Gold once again blasted through the $3,400 per ounce mark on Monday, sending a not-so-subtle message to anyone still clinging to the idea that we’re in a “normal” market cycle that things are, in Wharton school terminology, starting to get really fucky.

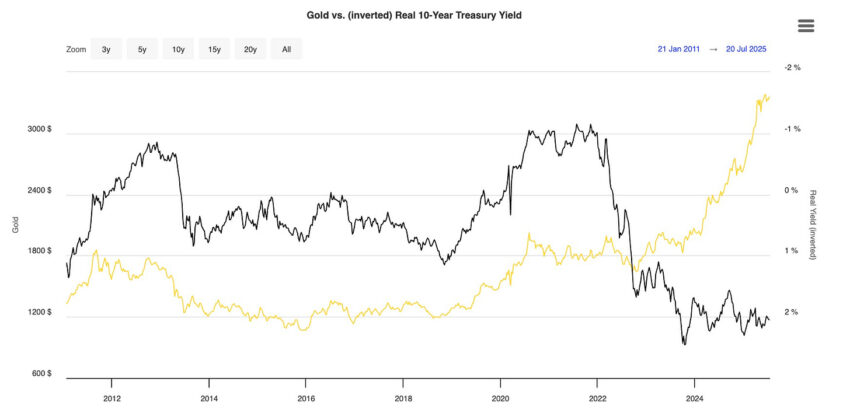

I’ve been saying for years that something has been “breaking” ever since gold decoupled from its trend with real rates back in 2023.

Now, we’re seeing signs of “breaking” not just in the metals market, but in bonds as well. For example, yields keep rising even as the Fed Funds Rate trends lower. This doesn’t look like a bond market that’s happy with monetary policy. What a time to be alive.

But back to gold and miners. The precious metal, long dismissed as a relic by tech-obsessed bulls happy to pay 100x sales for the investment equivalent of a man stepping on a flaming bag of shit on his front porch, has emerged as a powerful signal of a tectonic shift underway in global finance.

At the same time, U.S. equities have surged higher, driven by renewed enthusiasm around U.S.–China trade talks, more Trump-era tax cuts, and—this week—Japanese trade agreements, despite the fact that a 15% tariff on Japan remains in place.

Markets, as always, love a good narrative. In fact, they’ll latch onto any narrative.

The S&P 500, Nasdaq, and Dow have all hovered near all-time or short-term highs over the past two weeks. Traders cheer, algorithms see all time highs as buy signals, and pundits reminded us just how “resilient” the consumer supposedly is—because apparently maxing out credit cards and using buy-now-pay-later services to buy cereal and toilet paper now qualifies as confidence.

But look a little deeper, and the disconnect between price action and economic reality becomes almost laughable.

Click this link for the original source of this article.

Author: Quoth the Raven

This content is courtesy of, and owned and copyrighted by, https://quoththeraven.substack.com feed and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.