.

So, realistically speaking, policy makers will have to choose from these five options.

1. Massive Debt Increase

Many politicians (including the two candidates in last year’s election) seem to think “Status Quo” is a choice. They don’t want to touch the program.

But this approach means $65.8 billion of additional debt over the next 75 years. And that’s adjusted for inflation!

The problem with this kick-the-can-down-the-road approach is that there’s eventually a fiscal crisis.

Think Greece about 15 years ago, except there’s no way to bail out the U.S. economy.

2. Massive Payroll Tax Increase

Theoretically, Social Security is supposed to be “social insurance.” This means workers finance their own benefits by paying taxes into a system.

Because of demographic changes, however, the Cato Institute calculated that a massive increase in payroll taxes would be needed to stabilize the program’s finances.

Here’s the impact on the average worker.

And since Social Security already is a bad deal for workers (they pay a lot of tax for relatively modest benefits), this option would make the program even worse.

3. Massive Class-Warfare Tax Increase

Politicians from both parties claim they don’t want higher taxes on lower-income and middle-class voters, so Option #2 is not very popular. So pro-tax politicians claim that Social Security’s built-in crisis can be averted with class-warfare taxation.

Which explains why Barack Obama, Elizabeth Warren, and Hillary Clinton all gravitated to a plan to to extend the 12.4 percent Social Security payroll tax so that it is imposed on all income rather than on income up to $176,100.

This would change Social Security from social insurance (the benefits that workers receive are related to how much they pay*) to income redistribution (tax higher-income people to give money to lower-income people).

More importantly (at least from an economic perspective), this would be a massive increase in marginal tax rates on entrepreneurs, investors, small businesses, and others with high incomes. I’ve cited research about the economic damage of higher tax rates, but I’ve always thought Larry Lindsey’s research gave us the best summary.

In one fell swoop, such as scheme would saddle Americans with European-level tax rates.

4. Massive Benefit Cuts

This is actually the real “Status Quo” option. When the Trust Fund runs out of IOUs, the law says that benefits automatically get reduced.

By how much?

The answer is that benefits would be limited by the amount of Social Security tax revenue. As calculated by the Committee for a Responsible Federal Budget, this means big benefits cuts for future retirees.

For what it’s worth, I strongly suspect politicians would panic and simply choose Option #1 (massive debt increase) to avoid benefit cuts.

5. Personal Retirement Accounts

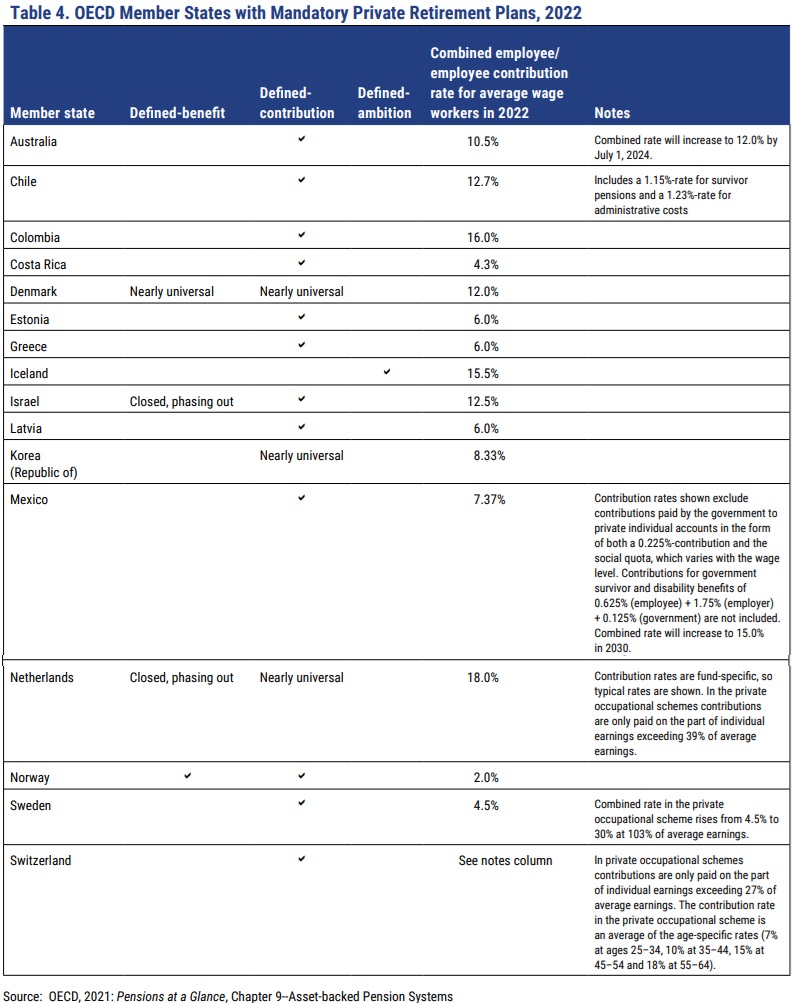

Since I’m a fan of personal retirement accounts (I did my dissertation on Australia’s private system), this is the option that I like.

But I find that many people think that a private system is impractical. So I like to cite my research on the many nations that already have personal accounts.

As you can see, a surprising number of countries have systems based on real private savings instead of empty political promises.

Sadly, the United States missed a chance to enact reform about 20 years ago when our fiscal situation wasn’t so precarious.

I’ll conclude by noting that politicians can – and probably will – opt for a some-of-the-above approach. In other words, instead of just choosing one of the five options, they wind up with a mix.

My guess is they’ll most rely on Option #1. My fear is they’ll ignore Option#5.

*Technically, retirement benefits are determined by the amount of income that was taxed. But that obviously is connected to how much tax workers pay.

P.S. Since I’m a fan of personal accounts, I feel obliged to acknowledge that Option #5 is not a freebie. There would be a multi-trillion dollar “transition cost” to a system based on private savings. But since all five options have multi-trillion dollar costs, picking Option #5 should be easy because at least you have a pro-growth system when the dust settles rather than a Ponzi Scheme.

P.P.S. If you want to enjoy some grim humor about Social Security, click here, here, and here. And we also have a Social Security joke, though it’s not overly funny when you realize it’s a depiction of reality.

Addendum: Some people have asked whether raising the retirement age should be listed as a 6th option. I did not include that choice since it is simply a combination of Option #2 (since it means people work longer and pay more tax) and Option #4 (since a later retirement means they will have fewer years to collect benefits).

———

Image credit: Matthias Zomer | Pexels License.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.