Back in 2016, I sarcastically opined that our leftist friends should be nice to upper-income taxpayers.

Why? Because those are the people who pay a hugely disproportionate share of taxes. So if you like big government, you should be very friendly to the people who are making it possible.

Today’s column updates this analysis.

I’m motivated to address this issue because the “champagne socialist” nominee to be Mayor of New York City, Zohran Mamdani, has joined other crazy leftists (see here and here) in asserting that billionaires should not exist.

In a column for National Review, Christian Schneider explains why this is very foolish. Here are some excerpts.

Zohran Mamdani…indicated that the wealthy had no place in his America. “I don’t think that we should have billionaires …,” he told Kristen Welker on Meet the Press. …it is that untold wealth to which people aspire that funds virtually the entirety of the federal government. We all know the numbers by now: In 2022, the top 5 percent of income earners paid 61 percent of the income taxes collected, while the bottom 50 percent of wage earners paid 3 percent of the total tax load. …As for the tax rates paid by the very wealthy, the U.S. Treasury Department estimates that the top 1 percent of income earners pay a tax rate of 31 percent, while the bottom 10 to 20 percent actually pay a negative tax rate of 4.6 percent. (Their rate dips into negative territory because of the benefits they receive from the tax system.) …wealthy people actually fund the programs that progressives crave… More rich people means more revenue. …If Mamdani rides his TikTok-fueled wave into the mayor’s office, the billionaires of New York may take their investments and innovations elsewhere. At that point, the young socialist will finally get schooled in economics.

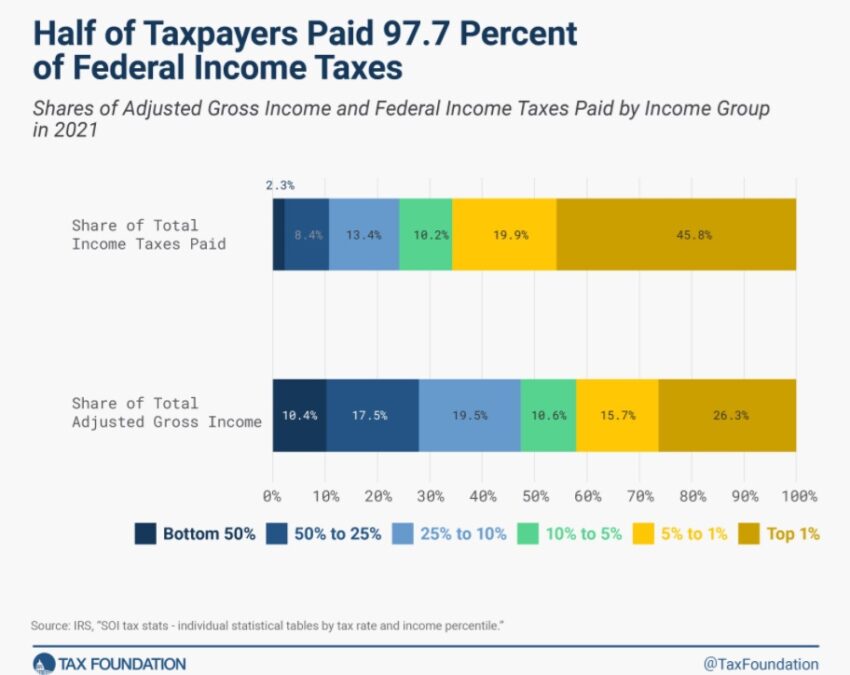

Let’s examine some more data on tax burdens for upper-income taxpayers.

Here’s a chart showing that the top-10 percent pay a hugely disproportionate share of income taxes.

What about the super-rich as opposed to run-of-the-mill upper-income households?

Well, in the last year of the Biden Administration, some economists at the Treasury Department calculated tax burdens on these households (top .0005 percent and above).

Scott Hodge then put this data into an easy-to-understand chart. As you can see, these people pay absurdly high tax rates.

This data should be compelling. Our tax system targets rich people and those upper-income taxpayers finance the lion’s share of a bloated federal government.

Sadly, I don’t think this will be persuasive to our friends on the left because maximizing revenue is not their top goal.

Sensible people, by contrast, want there to be more rich people (assuming, of course, they earn money honestly).

Click this link for the original source of this article.

Author: Dan Mitchell

This content is courtesy of, and owned and copyrighted by, https://freedomandprosperity.org and its author. This content is made available by use of the public RSS feed offered by the host site and is used for educational purposes only. If you are the author or represent the host site and would like this content removed now and in the future, please contact USSANews.com using the email address in the Contact page found in the website menu.