California News:

On July 21, 2025, the price of gasoline in California was 42.2% higher than the national average, 40.7% higher than Arizona, 20% higher than Nevada, 46.86% higher than Florida, and a whopping 63.12% higher than Texas. California has the highest gasoline prices in the nation, yet California ranks 7th in proven petroleum reserves in the U.S. but is increasingly dependent on foreign oil imports from sources such as Iraq, Brazil, Saudi Arabia, and Guiana. In 1982, California imported around 6% of its oil needs from foreign sources; today, the Golden State imports around 63% from various petrostates. In the future, California may be importing its gasoline from foreign sources made from Iranian, Russian, and Venezuelan oil.

The recent decline in California gasoline prices and the favorable impact on California consumers occurred despite California policies. Californians are beneficiaries of the: (1) drop in global crude oil prices, (2) Trump Administration energy policies and increased U.S. oil production, (3) growing world oil supplies, (4) a plateauing in Chinese oil consumption, and (5) the anticipated improved stability in the Middle East. Here are some factors to consider:

- U.S. oil production has reached an average of 13.43 million barrels a day with expectations for record highs for 2025.

- Brent crude oil prices, which California prices its oil purchases on and is the largest component of gasoline prices, have fallen 17% since President Trump took office on January 20, 2025. Crude oil is the primary ingredient of gasoline.

- OPEC8+ is estimated to be increasing oil production by 34% to 550,000 barrels a day. (Iraq has increased production by 80,000 barrels a day & Libya is coming on-stream with greater production.)

- The Congressional rescission, signed by President Trump, reversing California’s 2035 ban on the sale of internal combustion engines.

- Elimination of certain CAFÉ, tail pipe emissions and fuel standards and revocation of California’s waiver to set its own emission standards and phasing out the ZEVs and EV mandates under the Big Beautiful Bill enacted on July 4, 2025.

- Supreme Court ruling that producers have standing and can litigate against the EPA and regulators over approvals of California emission standards.

- The recent consensus is that crude oil prices will remain around or below $70 a barrel for the duration of 2025…but anything can happen in the oil industry. Example: On July 7, the Brent price of crude oil jumped 2% because of a Houthi attack on a Greek maritime vessel in the Red Sea.)

Based on EIA data, there is no notable effect on current gasoline price declines from California policies. To the contrary, California’s regulations have increased retail gasoline prices.

- Since 2011 California Low Carbon Fuel Program (See Figure 1.0)

- Ca gasoline retail price differentials increased 12%, due to the LCFS administrative and growing renewable fuel procurement requirements for gasoline and diesel fuels.

- Since January 2025:

- While overall U.S. average gasoline prices have declined by 1.7%, California prices have increased by 4.18%, with two sharp price increases in early January and July. The price increases appear to be related to the LCFS cost pass throughs to consumers. (Figure 1.0).

- The average retail price differential between California gasoline to U.S. increased from 34.89% to 42.99%.

- California policies have contributed to increases in the regulatory cost components of gasoline prices while crude prices fell.

- The State’s excise tax, which is the highest in the nation, has increased by nearly two cents a gallon.

- The new LCFS, has incrementally increased prices by around $0.14 to $0.19 cents a gallon, initially, according to CARB.

- While the average monthly retail price of gasoline in California declined by 9.22% from April 2024 to April 2025, CARB’s own data indicates that the cost of the LCFS has increased by 87.5%, from $0.08 to around $0.15 a gallon based on an April 2024 to April 2025 comparison.

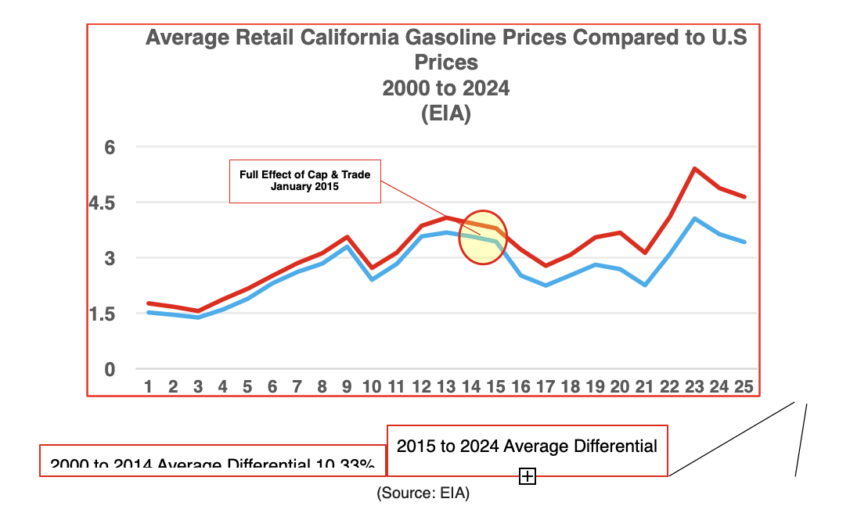

- From 2000 to 2014, the average price differential of California gasoline prices was 10.33% (Figure 1.0).

- From 2015 to 2024, the average price differential of California gasoline was 23.54%, or more than doubled (Figure 1.0).

From 2019 to 2025:

- California’s State Excise Tax has increased by 29.39%.

- California’s refinery capacity has (or will) decline by 21% (est.).

- California’s in-state oil production has fallen by 35.1%.

- California’s drilling permits have fallen by 97.26%.

