Meta and Microsoft both posted strong earnings yesterday, easily surpassing expectations. Meta reported EPS and revenue well above analyst forecasts, driven by strong user engagement and advertising growth. Microsoft also delivered better-than-expected results, fueled by robust cloud and AI demand, particularly in Azure.

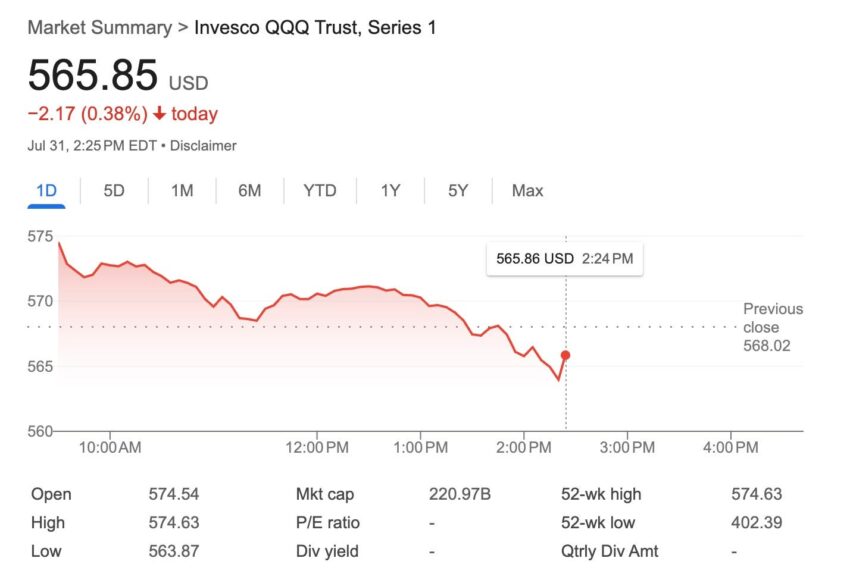

These earnings helped drive a powerful after market — then early morning rally in tech, with the QQQ reaching as high as $576 shortly after the open today.

However, that strength is fading notably. By midday, the QQQ had sold off sharply, sliding all the way down to a low with a $564 handle. A $12 intraday swing lower represents a significant move of about 2% for the index.

The reversal is even more striking when you consider that QQQ has been on a relentless grind higher over the past month, largely driven by just a handful of mega cap names — led by the same ones that just “beat” earnings handily.

While the ETF touched new highs earlier this week, its gains have been increasingly narrow—market breadth has been awful, as I’ve noted, with most of the advancing concentrated in the same small cluster of stocks that make up the bulk of its weight — again, led by the same ones that just “beat” earnings.

The selloff could be a reflection of stretched valuations, with the market finally showing signs of rejecting the extreme multiples it has been willing to pay.

Valuation remains just as important as earnings beats, and the market has been trading at a absolutely batshit historically elevated Shiller PE ratio near 38x for months. Even with strong fundamental performance, the price investors are willing to pay for each dollar of earnings could be starting to face resistance.

The situation is amplified by the structure of the market itself. The Mag 7—Microsoft, Apple, Amazon, Meta, Alphabet, Tesla, and Nvidia—make up such a massive portion of the S&P 500 that they effectively are the index (or in this case, the NASDAQ).

Passive index flows have concentrated capital into these names, creating a feedback loop where new inflows automatically drive up their prices, regardless of valuation.

But with market breadth so thin, any stall in this passive bid — or enough selling — could cause an outsized impact, as is detailed here:

If inflows slow or reverse, the mechanical buying pressure that has supported these stocks could quickly become a lack of support—and in a market this concentrated, that could translate into sharp downside for the broader indexes. Especially because a lot of the passive funds may not have liquid cash to meet redemptions, they take on leverage to do so. That jig ends after enough people redeem.

Technically, today’s intraday action is nasty. The sharp reversal from highs to deep red could suggest there is little appetite to keep bidding the Mag 7 stocks at their current valuations. The market’s message seems to be: great earnings, but for now, not enough. This is an important dynamic to watch because the Mag 7’s dominance means their price action can dictate the S&P 500’s direction almost entirely.

The next key test comes tonight, when Amazon and Apple report earnings. If either one misses expectations, the market could get crushed. Even if they beat but the QQQ still sells off, it could mark the start of a multiple contraction phase—where earnings growth is no longer enough to justify price levels.

With the market this concentrated, deteriorating breadth, and passive flows potentially stalling, today’s reversal could be an early signal of just how fragile the current rally is.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Click this link for the original source of this article.

Author: Quoth the Raven

This content is courtesy of, and owned and copyrighted by, https://quoththeraven.substack.com feed and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.