Anyone tuned into America’s affordability crisis knows it has long hit hardest in ultra-progressive Democratic states like California. Over the past decade, median home prices have skyrocketed 134 percent in Phoenix, 133 percent in Miami, 129 percent in Atlanta, and a staggering 99 percent in Dallas, with coastal cities like New York, San Francisco and Los Angeles seeing increases of only 75 percent, 76 percent and 97 percent, respectively.

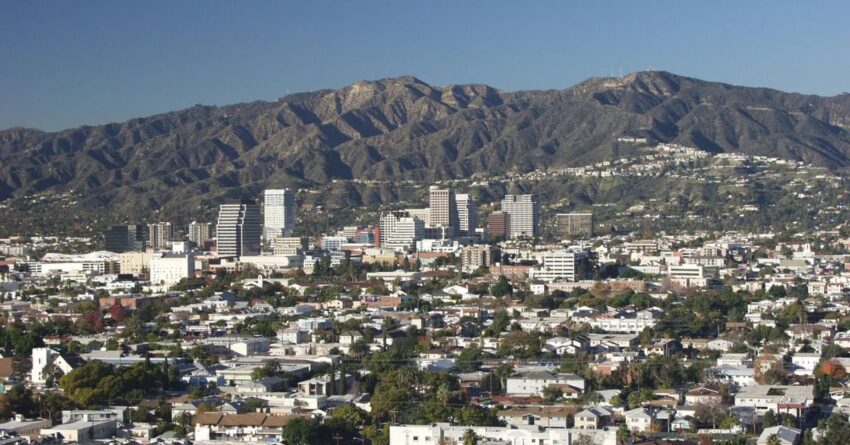

California Housing

This trend could spell disaster for many. For decades, suburban sprawl across the Sun Belt acted as a much-needed safety valve for those priced out of expensive cities. However, even these affordable alternatives are now slipping beyond the reach of many Americans. According to expert consensus, overreaching liberal regulations stifled home construction, draining the housing market dry. The housing crisis, in turn, has become emblematic of ineffective governance in blue states. The simplest theory suggests the current expert consensus is misguided. Experts view the growth of NIMBYism as an impending storm on the horizon that eventually hits every region.

Anti-California

Historically, the Sun Belt was celebrated as the anti-California. Economists Ed Glaeser and Joe Gyourko, both urban experts, recently examined housing production rates since the 1950s across 82 metropolitan areas and uncovered a startling truth. As late as the early 2000s, cities like Dallas, Atlanta and Phoenix were hammering out new homes at more than four times the rate of coastal giants like San Francisco and Los Angeles. The fact that millions were being priced out of superstar cities wasn’t ideal, but the Sun Belt boom helped prevent this housing shortage from escalating into a full-blown national crisis.

Sun Belt

Fast forward to now: Although the Sun Belt is still churning out more housing than the coasts, Glaeser and Gyourko reveal that the rate of construction has plunged by more than half in many Sun Belt cities over the last 25 years. “When it comes to new housing production, the Sun Belt cities today are basically at the point that the big coastal cities were 20 years ago,” Gyourko told us, unveiling the dark reality behind the rising home prices and the New York minute of demand. In a properly functioning housing market, the post-COVID demand boom should have signaled a building frenzy, taming price hikes. Instead, five years on from the pandemic, these sizzling markets are still struggling to keep pace with the surge in interest, allowing prices to explode.

Housing Crisis

The housing debate has taken center stage in Democratic politics as some pundits spotlight rising costs in the so-called laissez-faire Sun Belt. “Blaming zoning for housing costs seems especially blinkered,” Vanderbilt University law professors Ganesh Sitaraman and Christopher Serkin argue in a recent paper, pointing out the nationwide nature of the housing crisis, despite local regulations varying dramatically. While some argue that consolidation in the home-building industry since the 2008 crash has empowered large developers to restrict new construction, others emphasize skyrocketing construction costs as a significant financial hurdle for builders. While both viewpoints hold merit, they can’t fully explain the broader crisis. Data show that while the home-building industry has indeed become more monopolized since 2008, the slowdown in production in the Sun Belt began long before. Glaeser and Gyourko find that developer profits have held steady, and despite rising construction costs, profits remain viable in markets with soaring prices. “The share of homes selling far above the cost of production in major Sun Belt markets has dramatically increased,” they caution, indicating builders are sitting on a gold mine unclaimed.

The post Safe Havens From California Housing Crisis Vanishing appeared first on Knewz.

Click this link for the original source of this article.

Author: Joshua Wilburn

This content is courtesy of, and owned and copyrighted by, https://knewz.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.