- The average price differential of California gasoline was 25.96%, the highest in over 20 years.

- Factors contributing to the doubling in California’s price differential include, but are not limited to:

- Full effect of Cap-and-Trade commencing January 2015 (Figure 2.0).

- Reduction in the number of refineries.

- California imports of non-U.S. oil increased 91.62%.

- Reduction of in-state refinery capacity and output.

Figure 1.0

Figure 2.0

We can continue to try to justify regulatory costs and policies, but at what cost to the hard-working California consumer? The data is clear, even as the price of crude oil declines, the various regulatory cost components associated with retail gasoline prices have increased. With the pending closure of two refineries, and as the inevitable dependency on foreign sources to supply gasoline grows, retail gasoline prices in California will most likely continue to increase and outpace the national average.

The foreign markets will supply gasoline, that was a never an issue. The three pertinent questions for California are:

(1) At what cost to the consumer?

(2) What will prices be if a third refinery exits the State or California loses the use of essential intra-state pipelines and critical oil production and refinery infrastructure?

(3) Why, with the 7th largest oil reserves in the U.S. and a history of some of the best and safest operations, doesn’t California look to its abundant petroleum resources to help navigate not only lower consumer prices but also as a method to reduce its $1.6 trillion total debt and its $12 billion budget deficit?

1 Michael A. Mische is an Associate Professor at the University of Southern California. The opinions, conclusions, and statements expressed herein are solely those of the author and do not

reflect, imply or represent the positions or policies of the University of Southern California in anyway.

2 “Weekly U.S. All Grades All Formulations Retail Gasoline Prices (Dollars per Gallon).” Www.eia.gov, www.eia.gov/dnav/pet/hist/LeafHandler.ashx n=PET&s=EMM_EPM0_PTE_NUS_DPG&f=W.

3 “Weekly California All Grades All Formulations Retail Gasoline Prices (Dollars per Gallon).” Www.eia.gov,

www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=EMM_EPM0_PTE_SCA_DPG&f=W.

4 —. “Annual Oil Supply Sources to California Refineries.” California Energy Commission, www.energy.ca.gov/data-reports/energy-almanac/californias-petroleum-market/annual-oil-supply-

sources-california.

5 Viktor Tachev. “China’s Oil Demand Drops in 2024, Experts See the Start of a Trend.” Energy Tracker Asia, May 2025, energytracker.asia/china-oil-demand-dropped/.

6 “U.S. Energy Information Administration (EIA) Press Release.” Eia.gov, 2025, www.eia.gov/pressroom/releases/press570.php. Accessed 7 July 2025.

7 Kennedy, Charles. “OPEC to Complete Unwinding of Oil Output Cuts with Big September Hike.” OilPrice.com, 7 July 2025, oilprice.com/Energy/Energy-General/OPEC-to-Complete-

Unwinding-of-Oil-Output-Cuts-With-Big-September-Hike.html. Accessed 7 July 2025.

8 https://www.youtube.com/watch?v=-VafMFY0QmI

9 Reyes-Velarde, Alejandra. “Reined in by Trump, What Will California Do next to Clean Its Air?” CalMatters, 7 July 2025, calmatters.org/environment/2025/07/california-smog-air-pollution-

solutions-electric-cars-trucks-trump/. Accessed 7 July 2025.

10 Reyes-Velarde, Alejandra. “Reined in by Trump, What Will California Do next to Clean Its Air?” CalMatters, 7 July 2025, calmatters.org/environment/2025/07/california-smog-air-pollution-

solutions-electric-cars-trucks-trump/. Accessed 7 July 2025.

11 Lind, Kevin. “Supreme Court Rules Fuel Producers Can Sue EPA over “Harming” Regulations.” Deseret News, 25 June 2025, www.deseret.com/politics/2025/06/25/supreme-court-rules-

against-epa-regulation-california-emissions-fuel-producers/. Accessed 7 July 2025.

12 https://www.eia.gov/outlooks/steo/

13 https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0_pte_sca_dpg&f=a

14 https://www.politico.com/f/?id=00000198-15a6-d661-a7ff-f7f7e0490000 “Based on data submitted to the CEC by refiners pursuant to SB 1322, it also appears that LCFS compliance costs of

5 to 8 cents per gallon associated with the amendments were included in retail fuel prices starting January 1, 2025, before the effective date of the LCFS regulatory amendments.”

15 https://www.politico.com/f/?id=00000198-15a6-d661-a7ff-f7f7e0490000

16 See Figure 2. https://www.politico.com/f/?id=00000198-15a6-d661-a7ff-f7f7e0490000

17 https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0_pte_sca_dpg&f=a

18 https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0_pte_nus_dpg&f=a

19 https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0_pte_sca_dpg&f=a

20 https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=emm_epm0_pte_sca_dpg&f=a

21 CDFTA.

22 Inclusive of Phillips 66 and Valero closures and based on CEC data. Estimates are cumulative for the 2023 to April 2026 period.

23 CEC.

24 https://www.prnewswire.com/news-releases/new-2024-ca-oil-drilling-permits-drop-to-73-as-groups-reveal-oil-regulators-halved-bonding-for-states-now-biggest-onshore-oil-well-operator-says-

consumer-watchdog-302369222.html

25 https://www.energy.ca.gov/data-reports/energy-almanac/californias-petroleum-market/annual-oil-supply-sources-california

Click this link for the original source of this article.

Author: Michael Mische

This content is courtesy of, and owned and copyrighted by, https://californiaglobe.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.