Live Updates

Updates appear automatically as they are published.

Stock still sliding

Abbott Labs conference call still about an hour away, meanwhile the stock continues to slide in pre-market trading, now down 4.85% as of 8 AM EDT.

More Details on Abbott’s Q2

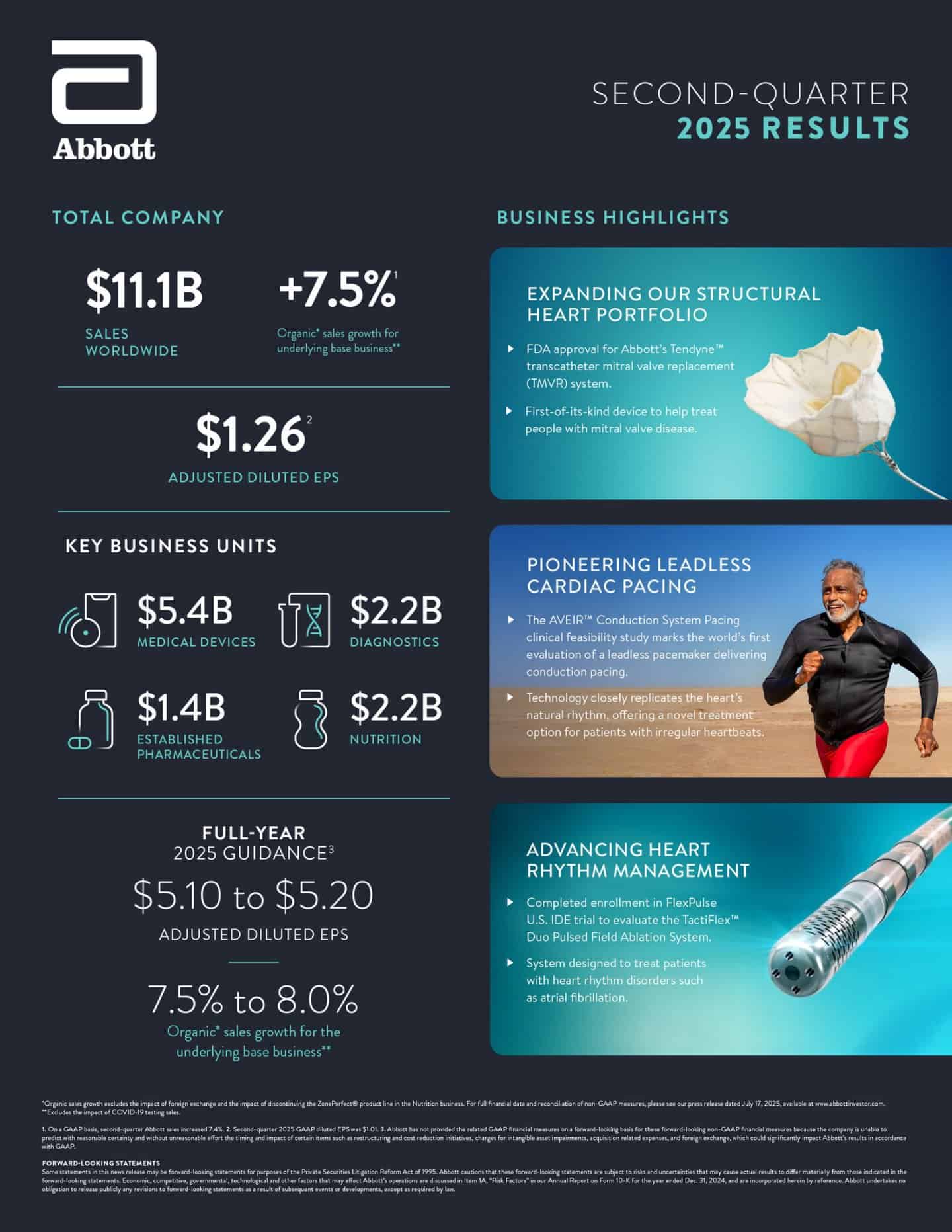

We’ve given the headline figures, but here’s a longer summary of Abbott’s Q2 earnings:

Abbott Laboratories reported strong results for the second quarter of 2025, with total sales reaching $11.142 billion, representing a 7.4% increase year-over-year.

Organic sales growth was 6.9%, or 7.5% when excluding COVID-19 testing-related sales, reflecting robust demand across most business segments.

