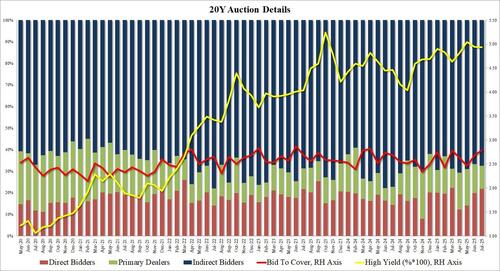

After another night of soaring bond yields in Japan, and a move higher in the yields of US paper since this morning, some were concerned today’s 20Y reopening could have difficult finding demand. It did not, and instead demand was brisk with the biggest stop through since June 2024.

Starting at the top, the auction priced at a high yield of 4.935%, down from 4.942% last month and the lowest clearing yield since April. The auction also stopped through the 4.951% When Issued by 1.6bps, the biggest Stop Through since June of 2024.

The bid to cover was als impressive, shooting up to 2.79 from 2.68 in June, and the highest since April 2024 (clearly, it was well above the six-auction average of 2.62).

The internals were solid, with Indirects awarded 67.4%, up from 66.7% last month and in line with the recent average of 68.0%. And with Directs awarded 21.9%, or the most since March, Dealers were left holding 10.7%, the lowest since March.

Overall, this was a stellar 20Y reopening auction, and easily one of the best coupon auctions of the summer, yet one wouldn’t know it by the secondary market because even though 10Y yields dipped after news of the auction hit the tape, yields across the curve have since resumed their gradual melt up higher.

Tyler Durden

Wed, 07/23/2025 – 13:25

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.