For all those basement-dwelling retail traders, whose one dream in life has been to reprise the infamous Roaring Kitty of Gamestop fame, and short squeeze their way to fame and riches (while crushing a hedge fund or two in the process), we have some great news: now’s your (second) chance.

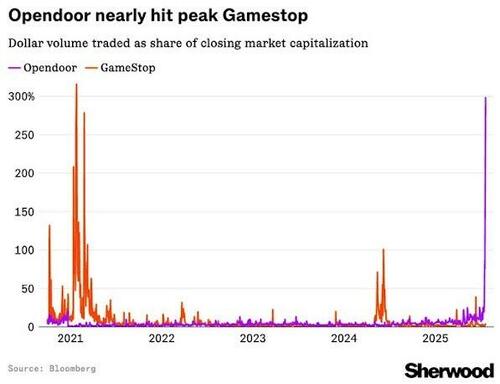

After yesterday’s unprecedented, historic gamma squeeze in Opendoor Technologies (OPEN) stock (and Chamath SPAC), which saw a record surge in call option activity…

… concurrently with an explosion in the dollar volume of the traded stock which nearly touched Gamestop during the unforgettable January 2021 squeeze.

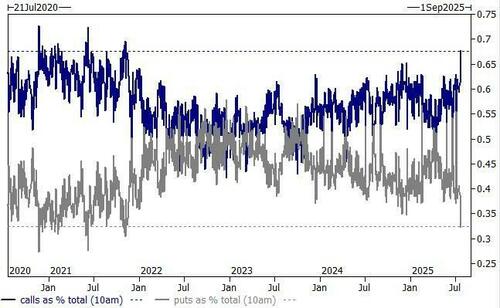

It’s not just us, who are reminiscing about the insanity of January 2021: so is Goldman, and as the bank’s trader Ryan Shakey wrote overnight, he is getting “2021 vibes … feels chasey out there: calls are almost 70% of the total market volume … hasn’t been this high since 2021 meme days.“

So to make a long story short, one can lament the idiocy of it all (and with the midterms in November of next year, one would have a long time to lament, especially since Trump has now decided to not only not cut spending but to be graded – as during Trump 1.0 – by the performance of the sto(n)k market), or one can join in the insanity and at least make some money in the process.

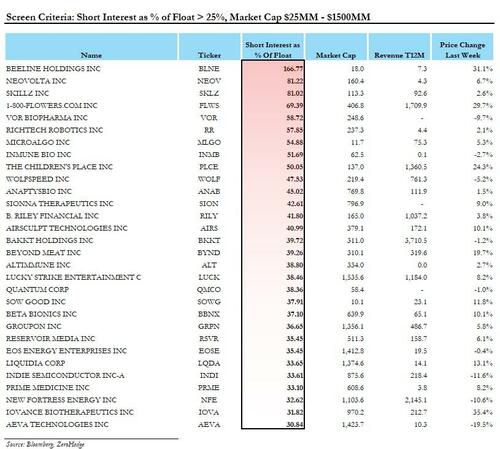

We are choosing the later, and to celebrate the lunacy we have run a Bloomberg screen of all micro and small-cap companies (market cap $10MM – $1500MM), that have a short interest as a % of float above 25%, which we believe have the highest chance of getting swept up in the next mega squeeze meltup.

The top 40 names are shown below…

… and the full list can be accessed by professional subs in the usual place.

Tyler Durden

Wed, 07/23/2025 – 06:55

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.