As North Carolina industries brace for the threat of new tariffs, a closer look at those already in effect reveals a sharp drop in imports, particularly in sectors like aluminum, steel, and vehicle manufacturing that depend heavily on these materials.

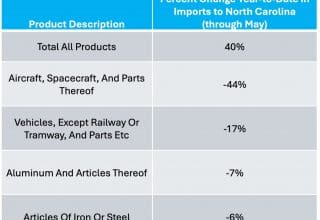

According to data from the Economic Development Partnership of North Carolina (EDPNC), imports to North Carolina have increased by 40% overall since May 2025; however, industries with tariffs already enacted show a clear decrease in imports.

The import increase across the board is “driven mainly by firms front-loading shipments in anticipation of potential Trump administration tariffs,” Joseph Harris, fiscal policy analyst for the John Locke Foundation, told the Carolina Journal.

“A 25% tariff on autos and auto parts has led to a decline in vehicle and parts imports from $3.1 billion to $2.6 billion,” said Harris.

According to the EDPNC, the automotive industry is the largest manufacturing industry in the Southeast, employing more than 37,000 workers in the state. North Carolina’s automotive manufacturers include Damier, Toyota, Bridgestone, Thomas Built Buses, Caterpillar, and many more. In addition, 20 of the top 100 global original equipment manufacturers (OEMs) have operations in the state.

“Similarly, a 50% tariff on steel and aluminum products not ‘melted and poured’ in the US has caused aluminum imports to fall 7% and steel and iron imports to drop 6%,” continued Harris. “Aircraft imports, indirectly affected by these metal tariffs, have experienced an even sharper decline, plummeting 44% year-over-year.”

“UK aerospace products covered by the WTO Agreement on Trade in Civil Aircraft are exempt from all reciprocal and Section 232 steel and aluminum tariffs,” according to the GBA Tariff Tracker.

Small businesses will feel a greater impact than larger manufacturers, which can stockpile supplies before a tariff surge. One example is in the brewing industry, where smaller brewers do not have the space or capital to stockpile aluminum cans like large brewers.

“The contrast suggests that while tariff threats drive import surges, actual tariffs dampen trade activity in the targeted sectors,” concluded Harris.

As tariffs impacting other sectors of North Carolina manufacturing are enacted, industries could face a similar decline in imports. For example, tariffs on pharmaceuticals, another significant manufacturing sector in the state, are in progress, or “pending,” and the US Department of Commerce has until December 27, 2025, to deliver its report to the president.

Tariffs have led to sharp import declines in key North Carolina industries like automotive, steel, and aluminum, disproportionately impacting smaller businesses that cannot stockpile materials. With new tariffs looming—particularly in pharmaceuticals—the state’s manufacturers face growing uncertainty.

The post Imports to North Carolina rise, but tariffed industries see decline first appeared on Carolina Journal.

The post Imports to North Carolina rise, but tariffed industries see decline appeared first on First In Freedom Daily.

Click this link for the original source of this article.

Author: Katherine Zehnder

This content is courtesy of, and owned and copyrighted by, https://firstinfreedomdaily.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.