Authored by Vince Quill via CoinTelegraph.com,

The Nasdaq stock exchange filed an application with the US Securities and Exchange Commission (SEC) on Wednesday on behalf of BlackRock to add staking to the asset manager’s iShares Ether exchange-traded fund (ETF).

If the application is approved, the fund would give investors exposure to staking rewards accrued from using the underlying Ether as collateral security for Ethereum’s proof-of-stake consensus algorithm.

In May, the SEC released guidance classifying staking rewards earned from validation services on proof-of-stake blockchain networks as earned income rather than securities transactions subject to capital gains tax.

The application to amend the BlackRock iShares Ethereum ETF to include staking rewards. Source: Securities and Exchange Commission

The SEC staking guidance opened the doors for institutional investors to earn yield on their ETH holdings, a major feature for TradFi institutions that must produce income or cash flow for shareholders.

Staked Ether supply hits all-time high, fueled by institutional buying

“Ethereum starts to look like a hybrid between tech equity and digital currency,” Ray Youssef, CEO of finance app NoOnes told Cointelegraph in July. “This appeals to treasury strategists looking beyond passive storage.”

Ethereum treasury companies scooped up 540,000 ETH, valued at $1.6 billion using current market prices, in the last month for their corporate reserves.

In June, the amount of staked ETH hit an all-time high, with 28% of the circulating supply dedicated to the network’s security.

The amount of staked ETH reached a new all-time high of 36,036,981 in July, accounting for over 29% of the circulating supply, according to Dune.

ETH staking metrics. Source: Dune

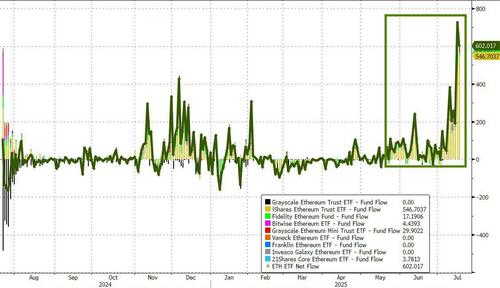

Rising demand for ETH is also reflected by Strong ETF flows during June and July, following stunted performance earlier this year due to macroeconomic fears and a flight to safety from risk assets.

Capital flows into Ether investment vehicles were positive for 11 out of the last 12 trading days, according to Farside Investors, with over $726 million flowing into the ETFs on Wednesday.

ETH ETF Flows

Attracting institutional interest is a major priority for the revamped Ethereum Foundation, which backed the creation of Etherealize, a marketing firm tasked with exposing institutional investors to the layer-1 smart contract network.

Tyler Durden

Fri, 07/18/2025 – 14:45

Click this link for the original source of this article.

Author: Tyler Durden

This content is courtesy of, and owned and copyrighted by, https://zerohedge.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.