My readers know that for the last year or two, I’ve harped on the idea that the market is being artificially bid up by passive flows—namely, forced buying as a result of retirement plans, ETFs, and the like.

The recurring forced buying from this passive bid knows no boundaries when it comes to valuation or timing. These programs buy stock consistently, regardless of valuation, and they weight their purchases toward the most popular names in the market.

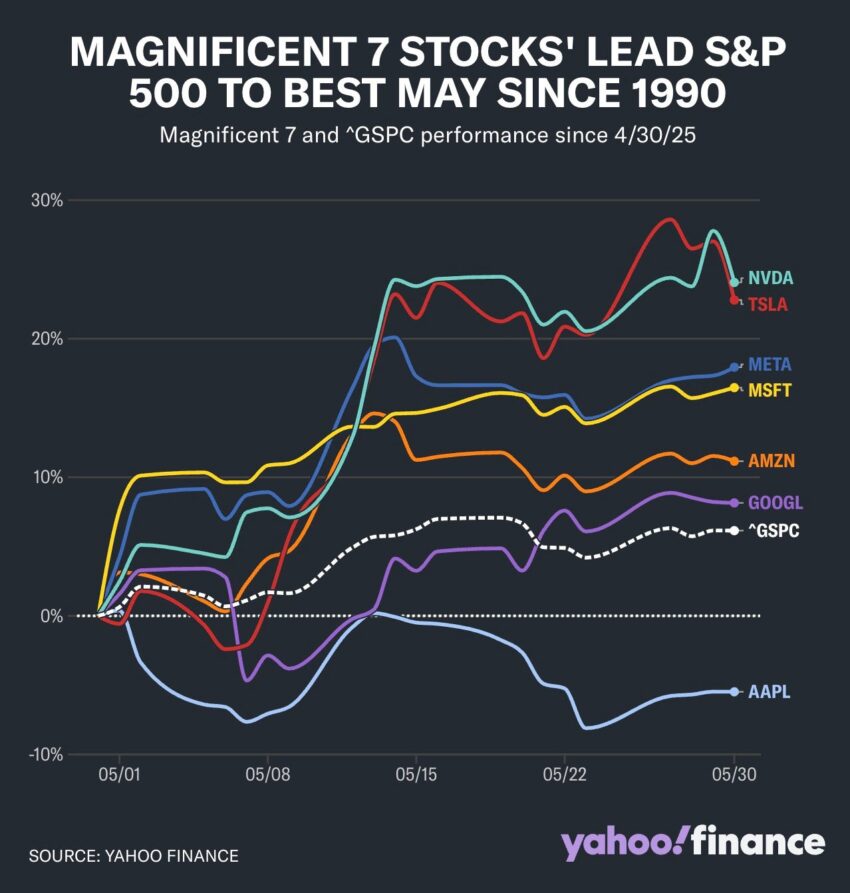

This is why the Magnificent Seven—Tesla, Facebook, Amazon, Apple, Microsoft, Netflix, and Google—have consistently outperformed the broader market. As I mentioned to Dave Collum a couple of days ago in our wide ranging interview, market breadth—which is the absolute number of advancing stocks versus those that are declining—has been markedly red, despite the market moving to all-time highs.

All this means is that broader index rallies are a function of just a few stocks moving higher, while the rest of the market actually stays the same or moves lower. This is a function of weighting.

I’ve also warned that a decline in job numbers would start to make me question this passive bid. After all, the fewer people with jobs, the more they may have to draw on their retirement savings—and the less they can consistently pour into the stock market, regardless of valuation.

The next logical question is: what does it look like when these passive funds start to dry up? While I understood the mechanics of it—namely, that redemptions from retirement accounts would force selling, and that loss of jobs would slow down the passive bid—I had no idea the numbers behind such selling could be completely catastrophic. But one interview I listened to this weekend quickly changed my outlook.

I wanted to pass along a detailed explanation of exactly how such an unwind could happen in what is a $50 trillion passive-bid market.

Click this link for the original source of this article.

Author: Quoth the Raven

This content is courtesy of, and owned and copyrighted by, https://quoththeraven.substack.com feed and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.