90 minutes after a solid 2Y auction stopped through in the first sale of this week’s abbreviated bond auction schedule, moments ago the Treasury sold $70BN in 5 year paper in what was a surprisingly ugly auction.

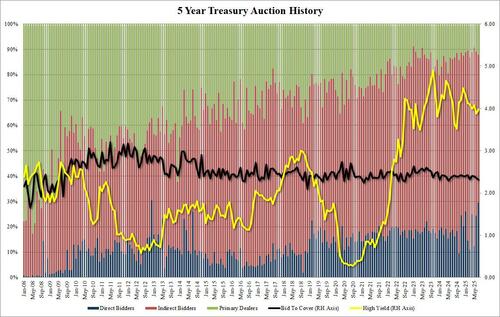

Starting at the top, the high yield was 3.983%, up from 3.879% in June, and tailing the When Issued 3.975% by 0.8bps, the biggest tail for this maturity since last October.

The bid to cover dropped to 2.31 from 2.36, the lowest since May 2024, and below the six auction average of 2.38.

The internals were also ugly, with Indirects slumping to 58.3% from 64.7%, and the lowest since June 2022.

And with Directs awarded 29.5%, or the highest since 2012, Dealers were left holding 12.2% just above the recent average of 11.0%.

Overall, this was a surprisingly poor auction, yet despite the very ugly reception, the broader market barely noticed, with 10Y yields trading a tad lower after the break. We expect this complacency toward lack of demand for US paper to change very soon.

Tyler Durden

Mon, 07/28/2025 – 13:28

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.