Adjusted diluted EPS came in at $1.26, up 10.5% from the prior year and matching the Q2 2025 analyst consensus estimate of $1.26.

The company achieved significant margin expansion, with adjusted gross margin rising to 57.0% and adjusted operating margin to 22.9%.

Medical Devices led growth with a 13.4% sales increase, driven by strong performance in Diabetes Care, Heart Failure, Structural Heart, and Electrophysiology.

Diagnostics saw a slight decline due to lower COVID-19 testing sales and procurement headwinds in China, while Nutrition and Established Pharmaceuticals posted solid gains.

Full-year 2025 guidance was narrowed, now projecting organic sales growth (excluding COVID-19 tests) of 7.5%-8.0% and adjusted EPS of $5.10-$5.20.

The company also highlighted pipeline progress, including FDA approval for its Tendyne mitral valve system and plans for a new manufacturing facility. Abbott declared its 406th consecutive quarterly dividend, reinforcing its status as a Dividend Aristocrat.

Abbott’s CEO Excited About Momentum into 2026

One note, Abbott CEO Robert Ford specifically cited momentum into 2026 in his commentary.

“Halfway through the year, we delivered high single-digit organic sales growth, double-digit EPS growth, significantly expanded our margin profiles, and continued to advance key programs through our new product pipeline. We see this momentum carrying into 2026.”

While shares are currently down 3.8%, if management issues bullish commentary on long-term momentum in their conference call, it could help blunt the immediate losses shares have seen after the earnings release.

Shares Continue to Slide

Abbott shares are now down 3.6% as the company posted largely inline results and slightly took down the high-end of EPS estimates for the year.

Shares were up 16% year-to-date headed into today, so this could be investors taking money off the table. That is to say, when shares have outperformed the market, largely matching results leads to selling pressure.

Quarterly Infographic

Tightens Range of 2025 EPS

Abbott has tightened the range on 2025 EPS from $5.05 to $5.25 down to $5.10 to $5.20.

Abbott Shares Moving

Abbott’s quarter is out. We’ll post more analysis shortly, but the headline is in-line EPS ($1.26, matching Wall Street expectations) and revenue slightly ahead of expectations.

Shares are down 3% after the release.

Still no earnings at 7:05 a.m. ET

We continue to monitor for Abbott’s earnings, but as of 7:05 a.m., they still haven’t posted to the company’s investor relations page.

How to Join Abbott’s Conference Call

Abbott will host its conference call at 9 a.m. ET today. If you’d like to join, you can sign up to listen to the call at this link.

Abbott Laboratories (NYSE: ABT) is reporting before the market opens and we’ll be upating this article with live analysis.

So far, the stock is up 16.1% in 2025. Will the company’s second-quarter report help fuel a red-hot second half or will it disappoint Wall Street? Wel’ll break down all the need-to-know information!

Let’s get started by looking at the figures Wall Street will be most interested in this morning.

Abbott Laboratories Q2 Earnings Expectations

Here are the big figures to watch when Abbott Labs first reports:

- Revenue: $11.06 billion

- EPS (Normalized): $1.26

- EPS (GAAP): $.99

- Cash Flow From Operations: $2.63 billion

Catalysts for the Second Quarter

After Abbott reports, they’ll host a conference call where Wall Street will get to ask management questions abou the second quarter and the company’s longer-term outlook. Here are a few areas to carefully watch that could determine whether Abbott shares rise or fall today.

- Core Diagnostics Growth: This segment has struggled with declines in COVID testing volumes depressing sales growth year-over-year. Abbott believes this unit can grow at mid-single digit percent growth, so any positive sales momentum for this group could help drive shares up today.

- Management Commentary on Medical Devices: There’s a long-term threat to Abbott’s medical devices and it’s name is GLP-1 drugs. These drugs have become extremely popular, but could create headwinds for Abbott’s diabetes and cardiovascular devices. Abbott has said these concerns are overblown and continues to post strong procedural volumes and grow its pipeline. Yet, the concerns about the segements future won’t be going away any time soon.

- Margins: Wall Street expects Abbott to post gross margins of 56.8%. With higher-margin COVID test sales fading, analysts will continue probing at where Abbott’s margins will land in the coming years.

The post Live: Abbott Labs (NYSE: ABT) Q2 Earnings Updates appeared first on 24/7 Wall St..

Click this link for the original source of this article.

Author: Eric Bleeker

This content is courtesy of, and owned and copyrighted by, https://247wallst.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.