I gave my overall assessment of the One Big Beautiful Bill Act last week, which can be summarized in two sentences.

- The good news is that “…the bill prevents a massive automatic tax increase starting on January 1 of 2026.”

- The bad news is that “…the legislation will not save the country from a fiscal crisis.”

Today, let’s look at some of the details.

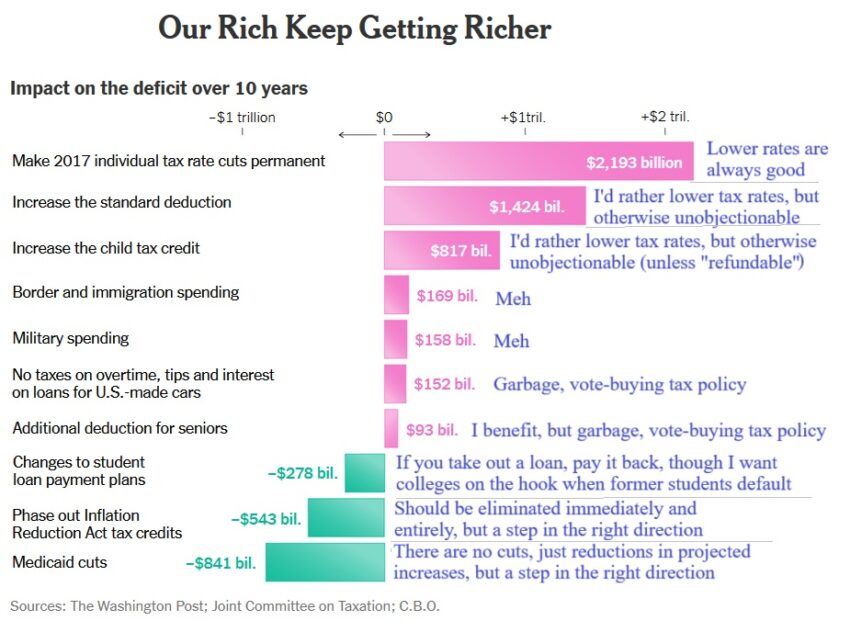

We’ll start with this chart from a recent New York Times column by Steven Rattner. As you can see, I’ve added my two cents on each of the major provisions.

By the way, I can’t resist commenting on the title of the chart. Rattner (who opposes OBBBA) obviously wants readers to think the bill is designed to help only the rich.

That’s a bit silly given the various provisions like child tax credits that are designed for the middle class. But what’s absurd – and utterly inaccurate – is the implication that only the rich have been enjoying income growth.

Rattner also has a sin of omission in that he doesn’t list the most pro-growth part of the bill, which is the reduction of the tax bias against new investment.

Here are some excerpts from the Tax Foundation’s summary.

The Senate bill makes permanent the House bill’s provisions allowing expensing for investment in short-lived assets and domestic research and development. Permanent expensing has the most bang-for-the-buck when it comes to economic growth. In the context of the full Senate bill, the two provisions boost long-run GDP by 0.7 percent by providing taxpayers the certainty they need to boost long-run investment. …The House and Senate bills both secure permanent extension of the rates and brackets of the 2017 individual tax cuts, providing certainty for households and stability to the structure of the tax code.

The Tax Foundation also explains some of the bad provisions.

…too much money on political gimmicks and carveouts. They both introduce tax exemptions for overtime pay and tips, a deduction for auto loan interest, and an additional standard deduction available for some seniors, all of which violate basic tax principles of treating taxpayers equally. …No tax on tips, overtime, and car loans comes with various conditions and guardrails that…will likely require hundreds of pages of IRS guidance to interpret. …

Now let’s shift back to Mr. Rattner’s column.

To his credit, he includes this chart that shows that fiscal imbalance in America is caused by a growing burden of government spending.

There’s one final chart I want to share.

Here are the various estimates of potential economic growth from OBBBA.

Rattner’s chart says the economic growth would be trivial.

For what it’s worth, I think the White House estimate is absurdly high.

However, I don’t view the growth estimates from the other groups as being “negligible.” Even small differences in growth, if sustained, can make a big difference in long-run living standards.

P.S. Keep in mind that it’s hard to predict potential growth effects when we don’t know what Trump will do on trade policy. If he is merely bad, maybe the effect of OBBBA will be enough to deliver additional prosperity. But if he is terrible (i.e., Liberation Day-type nonsense), then the net effect of his policies will probably be negative.

———

Image credit: Gage Skidmore | CC BY-SA 2.0.

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.