Guest Post by Peter Reagan

What do a $2,500 gold “crash,” Trump’s Fort Knox questions and Ray Dalio’s civil war warning have in common? They all underscore the same point: If you have the gold, you make…

Your News to Know rounds up the most important stories about precious metals and the overall economy. This week, we’ll cover:

- JPMorgan sticks to $4,000 gold, Citi wonders if a crash to $2,500 is coming…

- …but would that really be a crash?

- If you have the gold, you make the rules

- Ray Dalio goes off on U.S. debt, suggesting it could bring on civil war

In line with trend, even gold’s worst-case predictions are sounding pretty good

The “forecast war” rages on, with JPMorgan reaffirming its $4,000 gold price target, while Citi raises eyebrows with a bearish call for $2,500. But take a step back – and you might see both as bullish in their own way.

Let’s begin with the now-mainstream view: gold is going to $4,000. Two years ago, you’d have been dismissed for saying that. Today, you’re dismissed for not entertaining it. That tells you something about sentiment – and about just how quickly fundamentals catch up.

JPMorgan’s rationale? Solid: 900+ tons of expected demand for central bank gold reserves, 400+ tons from funds, 1,200 tons from Asian retail buyers, plus 300+ tons from Chinese institutions. Throw in what they call “possible stagflation” – which already feels like a polite understatement – and a steady erosion of trust in the U.S. dollar, and you’ve got plenty of tailwinds.

Meanwhile, Citi’s forecast hinges on Chinese insurance firms substituting for Western investors – as if that demand doesn’t “count.” Their bearish outlook assumes 400–500 tons of fund outflows. But here’s the kicker: funds haven’t even shown up yet. They’re late to the party. And with gold becoming a default portfolio inclusion again, it’s not clear why they’d start selling en masse.

Citi’s ultra-contrarian thesis ends with a fantasy: pro-growth policies restoring trust, recession fears fading, investors abandoning safe havens. But the buyers driving the gold surge – namely, central banks – aren’t betting on happy endings. They’re hedging against systemic collapse.

And yet, Citi’s dire warning? A “crash” to $2,500.

That number – once seen as wildly bullish – is now the floor. That’s your worst-case scenario. (And keep in mind that, when gold price falls, risk-on asset prices soar…)

If that’s where gold bottoms out, what does that say about upside?

Jupiter Asset Management is excited on gold

Jupiter Asset Management’s June presentation – boldly titled He Who Has the Gold Makes the Rules – offers a surreal mix of imagery, insight, and gold-bug energy.

Among the highlights:

- President Trump looms large, from references to a “golden age” to half-joking queries about whether the Fort Knox vault was looted in his absence. Remember the first words of his second inaugural address: “The golden age of America begins right now.”

- Treasury Secretary Scott Bessent (2024) is quoted saying something like a “new Bretton Woods” is coming – and he wants to help build it.

- He also hints that the U.S. will monetize liquid and domestic assets – gold among them. (Yes, Fort Knox is mentioned.)

- Trump, in April 2025, reportedly said: “He who has the gold makes the rules.” Curious if the media will pick up on that.

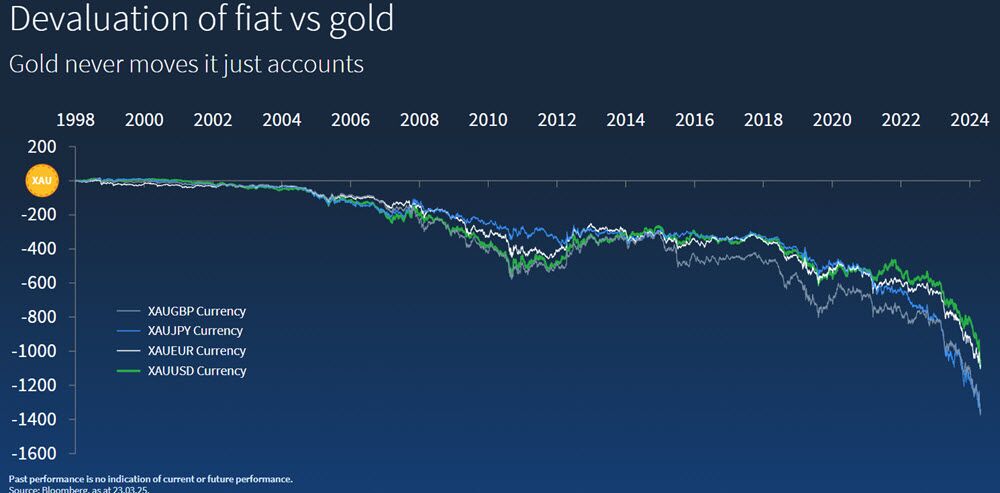

The presentation transitions from speculative commentary to stark charts. Gold isn’t moving up, it argues – rather, currencies are moving down. Charts show shocking devaluation of the dollar, euro, pound, and yen relative to gold:

But maybe you feel like you missed out on buying into the current gold market?

Well, JAM has some good news about silver, too:

Perhaps coincidentally, on July 11 we saw silver price hit a 14-year high…

Despite this, JAM calls the last 43 years a “bear market” for gold in dollar terms – one that just ended. What comes next? They don’t say. But perhaps the former President said enough: If you have the gold…

Ray Dalio has a plan to address U.S. debt (but they’re politically impossible)

Ray Dalio, founder of Bridgewater Associates and longtime gold advocate, is sounding the alarm. In a recent interview, he warned that America is in stage five of six in a nation’s life cycle – just before collapse or civil war.

Stage five is marked by deepening wealth inequality, currency debasement, and political extremism. But Dalio argues these aren’t the cause of instability – they’re symptoms. The root issue? The evaporation of the middle class.

Ask yourself: how many Americans still confidently identify as “middle class”? How many expect to remain there five or ten years from now? The squeeze is real, and getting tighter by the day.

Dalio hopes for a peaceful solution. But even he seems to know it’s unlikely. His prescriptions – wealth redistribution, bipartisan unity, fiscal responsibility – are political non-starters.

He proposes spending less and taxing more. But when the top 10% already shoulder most of the tax burden, and the bottom 90% can’t afford more, where’s the wiggle room? Raise taxes, and you alienate the powerful. Leave them alone, and the system keeps rotting.

So what’s left? A slow unraveling. A debt spiral. And a growing distrust in the U.S. dollar itself.

That’s why, as Dalio might agree, central banks are loading up on gold and silver while quietly watching another fiat experiment circle the drain.

When nations hoard gold and print paper, it doesn’t take a hedge fund titan to see where this ends.

And maybe that’s the real lesson: You don’t need to predict the collapse. You only need to prepare for it.

As always, we believe the prudent path forward – for individuals and nations alike – starts with sound money. And it’s hard to get sounder than gold.

As central banks continue unprecedented money creation, protecting your purchasing power becomes critical for retirement security. Physical gold IRAs offer a tax-advantaged solution, allowing you to hold tangible precious metals with intrinsic value independent of currency fluctuations. To learn more about how physical gold could help protect your retirement portfolio, click here to get your FREE info kit on Gold IRAs from Birch Gold Group.

Click this link for the original source of this article.

Author: Administrator

This content is courtesy of, and owned and copyrighted by, https://www.theburningplatform.com and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.